When the global financial crisis and ensuing recession hit the financial services industry a few years ago, the insurance channel felt minimal effects, resulting in steady satisfaction ratings from insurance advisors. It should come as no surprise then that those advisors surveyed for this year’s Insurance Advisors’ Report Card continued to hold their firms in very high regard.

“The general atmosphere is welcoming and encouraging,” says an advisor in Ontario with Mississauga, Ont.-based managing general agency IDC Worldsource Insurance Network Inc.

Adds an advisor in Alberta with Calgary-based MGA PPI Solutions Inc. : “They have genuine concern for viability [of] my business, and there is trust there.”

Although the overall mood was upbeat, advisors also revealed that the expectations they have of their firms — in terms of the services they provide — are increasing. This is evident in the variety of categories to which advisors gave much higher importance ratings than in last year’s survey, including support for financial planning, retirement planning, post-retirement income planning, wills and estate planning and tax planning.

“There’s a huge importance placed on creating a plan and a road map,” says an advisor in Ontario with Vaughan, Ont.-based World Financial Group Insurance Agency of Canada Inc. (WFG). “The products are secondary.”

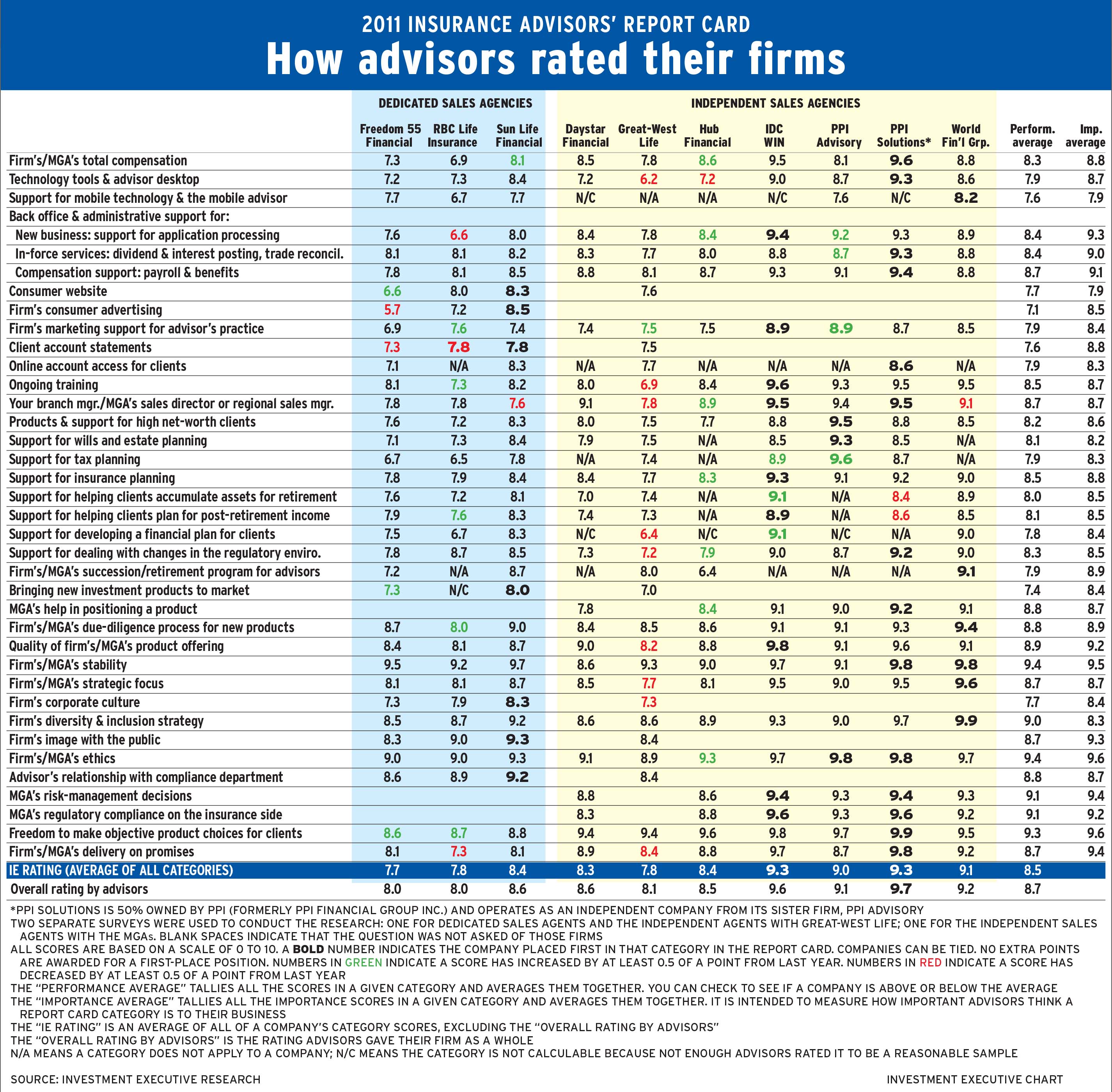

To find out about advisors’ expectations — and how their firms have performed in meeting them — Investment Executive researchers Sanam Islam, Iris Leung and Yumi Otagaki spoke with 399 insurance advisors at 10 firms. Advisors gave two ratings for each category: one for the firm’s performance and the other indicating how important that category is to their businesses.

Advisors were asked to rate the categories on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.” Individual scores were averaged for each category — both firm-wide and Report Card-wide.

The “IE rating” indicates the average of all categories for each firm, while the “overall rating by advisors” is the average of how advisors rated their firms out of 10.

