In general, the financial advisors surveyed for this year’s Dealers’ Report Card said they welcome the new regulatory requirements coming into place as part of the second phase of the client relationship model (CRM2). However, almost half of the advisors surveyed were concerned about the potential hiccups that the implementation of the new regulatory regime could cause to their businesses.

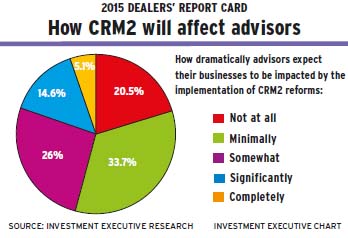

In a supplementary question added to this year’s Report Card, advisors were asked how dramatically they expect the implementation of CRM2, which will require firms and advisors to disclose fees and performance to clients fully, to impact their businesses. In response, 45.7% of advisors said they expect CRM2 would have somewhat of an impact (26%), a significant impact (14.6%) or would completely transform their businesses (5.1%).

An ongoing big concern among these advisors is their clients’ reaction to seeing fees on their account statements. Although many advisors said they already disclose fees to their clients, they’re worried that once clients start seeing the actual dollar amounts on their statements, those conversations will be long forgotten.

“There will be an impact [from CRM2] because change always takes time,” says an advisor in Ontario with Montreal-based Peak Financial Group. “I’ve talked about [fees]. But how much the clients actually absorbed, I don’t know.”

Other advisors were concerned that the implementation of CRM2 may lead to more administrative work when handling client business. Such additional work is of particular concern to advisors who are in the midst of making the transition toward a fee-based business model from commissions-based one, something some advisors are doing as a result of CRM2.

“I have a few fee-based accounts, but I’ll have to increase that,” says an advisor in British Columbia with Toronto-based HollisWealth Inc. “So, there will be more administrative work needed to make that transition.”

On the other hand, advisors who have made the full transition to a fee-based business model felt well prepared for CRM2. “I’m already primarily fee-based, so the impact is going to be pretty minimal,” says an advisor in Ontario with Markham, Ont.-based Worldsource Wealth Management Inc.

Most advisors, fee-based or otherwise, felt they’re ready for the new regulatory regime. They said that fees and services have been topics of discussion for years.

“We’ve been doing fee disclosure for the past decade,” says an advisor in Atlantic Canada with Toronto-based Assante Wealth Management (Canada) Ltd. “When fees have to be disclosed, then you have to start justifying them – and we do so much work for clients that [CRM2] might end up being a positive for us.”

Indeed, many advisors believe that the new regulatory regime will be a boon for their practices because these advisors will take new business from advisors planning to leave the industry or who are simply less prepared to deal with the significant regulatory changes.

“[CRM2 is a] huge opportunity to grow my business,” says an advisor in Ontario with Oakville, Ont.-based Manulife Securities. “Lots of senior advisors will decide they don’t want to compete on CRM2, and small dealers can’t afford to put technology in place [to help advisors make the transition to the new regulatory regime].”

For advisors, getting support from their firms as the investment industry moves toward full implementation of CRM2 is critical. And the dealers that advisors rated highest in the “support for helping to deal with changes in the regulatory environment” are preparing their advisors for the changes thoroughly and well ahead of time.

For example, advisors with Winnipeg-based Investors Group Inc. rated their firm at 9.1 in this category, praising their firm’s training and proactive approach to dealing with the new regulations.

“CRM2 is coming down the pipeline, and they’re already educating us on these changes and making the necessary adjustment to our client statements early,” says an Investors Group advisor on the Prairies. “We’re usually prepared a year in advance of regulatory changes.”

Investors Group intends to stay ahead of CRM2 requirements by including dollar-weighted average returns (DWAR) on client statements in June – more than a full year ahead of the July 2016 deadline. “We would have delivered [the reporting] sooner, but we only wanted to do it once,” says Todd Asman, senior vice president of products and financial planning with Investors Group, noting that the firm began working toward including DWAR reporting on clients’ account statements in 2009.

Meanwhile, advisors with the smaller, independent dealers want greater support from their firms in dealing with the coming regulatory changes. Calgary-based Portfolio Strategies Corp., Richmond Hill, Ont.-based Global Maxfin Investments Inc. and Windsor, Ont.-based Sterling Mutuals Inc. saw their ratings in the category drop by half a point or more year-over-year.

Sterling Mutuals advisors would like to see their firm provide more training on what’s coming with CRM2. “We hosted a speaker from the [Mutual Fund Dealers Association of Canada]. But regional meetings would be super-helpful, just so that the branches could share [information],” says a Sterling Mutuals advisor in Ontario.

Although Sterling Mutuals has hosted seminars and sent out summaries on CRM2 requirements, Nelson Cheng, the firm’s CEO, believes that most advisors don’t want too much advice from their dealer.

“Most of our advisors are more independent,” Cheng says. “They don’t really want us getting involved in giving them things like sales training.”

© 2015 Investment Executive. All rights reserved.