The investment industry may never love its regulators, but compliance officers’ (COs) and company executives’ esteem for their overseers appears to be holding surprisingly steady at a time when markets are exceptionally volatile, the economy is decidedly unsettled and the future seems particularly uncertain.

In fact, the results of Investment Executive‘s (IE) 2016 Regulators’ Report Card reveal that, in general, COs’ and company executives’ views on the major provincial securities commissions and the industry’s self-regulatory organizations (SROs) are on the upswing compared with last year.

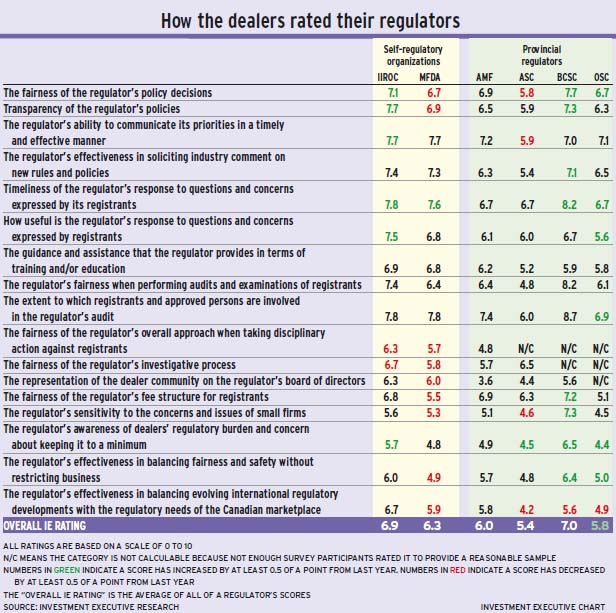

For example, the overall ratings for both the B.C. Securities Commission (BCSC) and the Ontario Securities Commission (OSC) are up notably from last year’s survey. Similarly, ratings for the Investment Industry Regulatory Organization of Canada (IIROC) also rose, albeit more modestly. However, both the Mutual Fund Dealers Association of Canada (MFDA), and the Alberta Securities Commission (ASC) saw their ratings dip a bit from last year. (For the first time, IE has included the Autorité des marches financiers (AMF) in the Regulators’ Report Card, revealing overall ratings that put that provincial regulator in the middle of the pack, more or less in line with the OSC.)

The generally positive trend in the regulators’ ratings this year comes as a bit of a surprise, given the gloomy and uncertain macroeconomic environment and a fair amount of grumbling about the rising regulatory burden from industry trade groups.

Since the start of the year, securities markets have been particularly unsettled. The global economic recovery seems to be faltering and Canada’s economy appears to be particularly fragile. Weak commodities prices are weighing on some of the most important sectors, both for the economy and in Canada’s capital markets. At the same time, the loonie has been spiralling downward and public deficits are ballooning. Yet, amid all of this turmoil, the industry’s perception of the regulators appears to be, if anything, a little rosier than in recent years.

This is all the more remarkable when you consider the recent regulatory environment. Specifically, the past few years have seen relentless reform; the regulators definitely have not been receding into the background. In fact, they have been particularly busy since the global financial crisis in 2008-09, bolstering oversight and closing supervisory gaps that were exposed by that episode.

At the same time, a long-running effort to reform retail securities regulation in Canada is set to culminate this year with the remaining aspects of the second phase of the client relationship model (CRM2) reforms taking effect. Furthermore, the regulators aren’t backing away from more radical possibilities, such as banning trailer fees or imposing a fiduciary duty upon retail financial advisors.

All this is also occurring against a backdrop of possible regulatory restructuring in Canada, which could see the creation of a new, co-operative capital markets regulator (CCMR) involving British Columbia, Ontario and a handful of smaller provinces. The past year hasn’t been a quiet time for regulators; yet, the industry appears to be relatively sanguine about their regulators’ performance.

Of course, high scores from COs and company executives aren’t unambiguously a good thing, given that regulators have the dual mandate of protecting investors and ensuring markets operate efficiently. IE’s survey evaluates only one side of the equation – the industry’s opinion – and, therefore, doesn’t capture the views of investors, issuers or the public at large.

