By and large, the financial advisors surveyed for Investment Executive’s (IE) Brokerage Report Card this year are dissatisfied with their firm’s compensation packages, as record-setting books of business have failed to translate into bigger paycheques.

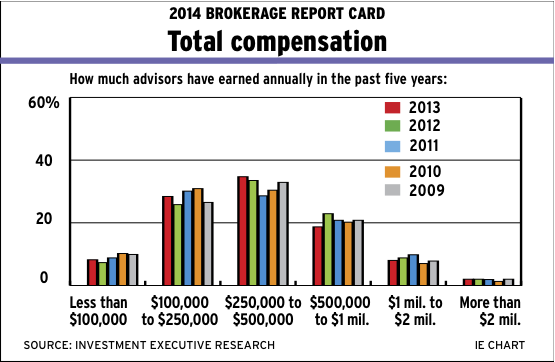

In particular, advisors reported an overall average book of $101.8 million, up substantially from years past – and a Brokerage Report Card all-time high. However, despite these large books of business, fewer advisors are making more than $500,000 a year compared with last year, as the percentage of advisors making this much has dropped to 28.7% from 33.4% in 2013. Meanwhile, the percentage of advisors reporting an annual income of less than $500,000 rose to 71.3% from 66.6% year-over-year.

As a result, advisors rated their “firm’s total compensation” performance at 8.2 overall – a slight decrease from last year’s overall average rating of 8.3. More revealing, however, is the category’s overall average importance rating of 9.1 this year, up slightly from 9.0 in 2013 – the fifth-highest importance rating in the 2014 Report Card. The “satisfaction gap” between this year’s overall average performance and importance ratings is 0.9 of a point – the fourth-widest gap in the Report Card.

Advisors unhappiest with their firm’s compensation packages complained of moving benchmarks and clawbacks. Conversely, the firms that are getting it right are those with a straightforward and apparently fair payout.

Among the latter group is Calgary-based Leede Financial Markets Inc.; its advisors praised the firm’s generous grid by giving it a performance rating of 9.5.

“The compensation is clearly defined and generous [by] industry standards,” says a Leede advisor in British Columbia. “Being at a place with great compensation rates up there with oxygen.”

Leede has found a recipe for success. The firm garnered the highest rating in the compensation category for the fourth year in a row, despite its payout remaining unchanged. (Leede advisors receive a 50% payout for revenue up to $400,000, then the payout rises to 55% before topping off at 60% for revenue of $600,000 or more.) For Robert Harrison, Leede’s president and CEO, this grid is all about “treating people the way you want to be treated yourself.”

A straightforward grid is why advisors with Mississauga, Ont.-based Edward Jones rated their firm among the top three firms in the compensation category this year, at 8.8.

“There are no bombshells. We get a lower payout than the Street [average], but the firm makes up for some of it in bonuses,” says an Edward Jones advisor in B.C. “Everyone is changing grids on the Street. [Edward Jones] never messes with it.”

Edward Jones’ quarterly bonuses are based on the profitability of both the firm as a whole and of the individual branches, says David Lane, the firm’s principal and head of Canadian operations. As well, Edward Jones has a long-standing tradition of profit-sharing and equity ownership in the firm for advisors. Says Lane: “We want to recognize those people who are doing the work, and we give opportunities for people to own or have ownership in Edward Jones.”

Similarly, Toronto-based TD Wealth Private Investment Advice (TD Wealth PIA) also offers its advisors stock in its parent company, Toronto-Dominion Bank. However, changes made in 2013 to the restricted stock units (RSU) program and the overall grid have taken a chunk out of advisors’ paycheques.

“The changes they’ve put in just this past year,” says a TD Wealth PIA advisor in Ontario, “[are] personally going to cost me $15,000 to $20,000 in revenue.”

As IE reported in its Mid-November 2013 issue, TD Wealth PIA cut its grid so that an advisor with gross production of more than $375,000 but less than $400,000 will earn a 20% commission, down from 30%-44% in previous years. Furthermore, 40% of RSU awards now are target-based rather than the 100% production-based that they were formerly.

These changes were meant to bring advisor compensation in line with the company’s overall strategic goals, says Dave Kelly, TD Wealth PIA’s president and national sales manager. In the end, he believes, any setbacks that advisors have with the new compensation structure will be only temporary: “I fully expect to more than recoup changes that we made in the compensation plan by yearend, in terms of payout to advisors.”

Advisors with Montreal-based National Bank Financial Ltd. (NBF) and Toronto-based BMO Nesbitt Burns Inc. also reported that their payouts are shrinking. The two firms garnered the lowest ratings in the compensation category, at 7.2 and 7.1, respectively.

“They’re getting cheaper and cheaper all the time,” says an NBF advisor in Atlantic Canada.

NBF’s grid ranges from 20% for advisors producing $350,000 or less and with more than seven years experience to 55.3% for the firm’s top 200 advisors. As well, all advisors are entitled to quarterly bonuses and a “deferred share units” program. Says Martin Lavigne, president of NBF’s wealth-management division: “We’re positioned to have a better grid than all the other banks.”

Nesbitt executives say they continue to evaluate the company’s compensation structure. As for the firm’s advisors, they were more outspoken. Says a Nesbitt advisor on the Prairies: “Compensation gets whittled away each year.” (Many colleagues shared this sentiment, citing clawbacks in the grid and added costs for services as reasons.)

Rewards and recognition programs

As for firms hoping to make up for any perceived deficiencies in their grid through rewards and recognition programs, advisors gave a clear message: they’d rather take the cash. As the aforementioned Nesbitt advisor put it: “Like Cuba Gooding [Jr.] said, ‘Show me the money’.”

In fact, this year, IE has asked advisors for the first time to rate their “firm’s reward/recognition program” separately from total compensation. Results show that most advisors don’t put much weight on rewards and recognition: the category received an overall importance rating of 6.9 – second-lowest in the entire Report Card.

Advisors with Toronto-based Raymond James Ltd., for example, were one of four groups of advisors to give their firm a 7.0 performance rating in this category. Although this suggests advisor dissatisfaction, Raymond James advisors gave the category an importance rating of 5.4, making it clear they don’t mind if the firm’s rewards program is thin.

“They’ll reward you with trips, but I don’t like those things,” says a Raymond James advisor in Ontario. “I’d rather go to France with my wife than with 30 advisors from across the firm.”

A problem for firms – even those that were rated highly in the rewards/recognition category – is the exclusive nature of their programs. Says an advisor in Ontario with RBC Dominion Securities Inc.: “Only a small percentage [of advisors] see those rewards.”

“We reward 500 of our top advisors,” says David Agnew, DS’s CEO and national director, of the trips available to advisors at three levels: chairman’s council, executive council and director’s council. “It’s a great opportunity to share strategies with training opportunities [and] best practices. We focus on the client experience.”

© 2014 Investment Executive. All rights reserved.