Managers make a difference

Advisors expect their branch managers to be supportive, knowledgeable and resourceful leaders who can be relied upon

- By: Clare O’Hara

- August 21, 2014 October 31, 2019

- 23:00

Advisors expect their branch managers to be supportive, knowledgeable and resourceful leaders who can be relied upon

Financial advisors across all channels of the financial services sector look to their firms to provide the necessary training to keep advisors’ knowledge and skills…

Support for mobile technology and for using social media rose in importance - and it's the younger advisors driving this trend

Not only is recognition a poor substitute for better pay, many advisors say, but it's just the top advisors who are rewarded

As the glut of baby-boomer advisors continues to get older, succession programs are becoming more and more important

Pablo Fuchs, senior editor at Investment Executive, and Clare O’Hara, staff writer, discuss report card results that suggest heady times are here for insurance advisors.

There's much concern among advisors that their firms are not doing enough to bring in new blood

More comprehensive support is needed from insurance agencies for financial planning and investment planning, advisors say

Outdated, archaic and inefficient systems drew the ire of advisors, who want easy-to-use systems online and mobile

Some firms have stepped up their support for compliance others have left advisors feeling as if they're on their own

Insurance advisors see big growth in AUM, clients and compensation

Insurance advisors have seen notable improvements in key metrics, but those have not translated into higher ratings for firms

Firms of all stripes are changing. But it's important for advisors that their strategic focus aligns with that of their firm

How advisors rated their firms

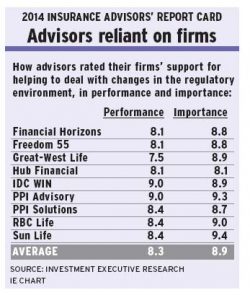

Insurance advisors surveyed for this year’s Insurance Advisors’ Report Card have higher expectations regarding the support they receive from their firms for using mobile technology…

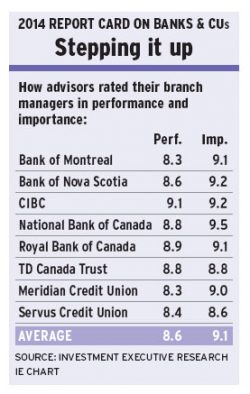

Advisors at all the banks and credit unions in the survey are happier. Many firms garnered major ratings increases

Many advisors say their branch managers fulfil a critical role in providing leadership, mentorship and ongoing support

Flexible work hours, collegial work environments and support for charity-related initiatives please advisors

All firms saw their ratings in this category rise after most increased their digital offerings

How advisors rated their firms

Advisors ramp up client rosters to stem their losses in AUM

Having a diverse list of products available - including a steady stream of carefully selected new ones - is a big help to advisors

For a variety of reasons, most advisors say their firms' marketing support efforts have fallen flat

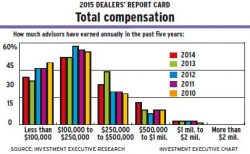

Advisors want to be recognized and appreciated for their work, but it must be balanced with strong, competitive pay

Pablo Fuchs, senior editor of Investment Executive, and Clare O’Hara, reporter, explain the research and interview approaches used to put together the 2014 Dealers’ Report…