Thus, a regulator that receives high scores in the Regulators’ Report Card isn’t necessarily doing a better job overall. In addition, there can be a high level of variation in these ratings, particularly for regulators in some provinces for which the sample size is fairly tiny.

Those caveats aside, regulators’ ratings in this year’s Regulators’ Report Card appear relatively rosy. Currently, the BCSC is leading the way in industry opinion. Indeed, the BCSC received the highest overall rating in our survey at 7.0, even edging out the SROs.

The BCSC received particularly high marks for its compliance auditing function, both in “the regulator’s fairness when performing audits and examinations of registrants” and “the extent to which registrants and approved persons are involved in the regulator’s audit” categories.

The provincial regulator also garnered notable increases vs the previous year in its ratings for “the regulator’s sensitivity to the concerns and issues of small firms,” “the regulator’s awareness of dealers’ regulatory burden and concern about keeping it to a minimum,” and the “transparency of the regulator’s policies” categories.

The OSC, Canada’s largest provincial regulator, also saw its overall rating rise notably this year to 5.8 vs 5.3 in 2015. In fact, the OSC received higher ratings in 11 of the 14 categories for which it received a rating, and two ratings remained level year-over-year. Only one category’s rating dropped compared with 2015.

In fact, of the 11 ratings that were higher than last year, six rose significantly (by half a point or more). Some of these shifts may reflect reversion to the mean amid relatively smaller sample sizes than for the SROs, but the breadth of the improvement suggests that COs and company executives are happier with the OSC’s work in general.

If the plan to create the CCMR does go ahead – it is officially scheduled to launch this autumn, although meeting that deadline appears highly unlikely – that would happen at a time when the industry’s opinion of the CCMR’s two primary players, the OSC and BCSC, appears to be on the upswing. Watching to see whether the inevitable disruption of undergoing a merger has a meaningful impact on those regulators’ ratings in the years ahead will be interesting.

In the meantime, the ratings for the ASC, which isn’t part of the CCMR project so far, appear to be trending in the other direction. Regulators in Alberta received lower ratings from the industry in eight of the 12 categories rated in both years. In fact, four of these declines were significant, dropping by half a point or more.

As for the SROs, their ratings are heading in opposite directions in this year’s Regulators’ Report Card. Last year, the SROs had identical overall ratings, at 6.7. This year, COs and company executives rated IIROC a bit higher overall at 6.9, but rated the MFDA lower at 6.3.

IIROC saw a broad-based increase in its scores, with higher ratings in 13 of the 17 categories in the Report Card, including six in which its ratings rose by half a point or more. These include the “timeliness of the regulator’s response to questions and concerns expressed by registrants,” “how useful is the regulator’s response to questions and concerns expressed by registrants” and its awareness of and concern for dealers’ regulatory burden categories. (See stories on pages 28 and 22, respectively.)

Conversely, IIROC’s ratings for the two enforcement-related categories – “the fairness of the regulator’s overall approach when taking disciplinary action against registrants” and “the fairness of the regulator’s investigative process” – declined by half a point or more. Again, however, the focus of the Regulators’ Report Card on obtaining responses from the industry only means that lower marks for enforcement aren’t necessarily a bad thing for the regulator.

On the other hand, most of the MFDA’s ratings trended downward this year, as it received lower grades in 13 of 17 categories, with significant declines of half a point or more in nine categories.

As with IIROC, the MFDA’s ratings in the enforcement-related categories took a significant hit, which, as noted above, isn’t necessarily a bad thing. However, the MFDA also received significantly lower ratings (half a point or more) in “the regulator’s effectiveness in balancing fairness and safety without restricting business,” “the fairness of the regulator’s fee structure for registrants” and the sensitivity to smaller dealers categories. In general, the industry appears to perceive the MFDA as being tougher than in recent years.

Of course, COs’ and company executives’ view of the regulators should always be kept in perspective. Nevertheless, the degree to which the regulators’ ratings are holding up, given both the tough market climate and the ever-changing regulatory environment, is somewhat surprising.

© 2016 Investment Executive. All rights reserved.