As brokerages continue their move toward a more holistic, clientcentric, wealth-management business, their investment advisors are placing greater importance and emphasis on financial planning than ever before.

This trend is most evident in the ratings and data obtained in Investment Executive’s Brokerage Report Card. For example, since the beginning of this decade, the importance rating that advisors gave the “support for developing a financial plan for clients” category has risen to 8.9 this year from 8.6 in 2015 and 8.3 in 2010.

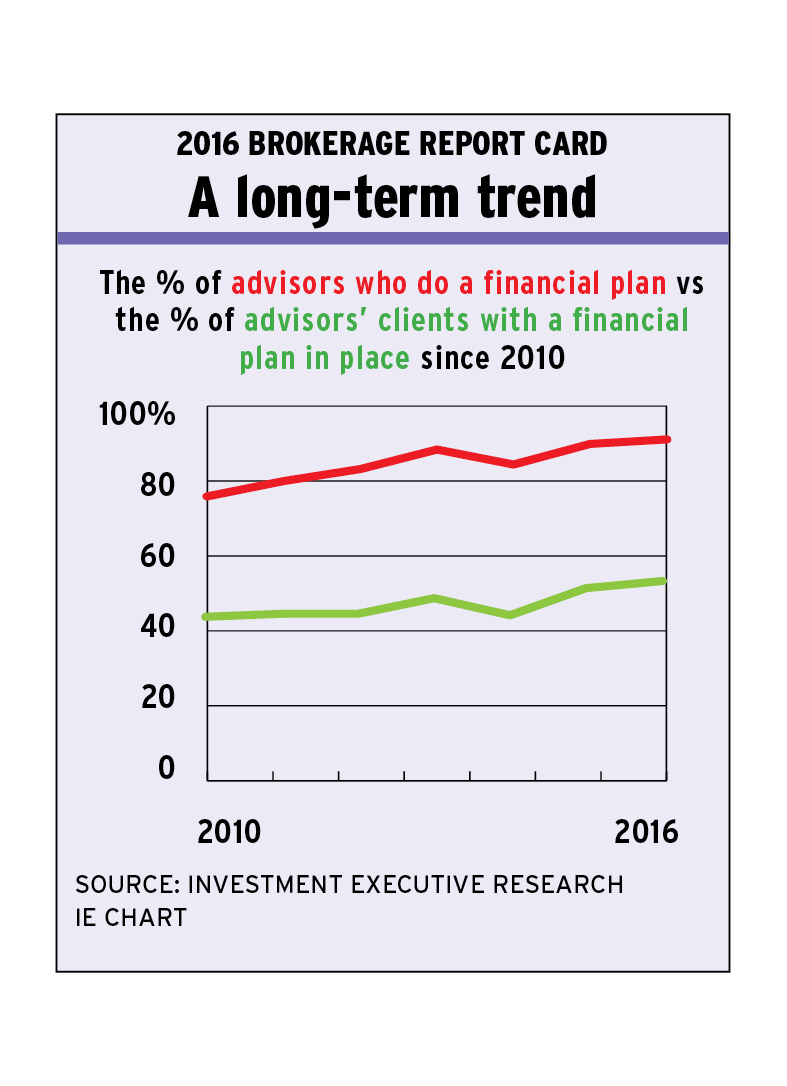

Furthermore, the percentage of advisors who create a financial plan for clients – either on their own or with the help of in-house financial planners – also has risen steadily during this period, to 91.1% today from 89.9% last year and 75.9% in 2010.

Some advisors said developing financial plans for clients can strengthen client/advisor relationships and build trust. Says an advisor in British Columbia with Toronto-based RBC Dominion Securities Inc. (DS): “This is the direction in which the industry is going. If we’re going to charge fees, people need some services around it.”

This is a vision that both firms and advisors share. For example, Patrick French, director of financial and retirement planning with Mississauga, Ont.-based Edward Jones, says that financial planning is becoming more important to his firm as it “shifts toward a client-relationship model.”

No coincidence, then, that Edward Jones and DS, which were among the highest-rated firms in the financial planning support category also have the highest percentage of advisors’ clients who have a financial plan in place. Edward Jones advisors rated their firm’s support for financial planning at 8.8 – and 66.8% of these advisors’ clients have a financial plan in place. Similarly, DS advisors rated their firm’s support for financial planning at 8.9, and 65% of their clients have financial plans in place.

“We have full-time financial planners, people doing plans for clients,” says a DS advisor in Ontario. “We put more emphasis on it than the clients do.”

“Our whole philosophy is built around creating a financial plan for clients,” says an Edward Jones advisor in Ontario. “It’s a standard process that every client goes through, and we are always improving that process.”

Although the emphasis on financial planning and the overall support for the service is increasing, most advisors do financial plans with only about half their clients, with the average this year being 53.2% of clients with a plan in place. Although this percentage is an improvement from 51.3% in 2015 and 43.6% in 2010, the latest figure suggests that advisors still face significant challenges when trying to get their clients to agree to developing a financial plan.

“Not every client cares,” says an advisor in Alberta with Toronto-based Richardson GMP Ltd. “Even though it’s critical to have [a financial plan in place].”

In fact, Rob McGavin, managing director, financial planning and insurance advisory, with Toronto-based ScotiaMcLeod Inc., says the biggest challenge related to financial planning is getting clients on board: “Some of the more practical objections [are] around the process being potentially time-consuming and laborious. Clients don’t see the value in [a plan] or don’t believe that they need it.”

“The primary challenge is clients being thoroughly engaged in the process,” French concurs. “Client engagement, in some instances, is challenging because it involves work on the client’s part.”

But there are steps that both advisors and their firms could take to get clients engaged in the process. For example, French explains, Edward Jones takes a tiered approach to financial planning: “What we’ve done is realize what people will need based on their situation. [As a result, the process is] effectively two levels: a more basic plan for younger investors, which is goal-oriented but requires much less detail on the part of the client; and a second level for clients who recognize that they need a greater level of detail, there’s a more sophisticated tool.”

The goal-oriented approach to financial planning is critical for getting younger or less sophisticated clients on board with the process. Says McGavin: “What we try to encourage our advisors to [do] is start the conversation with clients’ goals as opposed whether a client wants a financial plan.”

The firm is doubling down on its efforts to enhance wealth-management and financial planning services for both clients and advisors in an effort to increase the prevalence of financial plans among clients. ScotiaMcLeod had the second-lowest percentage of advisors who do financial plans for clients (82%) and the lowest percentage of clients with a financial plan in place (40.5%) in this year’s Report Card.

To do that, ScotiaMcLeod’s parent bank rebranded and restructured its complement of wealth advice and services under the Scotia Wealth Management name late last year. Some ScotiaMcLeod advisors say the support for financial planning is improving, as the firm has more experts to rely upon.

“It’s getting better,” says a ScotiaMcLeod advisor in Ontario. “We’re adding dedicated personnel in each branch; we used to have a regional person.”

© 2016 Investment Executive. All rights reserved.