Latest news in Report Cards

Advisors look to the future

As the financial services sector undergoes profound changes, advisors will need support from their firms to meet the increasing challenges and build strong practices

- By: Fiona Collie

- August 24, 2017 November 9, 2019

- 23:11

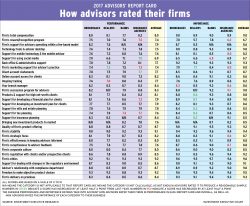

Advisors’ Report Card 2017 main chart

How advisors rated their firms

- By: IE Staff

- August 24, 2017 November 9, 2019

- 00:08

Decisive support

Overwhelming backing for “best interest” standard

- By: James Langton

- August 24, 2017 November 9, 2019

- 00:07

Communication’s key role

How advisors feel about their firms' communications efforts has an impact beyond measure

- By: Fiona Collie

- August 24, 2017 November 9, 2019

- 00:06

Notable changes in advisors’ businesses

Although there's little movement in the overall numbers, a closer look at advisors' metrics in the four distribution channels included in the Report Card series…

- By: James Langton

- August 24, 2017 November 9, 2019

- 00:05

Shift from smaller accounts begins

Brokerages are leading the way in encouraging advisors to drop the smallest clients from their books of business

- By: Sophie Allen-Barron

- August 24, 2017 November 9, 2019

- 00:04

Advisors praise product shelves

Having a robust product offering from firms is very important to advisors

- By: Leah Golob

- August 24, 2017 November 9, 2019

- 00:03

No secret formula for success in tech

Two firms have taken very different strategies regarding their technology, but both received high praise from their advisors

- By: Sophie Allen-Barron

- August 24, 2017 November 9, 2019

- 00:02

Stepping up on regulatory support

Advisors lauded firms that are proactive in informing them about changes in regulations and in training

- By: Charles Bossy

- August 24, 2017 November 9, 2019

- 00:01

Slideshow: How insurance advisors have rated their firms this decade

The Report Card average has remained quite stable during the past eight years, but some firms have seen some dramatic changes

- By: Fiona Collie

- August 15, 2017 November 9, 2019

- 09:00

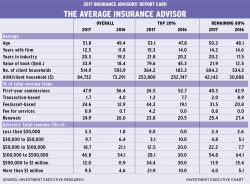

Slideshow: Unique differences among insurance firms’ advisors

For insurance advisors, average age, tenure in the industry and with their firms, as well as annual compensation, is most revealing

- By: James Langton

- August 2, 2017 November 9, 2019

- 11:00

Insurance Advisors’ Report Card 2017: Editors discuss results

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of this year's Insurance Advisors’ Report Card, which show advisors…

- By: Fiona Collie, Pablo Fuchs

- July 28, 2017 November 9, 2019

- 08:00

Big shifts in four firms’ ratings

Many ratings for Financial Horizons, Freedom 55 and Hub dropped significantly, while Sun Life enjoyed several increases

- By: Fiona Collie

- July 27, 2017 November 9, 2019

- 23:50

Advisors in need of more support

Most insurance agencies were rated much lower in a bevy of categories this year. Advisors want firms to step up their efforts

- By: Fiona Collie

- July 27, 2017 November 9, 2019

- 23:50

Room for improvement on CMS

Most advisors voiced their displeasure with their firm's CMS, but advisors with Sun Life and IDC WIN were very satisfied

- By: Charles Bossy

- July 27, 2017 November 9, 2019

- 23:50

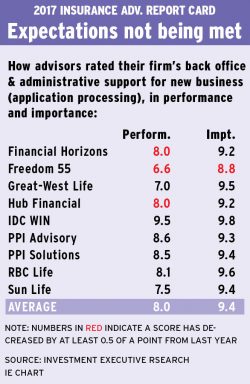

Application processing still a big concern

For many advisors, their firm's back office and administrative support for new business leaves much to be desired

- By: Jade Hemeon

- July 27, 2017 November 9, 2019

- 23:50

Work to do on financial planning

Advisors seek the right combination of technology and support specialists to create strong financial plans for their clients

- By: Sophie Allen-Barron

- July 27, 2017 November 9, 2019

- 23:50

Insurance firms get top marks for freedom

There's an approach to advisor autonomy at firms, which allows advisors to make product choices for clients without any interference

- By: Charles Bossy

- July 27, 2017 November 9, 2019

- 23:50

Insurance Advisors’ Report Card 2017 main chart

How advisors rated their firms

- By: IE Staff

- July 27, 2017 November 9, 2019

- 23:50

Advisors’ businesses surge forward

The average insurance advisor is notably older and has a much larger investment component in his or her book of business

- By: James Langton

- July 27, 2017 November 9, 2019

- 23:10

Slideshow: Big differences among banks’ advisors

At some banks, advisors resemble their brokerage or dealer counterparts; at others, they appear to be positioned much closer to traditional frontline retail bankers

- By: James Langton

- June 28, 2017 November 9, 2019

- 07:00

Report Card on Banks 2017: Editors discuss key themes

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of this year’s Report Card on Banks, which show that…

- By: Fiona Collie, Pablo Fuchs

- June 23, 2017 November 9, 2019

- 10:50

Pension plans leave much to be desired

Advisors have high expectations of their banks' pension plans, but many bemoaned the changes their firms have implemented

- By: Sophie Allen-Barron

- June 22, 2017 November 9, 2019

- 23:50

Banks deliver on clients’ online access

Advisors praised their banks' websites and mobile apps for being easy to use and providing clients with access to accounts

- By: Charles Bossy

- June 22, 2017 November 9, 2019

- 23:50