Despite the regulators proposing or implementing some of the most fundamental reform efforts in recent years, compliance officers (COs) and executives at companies in the retail investment industry are happier overall with their regulatory overseers this year vs last year.

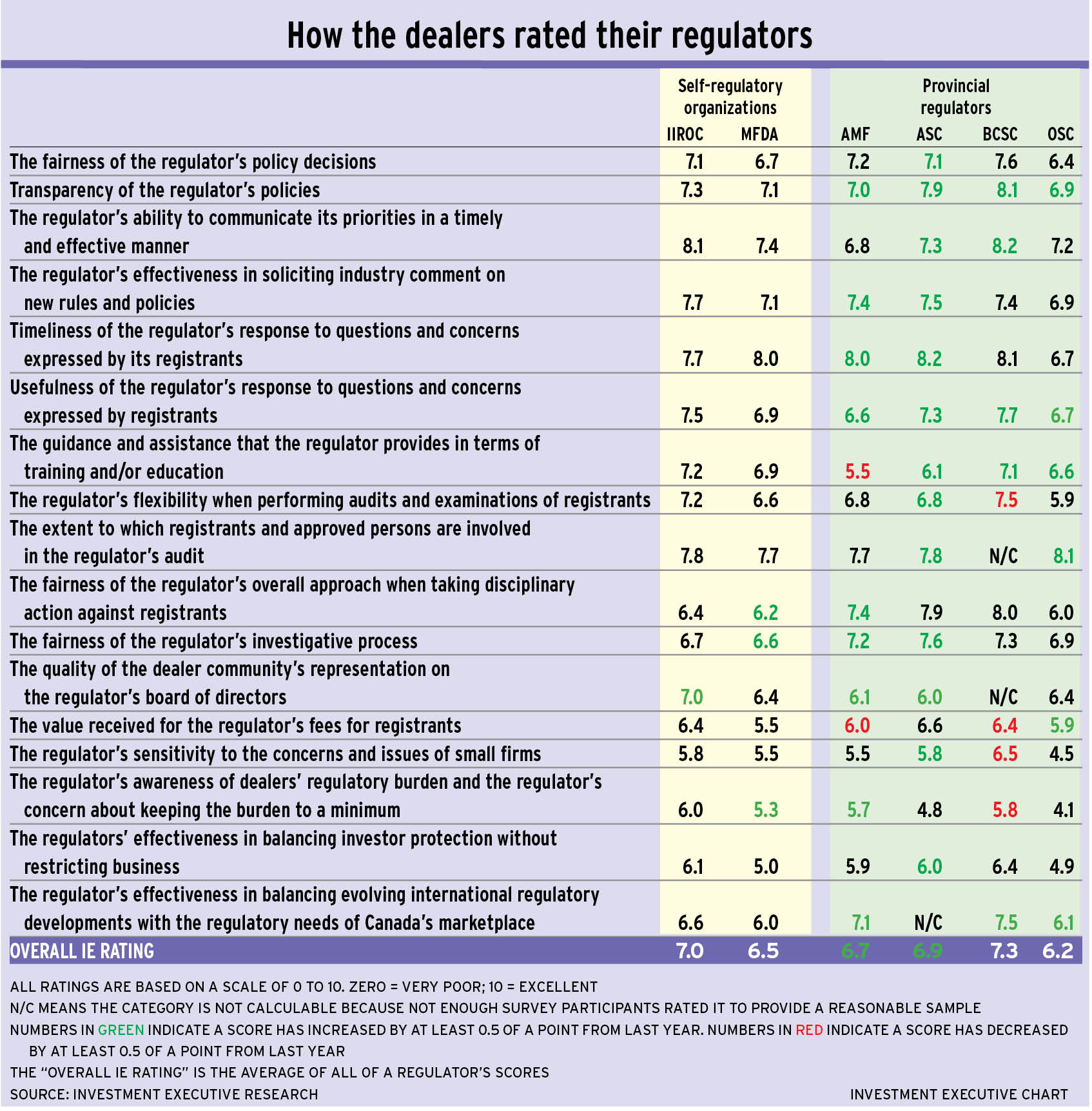

The latest edition of Investment Executive‘s (IE‘s) Regulators Report Card indicates the industry’s marks for both the self-regulatory organizations (SROs) – that is, the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Fund Dealers Association of Canada (MFDA) – and the Big Four provincial regulators (the Alberta Securities Commission [ASC], the B.C. Securities Commission [BCSC], the Ontario Securities Commission [OSC] and the Autorité des marchés financiers [AMF]) improved marginally from 2016.

