Although financial advisors surveyed for this year’s Report Card series report a steady increase in their income, there is growing displeasure with their firms’ compensation packages.

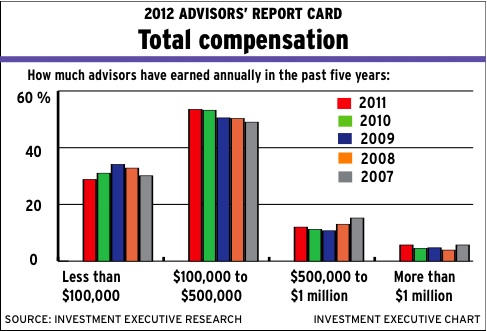

According to Investment Executive‘s data obtained for this year’s Report Card series, the percentage of advisors earning $100,000-$500,000 a year has risen slightly to 53.5%, vs 53.2% last year and 50.5% in 2010. More notably, advisors who earn $500,000-$1 million has risen to 12% from 11.2% in 2011 and 10.7% in 2010, and those earning more than $1 million has risen to 5.7% from 4.5% in 2011 and 4.7% in 2010. In line with these metrics, the percentage of advisors earning less than $100,000 annually has fallen to 28.8%, vs 31% in 2011 and 34.1% in 2010.

Yet, the satisfaction gap – the difference between the average result in the “overall performance rating” in all the Report Cards for the “firm’s total compensation” category (8.1) and the average of all results for the “overall importance rating” (9.0) – of 0.9 of a point is the third-largest among the categories, lagging only the satisfaction gaps in the “technology tools and advisor desktop” (1.1 points) and “client account statements” (1.0 point) categories, both of which are constant sources of dissatisfaction.

Furthermore, the overall importance rating of 9.0 for compensation is now the fourth-highest, up from 8.9, which was good for tenth overall last year. The only three categories ranked ahead of compensation in importance this year were the recurrent top three: “firm’s stability,” “freedom to make objective product choices” and “firm’s ethics.”

This dichotomy between rising compensation and advisors’ dissatisfaction with it was best captured in this year’s Report Card on Banks and Credit Unions. Advisors surveyed for this Report Card were happier than they’ve ever been with their firms’ compensation packages, yet they gave their firms the lowest performance rating, on average, in the category among all the Report Cards – at 8.0 vs 8.2 in each of the other Report Cards. The satisfaction gap for the deposit-taking institutions, at 1.0 point, was also the largest among the Report Cards.

“The compensation isn’t unfair, compared with what other banks are offering,” says an advisor in British Columbia with Montreal-based National Bank of Canada. “But it would be nice if there were larger bonuses for reps who close larger accounts.”

Adds an advisor in Atlantic Canada with Toronto-based Canadian Imperial Bank of Commerce: “The firm’s expectations [for hitting sales targets] are a little high. I’m in an economically depressed area, but I still have to produce at the same level as when things were going well.”

The complaints among advisors with firms in the other channels of the financial services industry varied, but most were focused on: firms that download costs onto advisors, bonuses that favour high producers, and grids and bonuses that have not yet returned to pre-recessionary levels.

This last issue was a source of dissatisfaction particularly among advisors with Toronto-based Assante Wealth Management (Canada) Ltd. Compensation at that firm was reduced in 2008 due to lower volumes; and although advisors are seeing their revenue return to pre-recessionary levels, the grid has not been restored accordingly. “They reduced our commission grid during the last recession,” says an Assante advisor in Ontario, “and they haven’t made any effort to return it to where it once was.”

Advisors with other firms were unhappy with changes to their bonus structures. Mississauga, Ont.-based RBC Life Insurance Co. drew the ire of its advisors because of the firm’s new production bonus payout grid, which calculates bonuses based on average production over three months of sales. Previously, the grid had allocated bonuses based on each month of production. “RBC Life changed the bonus structure so it hurts advisors like me,” says an RBC Life advisor in B.C. “[The grid] was changed to reward high producers. I saw a significant drop in my earnings; I’m working harder to get the same pay.”

Meanwhile, some advisors with Mississauga-based Edward Jones complained of too many overhead costs, which have cut into their overall compensation. Says an Edward Jones advisor in Ontario: “I don’t like that there are so many costs being downloaded onto the advisor that we pay out of our pockets.”

However, some Edward Jones advisors praised the firm’s five-component compensation structure, in which advisors can earn commissions, a bonus, profit-sharing, trips or other rewards, and a pension. Payouts at the firm range from 40% to 60%, depending on advisor performance. “We have outstanding opportunities to grow,” says an Edward Jones advisor in Ontario, “and big incentives to perform.”

Having various sources of income in addition to a strong balance between payout levels and value received are key to advisors’ satisfaction with their firms’ compensation practices. Case in point: the firms with the highest compensation ratings were Calgary-based Leede Financial Markets Inc., and Mississauga-based PFSL Investments Canada Ltd. Advisors praised these firms for having fair and transparent compensation programs that include high payouts and equity ownership options, as well as ample reward programs and support services.

Leede, in particular, was commended for having an easy-to-understand compensation program and because it has added a 60% payout level for advisors earning more than $600,000. (The base payout for all lower levels of production is 50%.) Says a Leede advisor in B.C.: “I think [the compensation] is as good as it can be in the industry.”

PFSL was lauded for changing its bonus program to paying them on a monthly basis instead of quarterly, as well as the available number of avenues advisors have in order to earn their compensation.

© 2012 Investment Executive. All rights reserved.