For financial advisors across all of the financial services sector’s distribution channels, having functional front-office technology is one of the keys to achieving maximum productivity. Although firms’ efforts leave much to be desired for the most part, there are some firms that are showing the way to provide advisors with state-of-the-art tech tools.

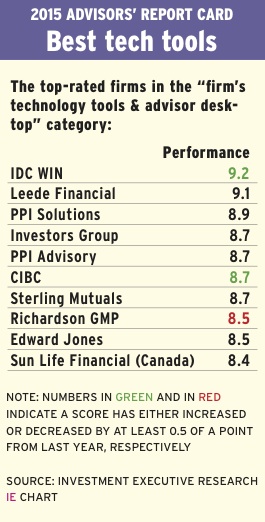

Much like years past, this year’s Report Card series provided evidence that firms are failing to meet advisors’ expectations in the “technology tools and advisor desktop” category. When looking at the difference between the overall average performance rating (7.5) and the overall average importance rating (8.9), it results in a tie for the largest “satisfaction gap” among all the categories in this year’s Report Card series – a trend that has persisted year after year.

One of the primary concerns that advisors had with their firms’ technology was that it’s outdated and, as a result, curbs productivity. Says an advisor in Atlantic Canada with Toronto-based ScotiaMcLeod Inc.: “The systems are outdated and inaccurate. How can you provide good advice if you don’t have good information?”

Another common frustration for advisors was a lack of integration between software programs. Says an advisor in Alberta with Toronto-based Bank of Montreal: “Our technology is awful. We have a million different systems that don’t talk to each other.”

Advisors need training

Even when firms are proactive and introduce new tech tools, that’s not enough. The technology has to perform well and advisors have to be taught how to use it. Says an advisor in British Columbia with Montreal-based National Bank Financial Ltd.: “They launched a lot of tools, but there’s little training and there are a lot of glitches.”

Nevertheless, there are firms that recognize the significance of advisors having technology that is robust, fully integrated and easy to use – as well as providing advisors with strong support and training for making the best use of that technology.

Advisors with Mississauga, Ont.-based managing general agency (MGA) IDC Worldsource Insurance Network Inc. (IDC WIN) and Calgary-based regional brokerage Leede Financial Markets Inc. gave their firms the highest ratings in the tech tools category because these companies have made a concerted effort to have strong systems in place and have made the necessary investments in this area.

Firms find the right mix

“Their system is phenomenal,” says an IDC WIN advisor in Ontario. “Everything is on there, including [insurance] applications. Compared to previous places [at which I’ve worked], it’s a huge step up.”

Adds a Leede advisor in British Columbia: “Although we may not have the range of other investment dealers, such as the bank-owned firms, we have all of the essential tech tools – and they are quality.”

Advisors with sister MGAs Calgary-based PPI Solutions Inc. and Toronto-based PPI Advisory not only praised the quality of the technology their firms make available, these advisors also went out of their way to point out how easy the technology is to use – and that they receive the necessary support to figure it all out.

“We have a great professional platform that’s easy to use and integrates well with the other [software],” says a PPI Solutions advisor in Alberta. “I didn’t grow up with technology, but [PPI Solutions has] great IT support.”

“[PPI Advisory] has user-friendly technology that allows me to put together presentations quickly. They’ve placed a focus on technology and training for it,” says an advisor on the Prairies with that firm.

Adds a colleague in Ontario: “I don’t have to go anywhere else. Everything I need or want is there, and I have people I can go to if I need help.”

Meanwhile, other advisors pointed out that their firms have customized tech tools with added benefits that help advisors run their businesses better. For example, advisors with Toronto-based Canadian Imperial Bank of Commerce (CIBC) praised the bank’s technology for incorporating an intuitive client management system (CMS) that has helped advisors be more proactive with clients.

Tools with added benefits

“We have a program that gives us a heads-up on any client management tasks and alerts us when we should call clients,” says a CIBC advisor in B.C.

Similarly, Winnipeg-based mutual fund dealer Investors Group Inc. offers advisors a system that many advisors said has been efficient at tracking client accounts.

“We have a customized interactive CMS called Pathway that allows us to see our portfolio, clients and all of their family members, transactions, accounts, banking products and statements all in one place,” says an Investors Group advisor in Atlantic Canada. “Investors Group keeps building on it – and it isn’t just something [from] off the shelf.”

Having customized tools is critical, advisors said, because making changes on such software usually is easy. This is especially the case during a time when regulatory changes are transforming the way that firms and advisors run their businesses.

Says an advisor in Ontario with Windsor, Ont.-based mutual fund dealer Sterling Mutuals Inc.: “The firm built its own trading platform, which allows for quick evolution as the regulatory environment changes. Our programming changes almost instantly. It’s quick and almost foolproof.”

© 2015 Investment Executive. All rights reserved.