Despite the resounding rebound in stock markets and, in turn, growing books of business, advisors surveyed for this year’s Dealers’ Report Card have yet to see any upward movement in their compensation levels.

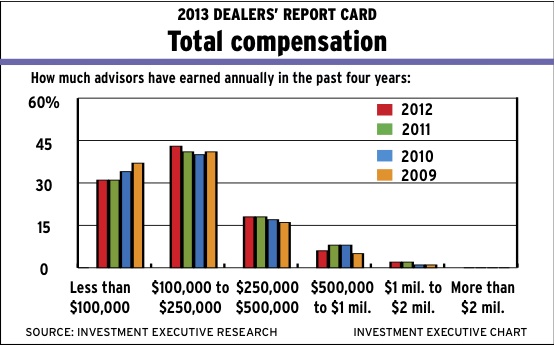

With average assets under management (AUM) increasing to $27.8 million from $23.7 million last year, it’s evident that advisors are working hard to bring in new business. However, they’re not seeing their wallets get any thicker in the process. In fact, the percentage of advisors surveyed who earn less than $250,000 actually rose to 73.2% from 72% last year; those earning between $250,000 and $500,000 remained stagnant, at 17.9%; and those earning more than $500,000 dropped to 8.8% from 10% in 2012.

Advisors’ dissatisfaction with their take-home pay stems from a variety of issues, including dealer firms being slow to re-establish their payouts to pre-recessionary levels, changes to equity ownership programs, fee increases, and lacklustre rewards and recognition programs.

“The grid used to be higher,” says an advisor in Ontario with Toronto-based Assante Wealth Management (Canada) Ltd. “But it was chopped a while ago and never went back up.”

Adds an advisor with Markham, Ont.-based Worldsource Financial Management Inc.: “They have kept the pay grade steady but have quadrupled the fees over the past few years. Someone has to pay for regulatory stuff.”

As a result of this dissatisfaction, there is disparity between how important advisors said compensation is to them and how well they felt their firm has performed on this topic.

Toronto-based DundeeWealth Inc. saw a major disconnection between the 8.6 importance rating its advisors gave the “firm’s total compensation” category and the 7.9 performance rating they gave their firm, which is down from 8.3 in 2012. This disconnection is no surprise, as the firm recently changed its equity-ownership program.

“We have a profit-sharing program,” says John Bai, the firm’s senior vice president of wealth-management strategy. “But the qualifications for the program have changed and fewer advisors have qualified for the program this year.”

Mississauga, Ont.-based Investment Planning Counsel (IPC) also saw its rating in the compensation category drop by the same margin, to 7.8 from 8.2 last year, although for very different reasons. IPC recently increased its payout for its advisors on the Investment Industry Regulatory Organization of Canada platform to 85% from 80% to match its payout for its advisors on the Mutual Fund Dealers Association of Canada (MFDA)platform.

However, the increase may not be making its way directly to some advisors because IPC’s compensation model works on a branch-based system. The firm pays each branch 85%, then the branch decides what an advisor’s compensation will be based on business and geographical area.

“There is a suggested payout grid,” says Chris Reynolds, IPC’s president and CEO. “But, really, at the end of the day, it’s up to the branch manager who runs each branch to design their own compensation grid.”

Furthermore, some IPC advisors complain about rising fees that are cutting into their earnings.

“The fees they charge are too high,” says an IPC advisor in Ontario. “We’re charged MFDA fees, technology fees, statement fees and bond fees.”

In addition to payouts, rewards and recognition drew the ire of advisors this year. Advisors complained of rewards being available only if they sell certain products.

“The compensation is fair for the most part,” says an Assante advisor in Ontario. “But I think the reward program’s focus is too narrow. They reward only the top 5% [of advisors].”

Adds an advisor in the Prairies with Lévis, Que.-based Desjardins Financial Security Independent Network: “They should recognize success and implement a better bonus structure.”

Mississauga-based PFSL Investments Canada Ltd. keeps its advisors happy with a rewards program that includes incentives ranging from recognition plaques to a recent campaign in which advisors were given an iPad Mini if they hit certain production targets. The firm also provides its top advisors with an annual reward trip.

In contrast, Ottawa-based Independent Planning Group Inc. (IPG) and Calgary-based Portfolio Strategies Corp. both take a different approach for keeping their advisors happy with compensation. Neither firm offers a rewards and recognition program; rather, they focus on having high payout structures. IPG had the second-highest rating in the compensation category, at 8.6. The firm offers its advisors a grid structure that goes as high as 90%.

Portfolio Strategies keeps its expenses to a minimum with its “bare bones” business model. The firm’s compensation structure remained unchanged year-over-year, as did its 8.3 rating in the category.

“We don’t give out plaques,” says Mark Kent, Portfolio Strategies’ president and CEO. “Our advisors are very independent-oriented. We found over time that the advisors, as much as they would like all kinds of extra services and support, they weren’t necessarily willing to pay for it.”

The firm has had a long-standing reputation for offering one of the higher payouts on the street, which averages 80% for an advisor who wants to run a truly independent business.

“The compensation is all I’m concerned with; rewards mean nothing to me,” says a Portfolio Strategies advisor in British Columbia. “I’d rather just have the money in my pocket, and then I can decide how to spend it.”

© 2013 Investment Executive. All rights reserved.