Faced with the stringent demands of a more robust regulatory environment, insurance advisors say that having clients sign letters of engagement is becoming an integral part in running their businesses.

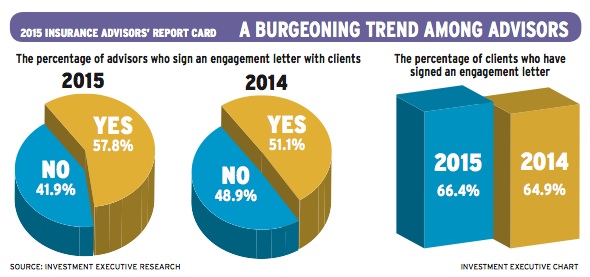

The percentage of advisors surveyed for this year’s Insurance Advisors Report Card who said they have clients sign engagement letters has risen to 57.8% from 51.1% last year, and the percentage of clients with a signed engagement letter also increased, albeit incrementally, to 66.4% from 64.9% year-over-year.

“Every single new client has [to sign an engagement letter] now,” says an advisor in Ontario with Toronto-based PPI Advisory. “In the past five years, I’ve done one with 100% of my new clients.”

Much like a contract, an engagement letter sets out the terms of the relationship between advisors and their clients, including what services the advisor offers or the client accepts, as well as the advisor’s compensation.

One reason why advisors may be more open to implementing a process of signing engagement letters is that, for the most part, they’re generally pleased with their firms’ and managing general agencies’ (MGAs) efforts in the “firm’s/MGA’s support for creating an engagement letter” category, as they gave firms an overall average performance rating of 8.3.

(The category was included in the main table on page 12 for the first time this year, although it was a supplementary question in last year’s Report Card.)

Advisors who gave their firms and MGAs the highest praise in the category did so because they were happy to have customizable templates available for engagement letters as well as the necessary support to put them together.

For example, advisors with Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. (IDC WIN) gave their MGA the highest rating in the category, at 9.6, because it makes templates available to advisors online with a guide on some basics that have to be included in the engagement letters. Once that’s done, advisors can then send it in for review.

“We have excellent support,” says an IDC WIN advisor in Ontario. “It’s mostly done online, and then you send the letter in for approval.”

Ron Madzia, IDC WIN’s president, says the MGA’s mantra is that “it’s better to be proactive than reactive.” As a result, IDC WIN posts all compliance documents, including engagement letters, as templates on the website so advisors can access and customize them easily.

“We did it primarily for protection of our advisors,” Madzia says, “to make sure they’re running their practices in a compliant fashion. The more you document everything, the less you have to try to remember what was said.”

Advisors with Woodbridge, Ont.- based Hub Financial Inc., who rated their firm much higher in the category this year, at 8.3 vs 6.5 last year, also lauded their MGA for making templates available online and having hands-on assistance.

“They review it, suggest a few little changes here and there, and catch stuff that, in my busyness, I miss,” says a Hub advisor in Alberta.

The percentage of Hub advisors’ clients who have signed an engagement letter rose to 70.2% from 57.4% in 2014. The support for these letters also is more critical to Hub advisors, as they gave it an average importance rating of 9.0 this year, up from 7.0 last year.

Terri Botosan (formerly DiFlorio), Hub’s president, said the reason for this is twofold. The MGA has made documents in which clients’ initials are necessary beside all the important points – “Like [for] a real estate transaction,” she explains. As well, Hub has been educating its advisors about their compliance responsibilities and is taking a co-operative rather than a punitive approach to compliance deficiencies.

“Don’t be afraid to tell us that you’re not doing something that you probably should be doing, because our approach is going to be to help you fix it – not to run you up the flag pole,” Botosan says. “So, maybe advisors are more willing to look to us [for support now].”

Another reason that a greater percentage of advisors have their clients sign engagement letters is simply because their firms require it. For example, London, Ont.-based Freedom 55 Financial and Waterloo, Ont.-based Sun Life Financial (Canada) Inc. have made preparing and signing engagement letters for clients mandatory for their advisors.

“Every single client I see [signs an engagement letter]. It’s mandatory. The firm enforces that we do it,” says a Freedom 55 advisor in Ontario.

Adds a colleague in Atlantic Canada: “Any new clients that I’ve gotten, I’ve signed an engagement letter with [him or her] because that’s when the firm started pushing it.”

At Sun Life, advisors are required to give clients a brochure entitled A clear connection: Your relationship with Sun Life Financial, which serves a similar function to an engagement letter.

Vicken Kazazian, senior vice president of Sun Life’s career sales force, says advisors may have their own personalized letters in addition to the brochures.

“Advisors will say to clients, ‘Here’s my value proposition. If you work with me, I’m going to ensure that I meet with you regularly and that you’re going to get total support and commitment’,” Kazazian says. “But what we have, from a company perspective, is a very well-documented commitment [to] our clients.”

© 2015 Investment Executive. All rights reserved.