Many financial advisors surveyed for this year’s Brokerage Report Card are taking home bigger paycheques than they did last year. In turn, advisors appear to be slightly happier overall with their firms’ compensation packages.

However, the results vary drastically among the firms. Some of the firms that have tweaked their compensation programs were punished with considerably lower scores, with their advisors complaining that payouts and bonuses continue to decline. In contrast, firms with steady grids and generous bonus programs were rewarded with high scores.

The overall average performance rating in the “firm’s total compensation” category was 8.3 this year, up slightly from 8.2 in 2012. However, compensation continues to be considered one of the most important categories for advisors, who gave it an overall average importance score of 9.0 this year, unchanged year-over-year.

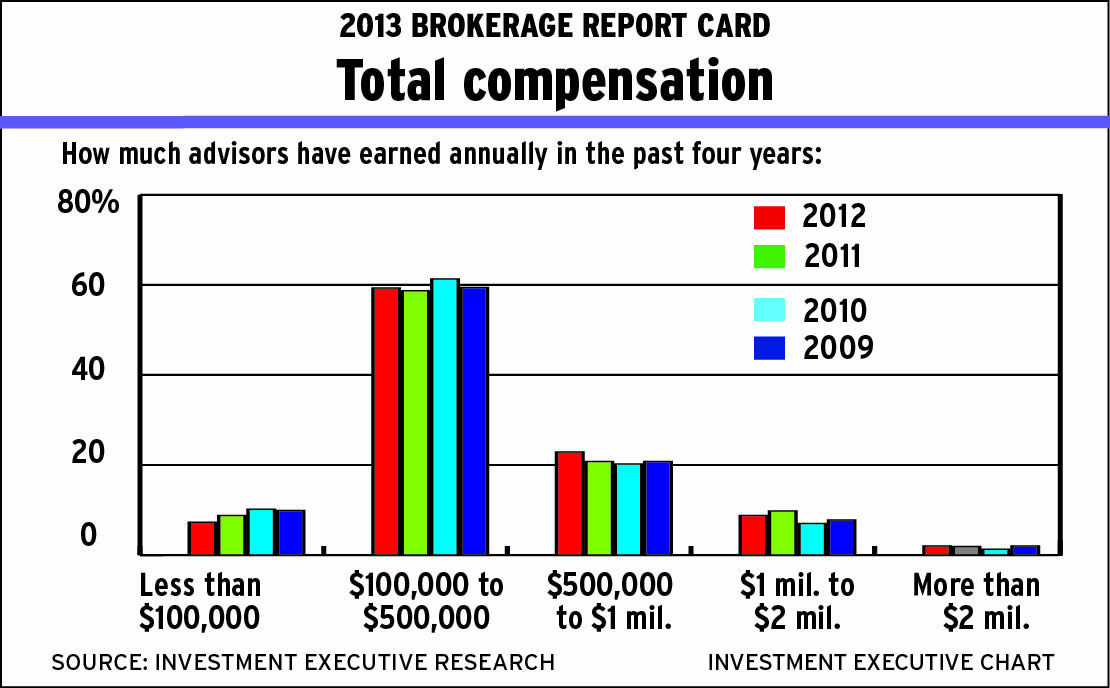

The Report Card results reveal that many advisors have seen their compensation grow year-over-year. The proportion of advisors who earned $250,000 or less annually has fallen to 33.1% from 38.9% in 2012, whereas the proportion of those earning more than $250,000 has increased to 66.9% from 61.1%.

Nevertheless, advisors have concerns about their compensation. One common complaint is that pay programs have become overly complicated. Says an advisor in Ontario with Toronto-based Raymond James Ltd.: “I’ve been here since 2005, and the pay grid used to be pretty straightforward. Now, they’ve complicated it to depend on products and production level. It’s become more bureaucratic, like a bank.”

Another concern: payouts at some firms appear to be trending gradually lower over time. Says an advisor in Ontario with Montreal-based National Bank Financial Ltd. (NBF): “The amount they pay us constantly decreases by [the firm adjusting] the grid.”