Much as in years past, this year’s version of the Report Card has evolved as a result of both changes in the insurance channel and executive feedback. In previous years, insurance firms were classified as dedicated sales agencies, an independent direct sales agency, managing general agencies and specialized MGAs. However, in an effort to simplify matters, firms now fall under one of two categories: dedicated sales agencies or independent sales agencies — the latter includes MGAs of all stripes, as well as the one independent direct sales agency.

That independent direct sales agency, Winnipeg-based Great-West Life Assurance Co. , was moved into the independent direct agency category from the dedicated sales category two years ago after a review of its business model. There was much confusion about where the firm stood in years past as a result of its significant Gold Key distribution network. That’s because Gold Key advisors are fully independent but also receive a full suite of in-house support services, much like their counterparts in the dedicated sales agencies.

As a result, after discussion with insurance channel experts and the firm itself, GWL was classified as an independent sales agency — although IE‘s research on GWL was conducted using the survey for dedicated sales agents.

That wasn’t the only change evident in this year’s Report Card. In fact, when looking at the firms’ names, you’ll find a new participant as well as new monikers for previously surveyed firms.

Among the latter, Toronto-based MGA PPI Financial Group Inc. is now PPI Advisory after a rebranding. The parent firm, now simply called PPI, owns PPI Advisory, which targets high net-worth clients, and 50% of Calgary-based PPI Solutions Inc. , which focuses on the middle market.

There also was the recent merger, completed last month, between Mississauga, Ont.-based MGA IDC Financial Inc. and Markham, Ont.-based MGA Worldsource Insurance Network Inc. As a result, IDC, a survey participant since 2008, is now referred to by its new name, IDC Worldsource Insurance Network Inc. — or IDC WIN, for short.

Former IDC advisors welcomed the news. “Their focus is growing — and there is communication between partners and advisors,” says an IDC WIN advisor in Ontario.

IDC WIN president Ron Madzia, who held the same role with IDC, says: “Now we have a partner with which we can continue to grow. We never wanted to be the biggest, but we do want to be the best.”

Consistent with the results of previous Insurance Advisors’ Report Cards, IDC WIN didn’t disappoint, earning 11 survey-best ratings this year. As well, it has tied for the top IE rating, along with PPI Solutions.

