Shifting fortunes for four firms

Acquisition wrecks havoc on ratings

- By: Rudy Mezzetta

- May 19, 2016 November 16, 2019

- 23:00

Acquisition wrecks havoc on ratings

For many financial advisors surveyed for this year’s Dealers’ Report Card, their firm’s corporate culture is difficult to define and embrace because of geographical distance.…

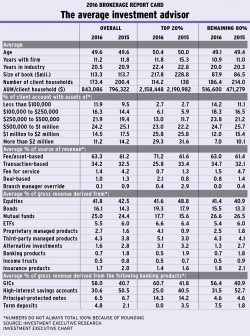

Although dealer reps have added to their AUM and client totals, a closer look reveals that top performers are focusing on serving their high net-worth…

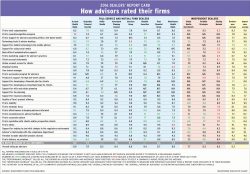

How advisors rated their firms

Many advisors hope the introduction of CRM2 will lead to clearer and better client account statements

Although some firms are doing a better job on technology, the "satisfaction gap" in this category suggests much work is needed

With little consensus among advisors about what they need from their firms in ongoing training, the firms that are praised most offer the right blend…

Regulatory initiatives such as CRM2 are forcing firms to create or improve their IT platforms - as well as increase the support and education for…

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the 2016 Brokerage Report Card.

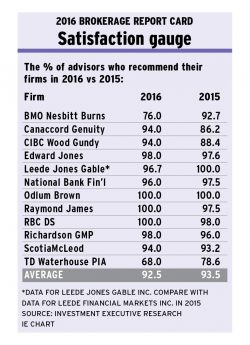

The brokerage business is going through profound change, and advisors are counting on their firms to help them navigate through the new twists and turns

How advisors rated their firms

As social media gains prominence as a marketing tool for advisors, access is more critical than ever. The firms that provide access to the online…

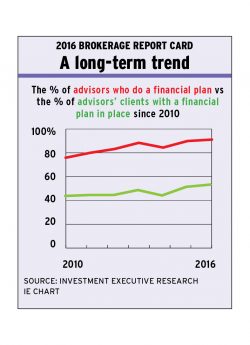

Advisors consider financial planning to be more important than ever, and more advisors are creating financial plans with their clients. However, challenges remain in getting…

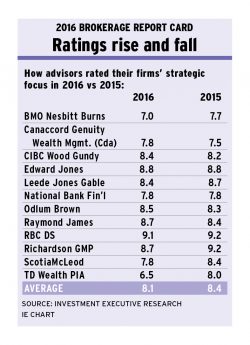

With strategic focus becoming more important for advisors, many are questioning their firm's efforts to attract and serve high net-worth clients while other advisors praise…

Quick response times, consistency, reliability and a client- and advisor-focused approach by back office staff are critical

Firms' greater focus on operating within a fee-based compensation model makes the transition easier for advisors

Firms have adjusted their pay structures to reward advisors with larger or faster-growing books at the expense of advisors with modest-sized books, many of whom…

The emergence of online financial services isn't a threat to most advisors' businesses because their clients prefer a personal touch

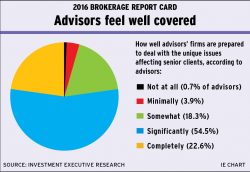

More than 75% of advisors surveyed said their firms are prepared for the unique issues affecting this demographic

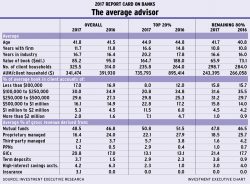

Assets under management have remained steady over the past year, ending a string of successive gains that advisors have enjoyed this decade, while productivity has…

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss whether survey participants want to see a merger of the SROs and…

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, outline the key findings of the 2016 Regulators’ Report Card. Ratings are a…

There are conflicting opinions about regulators' auditors and the approach they take during the auditing process

Although regulators usually provide quick responses to registrants, the replies are too cautious in the content they provide