NBF’s rating in the compensation category suffered the biggest drop this year, falling to 6.9 from 7.8 last year. That decline can be attributed, in part, to the dissatisfaction among former Wellington West Capital Inc. advisors who now are getting lower payouts compared with what they received prior to NBF’s acquisition of Wellington West in 2011.

“They are taking more now after being bought by NBF,” says one such advisor in Ontario. “The commissions system is brutal.”

And NBF tweaked its bonus program recently, which also appears to have contributed to the drop in the firm’s rating. Specifically, part of the quarterly bonus that advisors receive is now deferred in the form of deferred share units (DSUs) – notional or “phantom” shares that mirror the value of the company’s stock without providing actual equity in the firm for the advisor. Unitholders are entitled to receive a cash payment equal to the value of the DSUs after a certain period, and taxes are deferred until the benefit is received.

“Through the DSU,” says Martin Lavigne, president of NBF’s wealth-management division, “[advisors] can defer, pretax, part of their income, which is a big advantage. A lot of people will see it as part of their pension. It’s an incentive program.”

NBF advisors are unimpressed with the program. “They are just taking our money,” says an NBF advisor in Alberta. “[You’re] going to see a lot of advisors leaving the firm in the next 12 months.”

Another brokerage that drew the ire of its advisors was Raymond James, which saw its compensation rating fall to 8.1 from 8.9 last year. Advisors with this firm attribute their discontent to changes in the grid, which have cut payouts for lower-producing advisors in particular.

“They moved the grid twice in 19 months,” says a Raymond James advisor in British Columbia. “They lowered the percentages we make on our business.”

However, Terry Hetherington, the firm’s executive vice president and head of its private client group, says the change was necessary from a profitability perspective: “We have to continue to be profitable, so one of the things we had to do was to tweak the grid at the lower levels. So, we did tweak the grids; not in a large way, but some of the people who were at the lower end of the production scale would have felt that this year.”

Although the adjustments were minor, according to Hetherington, some Raymond James advisors say the changes impacted their businesses “radically.”

In contrast, simplicity and consistency were the prominent themes among the compensation structures that earned the highest ratings. Advisors say they appreciate grids that are straightforward and stable.

Says an advisor in B.C. with Vancouver-based Odlum Brown Ltd., which earned a rating of 8.9 in the category: “[It’s] one of the best grids on the Street. There’s no constant change in the numbers and it stays consistent.”

Similarly, Calgary-based independent brokerage Leede Financial Markets Inc., which earned the top rating in the compensation category for the third consecutive year, has left its compensation package unchanged.

“That’s one of the reasons we’re growing,” says Robert Harrison, the firm’s president and CEO. “A lot of firms are making changes. We have brokers that are tired of that who have come over here from all the different firms.”

A stable compensation program is particularly important during periods of economic uncertainty, says David Agnew, CEO and national director of Toronto-based RBC Dominion Securities Inc., which saw its score in the compensation category jump to 8.7 from 8.1 year-over-year: “We know the advisors have had a very challenging few years navigating the tough financial markets, so we thought it was prudent to keep everything the same.”

Another firm lauded for its compensation was Toronto-based boutique brokerage Richardson GMP Ltd., which garnered a 9.2 in the category. Advisors with the firm commend its incentive program, in particular, which rewards advisors for hitting certain thresholds in revenue and net new assets.

“They’re good at putting together motivating compensation packages, rewards and bonuses,” says a Richardson GMP advisor in Quebec. “It’s an additional push to grow your business.”

Other firms with strong bonus programs also earned praise from their advisors. This includes Toronto-based ScotiaMcLeod Inc., which saw its compensation rating rise to 8.1 from 7.2.

“Besides our grid, we have a unique compensation program that rewards our advisors for growing their businesses,” says Hamish Angus, managing director and head of ScotiaMcLeod. “It really focuses on recognizing and rewarding top-growing advisors.”

Mississauga, Ont.-based Edward Jones also saw its rating rise considerably in this category. After dropping by half a point to 8.2 in 2012, the firm’s score has climbed back to 8.7. Advisors laud the firm’s fair payouts and bonuses.

© 2013 Investment Executive. All rights reserved.