As always, IDC WIN garnered significant praise from its advisors. “[The firm] has top people,” says an IDC WIN advisor in Ontario. “They’re very good at offering support services.”

Meanwhile, advisors with this year’s new entrant to the Insurance Advisors’ Report Card — Winnipeg-based MGA Daystar Financial Group Inc. — also found its strength in the firm’s personnel. In fact, when asked to name the most positive aspects of working at the firm, a Daystar advisor in British Columbia says it’s “the people — without a doubt.”

Not surprisingly, one of Daystar’s highest ratings was in the “your branch manager/MGA’s sales director or regional sales manager” category. “Their role is to add value, in terms of practice management,” says Rene Pereux, co-CEO of Daystar. “Their job is to deliver those kinds of things to advi-sors on a proactive basis.”

In Daystar’s first showing in the Report Card, the firm also did well in some of the categories that advisors, overall, rated highest in importance, including “firm’s/MGA’s ethics” and “freedom to make objective product choices for clients.”

Much like Daystar, most firms in the Report Card also saw their performance ratings match up with their importance ratings in those three key areas.

The top rating of 9.8 in the ethics category was shared by both PPI firms. In fact, PPI Advisory and PPI Solutions both performed very well overall. PPI Advisory had top ratings in five categories, while PPI Solutions had top scores in 14 categories — as well as being tied for the top IE rating and garnering the highest “overall rating by advisors.”

WFG and Waterloo, Ont.-based dedicated sales agency Sun Life Financial (Canada) Inc. also fared well, as both firms had top ratings in six categories.

Among them was WFG’s near-perfect 9.9 rating in a new category introduced in this year’s survey: “firm’s diversity and inclusion strategy.” Says a WFG advisor in Ontario: “We have all colours. Most leaders are women. It helps us expand our market, which is so important.”

Overall, the insurance channel seems to fare just as well as the deposit-taking institutions when it comes to workplace diversity, capturing a 9.0 overall performance average in the category compared with the 9.1 overall performance rating in the Report Card on Banks and Credit Unions.

Meanwhile, Hub Financial Inc. didn’t register any first-place rankings; however the Woodbridge, Ont.-based MGA showed marked improvement in several categories. For instance, Hub’s rating in the ethics category rose by half a point to 9.3 from 8.8 year-over-year, while its rating in the “firm’s/MGA’s total compensation” category increased to 8.6 from 8.1. (See story on page 21.)

“They delivered on promises and on the compensation grid,” says a Hub advisor in Alberta. “What we discussed was put in place. They are ethical and they have integrity.”

Hub advisors were especially positive about their head office. Says a Hub advisor in Ontario: “This is their strength. If I ran into a problem, that’s where they offer value.”

Hub president Terri DiFlorio says advisors appreciate the firm’s long-term stability in management: “You build the relationships; so, every day that ticks by makes that a better relationship.” The shortest tenure for a senior manager at Hub is eight or nine years: “When your management team’s been around for a long time, they know the company, they know the advisors and they know the processes. It’s always a good thing.”

In contrast, GWL saw troubling results related to management: its rating in the branch manager/sales director category fell to 7.8 from 8.4 in 2010; its rating in the “firm’s delivery of promises” category fell to 8.4 from 8.9; and its score in the “firm’s corporate culture” category fell to 7.3 from 8.1.

Advisors’ comments indicated dissatisfaction with a corporate restructuring in the firm’s regional reporting centres. Says a GWL advisor in B.C.: “Last year, they closed out or downgraded regional office support. We used to have a local office sales manager in my area who watched every agent’s production … but now we have a new manager out of Vancouver, and he has to deal with 100,000 cases.”

However, Hugh Moncrieff, senior vice president of GWL’s Gold Key distribution network, says stability at the firm remains strong despite the changes: “We have not reduced the number of product support wholesalers or the number of sales and marketing centres.” IE