It’s not surprising that financial advisors surveyed for this year’s Insurance Advisors’ Report Card were more satisfied with their firms’ compensation structures. They took home bigger paycheques in 2012 than they did in 2011.

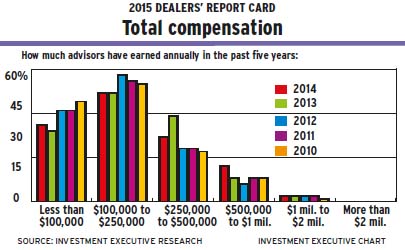

The figures obtained for this year’s Report Card reveal that advisors are moving up the pay scale. For example, the percentage of advisors who earned less than $50,000 a year has dropped to 8.7% for 2012 from 13.6% in 2011 and the percentage of advisors earning between $50,000 and $100,000 annually rose to 22.3% from 18.4% for the same periods.

In addition, although the percentage of advisors who earned between $100,000 and $500,000 in 2012 declined to 50.5% from 52.7% in 2011, the increase in advisors who said they earn more than that rose to 18.5% in 2012 from 15.3% in 2011.

This has resulted in some healthier ratings in the “firm’s/MGA’s total compensation” category. Although the overall average performance rating rose only slightly, to 8.3 this year from 8.2 in 2012, the satisfaction gap – the difference between the performance and importance ratings advisors bestowed on the category – dropped notably year-over-year to 0.5 of a point vs 0.9 of a point.

A closer look reveals that Winnipeg-based Great-West Life Assurance Co. (GWL) and Toronto-based managing general agencies (MGAs) PPI Advisory and World Financial Group Insurance Agency of Canada Inc. (WFG) saw their ratings in the compensation category rise by half a point or more year-over-year. Advisors at these firms said they’re happy with how their firms provide competitive bonus structures and, in the case of WFG, additional opportunities to increase their income.

In the case of PPI Advisory, which saw its rating rise to 8.6 from 8.0 in 2012, Claude Ménard, the firm’s senior vice president, marketing, says the firm made changes to its override structure in order to be more in line with the rest of the insurance sector.

Under the firm’s old system, an advisor’s override was in effect only from the time that he or she qualified for it. But now overrides are “retroactive to Dollar 1,” Ménard says. “Let’s say we agree at the beginning of the year that [an advisor] will get 170%. If he produces more than what’s required for 170% – let’s say, [he qualifies for] 180% – we pay him back from Jan. 1 at 180%, which is something we didn’t used to do.”

Some PPI Advisory advisors have taken notice of this change, with one advisor in British Columbia saying that the compensation structure “is very competitive now.”

Regarding GWL, although some advisors said that firm’s compensation structure is confusing, an advisor in Quebec believes the bonuses that GWL pays out are tops in the insurance sector: “I don’t always sell GWL’s products. When I look at bonuses for other insurance companies, GWL’s are higher. In addition, we get 10% [in commissions] for renewals [on GWL policies] compared with 5% or even 3% from other companies.”

As for WFG advisors, they admit they don’t make as much money as advisors at other firms do. However, WFG advisors believe they have an opportunity that puts their MGA ahead of the pack: they’re not only paid for the products they sell, but for growing the firm’s business by bringing other advisors to WFG.

“We’re able to build an agency; we can help people [grow their practices] and we’re compensated for that,” says a WFG advisor on the Prairies. “I might get paid less for products, but I get paid to train. That puts us at the top of the heap.”

Despite these successes in the compensation picture, it’s not all rosy. The recent overhaul of Mississauga, Ont.-based RBC Life Insurance Co.’s compensation structure for its field sales advisors resulted in a rating of 6.6, down from 7.1 in 2012.

In November 2012, RBC Life’s field sales advisors were taken off a commissions-based structure and put on a base salary with variable compensation tied to production, including bonuses. The firm’s more experienced and independent “platinum-level” advisors continue to be paid commissions, says Mike Hamilton, RBC Life’s senior vice president of sales and distribution.

As a result of this change, some RBC Life field sales advisors saw their compensation drop drastically. Some say management could have done a better job in introducing the changes. Says an RBC Life advisor in Western Canada: “The changes were so drastic, we’re still sitting here in shock.”

© 2013 Investment Executive. All rights reserved.