Insurance Advisors’ Report Card 2015 main chart

How advisors rated their firms

- By: IE Staff

- July 23, 2015 November 9, 2019

- 23:00

How advisors rated their firms

Advisors lauded compliance staff who are approachable and take the time to make sure all regulatory requirements are met

Advisors want their firms to have teams of specialists to help with clients' increasing needs in wealth-management services

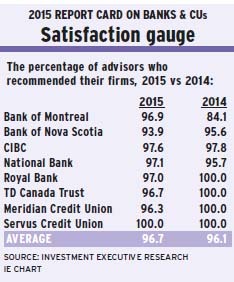

CIBC and Meridian received great praise from their advisors, while the other firms in the survey have areas to improve

Big increase in AUM and productivity

How advisors rated their firms

Advisors praise their firms' online platforms, which have significant integration of investment and banking accounts

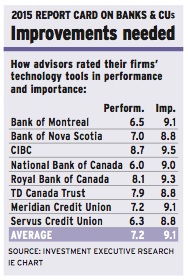

Advisors have many concerns about their firms' technology, and several firms have much room for improvement

Banks and credit unions need to provide advisors with a variety of training opportunities delivered in various ways

Comprehensive programs matter to these advisors as they can't sell their books of business to fund their retirement

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the Dealers’ Report Card 2015, which reveal that the…

How advisors rated their firms

Although advisors are making significant efforts to get ahead in today's challenging environment, their AUM is dropping in value while their firms struggle to deliver…

Advisors lauded firms that make an effort to let advisors know what's important in a variety of ways

Although most advisors gave their dealer firms' rewards programs a shrug of the shoulder, some consider them appealing

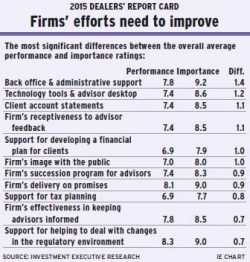

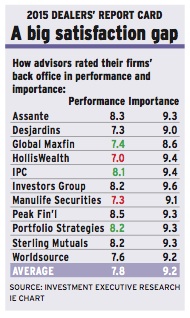

Advisors' complaints about their back offices remained the same as in previous years. Most notably, advisors cited overworked staff, delayed response times and multiple processing…

Financial planning is becoming more important. Advisors said it helps them show the value they provide to their clients

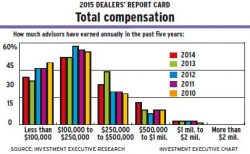

Despite surging equities markets and increasing assets being directed into mutual funds, advisors surveyed for this year's Report Card report a drop in the average…

Advisors went out of their way to praise executives who take the time to develop and maintain personal relationships with them. Such efforts build trust…

About half of the advisors who ply their trade with Canada's mutual fund and full-service dealers have a litany of concerns about the challenges that…

With all but one firm seeing a drop in their rating for delivery on promises, it's clear that firms have to make a greater effort…

Advisors are taking home less in pay this year, but many still lauded their firms for maintaining fair payout structures

Terry Hetherington, executive vice president and head of Raymond James’ private client group, discusses the firm’s wealth-management support for advisors, an area that saw a…

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the 2015 Brokerage Report Card. This year's Report Card…

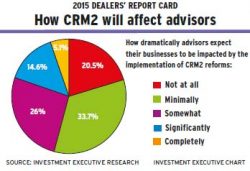

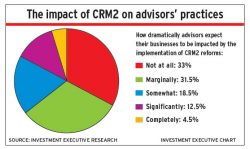

Advisors ready for CRM2 changes