Great displeasure with marketing support

Advisors had concerns relating to staffing and little variety or customizability in marketing materials

- By: Jeff Wimbush

- July 25, 2013 October 31, 2019

- 23:00

Advisors had concerns relating to staffing and little variety or customizability in marketing materials

Three firms saw notable increases in their ratings, and the satisfaction gap in the category was cut almost in half

WFG, PPI Advisory and IDC WIN received improved ratings in a variety of categories while Freedom 55's and Daystar's ratings tumbled

Advisors respond favourably to their firms' efforts in some key areas of importance

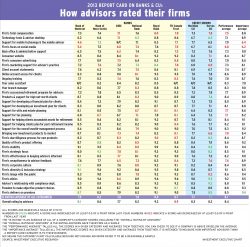

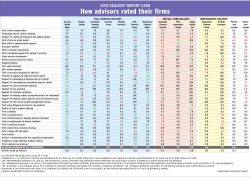

How advisors rated their firms

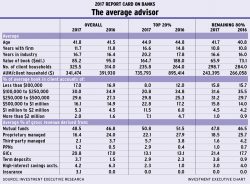

Top 20% of advisors have four times the AUM of rest of sector

Banks and credit unions have place added emphasis on issues affecting minorities, women and people with disabilities

Firms are failing to live up to their advisors' expectations regarding the back office. Most issues are related to the staff

Advisors say there are various reasons why they feel their feedback is ignored. Will their firms step up and begin to listen?

Advisors still are concerned that certain key metrics are omitted from the calculation used to determine their pensions

Although advisors at most firms say there is much work to be done, those with two banks report significant levels of satisfaction

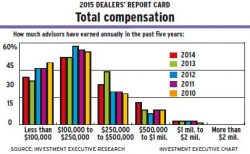

Deposit-taking institutions need to do much better when it comes to advisors' compensation structures

There were lower ratings across the board - and for three banks, in particular.But there also were bright rays of light

Younger advisors are joining the business in greater numbers

How advisors rated their firms

Steven Donald, president of Assante Wealth Management (Canada) Ltd., talks about the strategic changes that fueled Assante’s improvement in 32 out of 34 categories in…

Pablo Fuchs, senior editor of Investment Executive, and Clare O’Hara, reporter, outline the key findings of the 2013 Dealers’ Report Card. They discuss the disparity…

Advisors with Canada's top dealer firms are growing their businesses, but many advisors would like to see their firms step up their efforts and provide…

How advisors rated their firms

Firms are doing little to help their advisors access social media beyond basic compliance support

Many advisors are dissatisfied because their firms have failed to deliver on certain promises

Most advisors and their dealer firms respect the value of the active management that mutual funds offer

The average age of advisors at dealer firms has risen, as has the number of advisors who have a succession plan in place

Advisors are dissatisfied with the material their firms send out and management's receptiveness to advisors' feedback

Advisors have long been demanding specialized services for HNW clients; it appears firms are listening