The BCSC was ranked the highest overall once again by executives in the industry. IIROC came next, while the ASC recorded the biggest overall improvement (27.8%) year-over-year.

There are a couple of key caveats to these observations. First, the sample sizes for the ASC, the BCSC and the AMF are relatively smaller, so the scores for these organizations tend to be more volatile from year to year. Second, securities regulators have a two-pronged mandate: protect investors and foster fair and efficient markets. Thus, IE‘s survey of COs and company executives reflects the industry’s view only and not that of investors.

That said, that the ratings for regulators improved for the most part from 2016 is surprising, given some of the bold initiatives that regulators have embarked upon in the past 12 months.

For example, the Canadian Securities Administrators (CSA) released a paper proposing a series of comprehensive reforms to client/registrant relationships, including the possible introduction of a new, overarching “best interest” standard in some provinces. (See story on page 14.)

The CSA also launched a consultation regarding a possible ban of embedded commissions, which could alter the economics of the investment business fundamentally. At the same time, the SROs and the provincial regulators are overseeing the implementation of the final component of the second phase of the client relationship model (CRM2) reforms and have begun to delve into compensation-related conflicts of interest – and both initiatives strike at the heart of the industry.

Despite this series of major reform efforts, all of which could shake up the industry, COs and company executives seem happy with the job their regulators are doing. In addition to the marginal improvement in the overall ratings for every regulator in IE‘s survey, higher ratings were widespread among the 17 categories in which survey participants were asked to rate their regulators.

For example, the MFDA received ratings this year that were either higher or the same as last year in 14 of 17 categories. IIROC, for its part, received higher or unchanged ratings in 12 categories. And the OSC was rated higher or the same in 10 of the categories, with lower marks in just four categories. (Year-over-year changes were not calculated in the three remaining categories because of smaller sample sizes in 2016.)

This broad-based uptick in the regulators’ ratings suggests that, in general, the industry’s COs and company executives are increasingly empathetic with the job regulators are trying to do – even if the regulators’ work ultimately makes the compliance department’s job more difficult.

Indeed, despite opposition from many executives in the industry regarding some of the regulators’ proposals – such as a possible ban on embedded commissions – some COs welcome the regulators’ efforts in these matters.

“I don’t want to see embedded commissions,” notes the chief CO (CCO) of a British Columbia-based mutual fund dealer.

“We’re all grappling with embedded commissions,” adds a CO with a Quebec-based IIROC-registered dealer.

As both the industry and regulators struggle with these issues, there is a growing sense of understanding regarding the regulators’ role. For example, ratings were higher this year, for the most part, for the regulators in categories such as “the regulator’s awareness of dealers’ regulatory burden and the regulator’s concern about keeping the burden to a minimum” and “the regulator’s sensitivity to the concerns and issues of small firms” – even if the regulators received some of their lowest scores in these categories.

Moreover, some of the survey participants’ comments reflected a growing understanding of the regulators’ plight. Says a CCO with an Ontario-based investment dealer: “The [regulatory] burden is the cost of doing business.”

Other survey participants reported that they see the regulators working to minimize the burden as much as possible, but recognize that this remains a challenge when weighed against the job of ensuring adequate investor protection.

“I can empathize with the [regulators]. They have a tough job,” says a company executive and CCO with a mutual fund dealer in Ontario.

In general, the SROs received higher ratings than the provincial regulators, as a whole, for their perceived awareness to the impact of regulation.

“The MFDA is the best regulator in the country in that regard,” says a compliance executive with an Alberta-based mutual fund dealer. “As an SRO, it makes more of an effort to have direct contact with the industry.”

Indeed, one of the central justifications for self-regulation is that an SRO is closer to the industry – and thus better able to tailor regulation to the characteristics of the business – compared with a provincial regulator that oversees a wide range of different businesses.

IIROC, the investment dealers’ SRO, ranked highest on the regulatory burden issue. The SRO’s rating also rose to 6.0 this year from 5.7 year-over-year.

“IIROC is very aware of [the regulatory burden],” says a CO with a dual-platform firm in Ontario. “Throughout the ranks, you can hear people being vocal about it.”

© 2017 Investment Executive. All rights reserved.