The results of Investment Executive‘s (IE) 2016 Report Card on Banks are resoundingly clear: most financial advisors in the banking channel are not afraid to take their respective firms to task over the numerous failings they see at their banks, ranging through the back office to consumer advertising and the way the banks take stock of advisors’ feedback.

A big reason why these branch-based advisors were more critical of their banks in this year’s Report Card is because the survey focused solely on a group of advisors who depend more on their firm’s services than some advisors who were polled in years past.

In previous years, survey participants for this Report Card included advisors who sold investment products, such as mutual funds, and worked in a bank branch regardless of their job title.

However, as banks have changed over the years, those criteria were refined further. There are many advisors at banks who now have only one-time interactions with clients, sell more credit-based products than investments and don’t have access to many of the services advisors are asked to rate as part of the Report Card.

So, in order to garner a more focused opinion of how the banks are doing, IE research journalists Ahmad Hathout, Megan Marrelli, Beatrice Paez and Kat Shermack spoke with a more targeted group of 268 advisors who are largely branch-based financial planners, hold a mutual fund licence – with some exceptions – and have long-term relationships with “mass affluent” clients who have a minimum of roughly $100,000 in investible assets.

These advisors have always represented a significant sample size in this Report Card in previous years, which is why the banks’ ratings are still comparable year-over-year.

As always, advisors rated their firm’s performance in each category and that category’s importance to their business on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

A close look at the results of this year’s survey show that there’s a higher demand among these advisors for better services and policies from their banks. Case in point: 41 of the ratings that advisors gave their firms in the main table were down by a half point or more compared with 2015, while only 19 ratings increased by the same margin. (See Report Card on Banks 2016 main chart.)

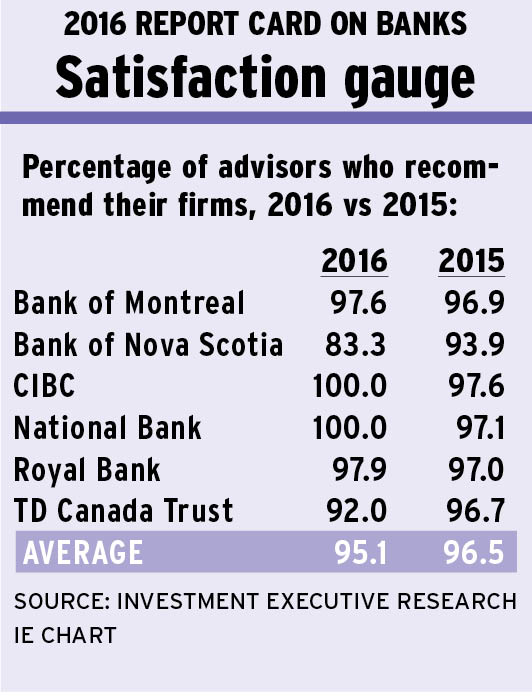

Furthermore, Montreal-based National Bank of Canada, as well as Toronto-based Bank of Nova Scotia and TD Canada Trust, saw their “overall rating by advisors” drop by half a point or more vs last year.

TD advisors, who are part of the bank’s TD Wealth Financial Planning division but work in TD’s branch network, were particularly hard on their firm. They ranked the bank significantly lower in 18 of the 29 categories in which they rated their firm. As a result, TD’s IE Rating, which is an average of all the categories, dropped to 7.8 from 8.4 in 2015.

For many TD advisors, the bank often takes one step forward and two steps back: even when managers introduce improvements, there are problems with the rollout or with training. As well, there are ongoing difficulties with the back office.

“There have been challenges [with the back office],” says a TD advisor in Ontario. “Some [back-office employees] have no clue about what we’re asking. I can’t really trust them.”

The “back office and administrative support” category has long been a thorn in the sides of advisors at all the banks, and this year was no exception. Once again, the category had one of the largest “satisfaction gaps” – the difference between the overall average performance rating and the overall average importance rating – in the Report Card.

In large part, advisors are frustrated with the amount of turnover they see among their back office’s staff, as well as the outdated technology. (See Back-office blunders continue.)

Many advisors surveyed for this year’s Report Card also had cause for concern in the “firm’s receptiveness to advisor feedback” category: advisors at four banks rated their firms lower by a half a point or more in the category. The main complaint was that although the banks are good at soliciting feedback from advisors, the banks often fall short on taking action on this feedback. (See Back-office blunders continue.)

“We have Employee Pulse surveys [and] we add tons of comments, [but] we don’t see a lot of change,” says an advisor in Ontario with Toronto-based Bank of Montreal.

Advisors also hammered their banks in the “firm’s consumer advertising” category this year, as three of the six banks in the Report Card saw their performance ratings in this category drop by half a point or more.

Although advisors in the banking channel appreciate the brand recognition that comes with working at one of Canada’s Big Six banks, the worry is that advisors’ business is overshadowed by other services sometimes.

For example, many advisors unhappy with their bank’s advertising said that other regions or product lines, such as mortgages, are given more of a spotlight than their own business and, as a result, clients often aren’t aware of a financial planner’s role.

“Marketing must improve. We have to tell people that we have financial planning,” says an advisor in Alberta with Toronto-based Royal Bank of Canada. “The way we manage money should be advertised well.”

One area in which firms are taking action to do better is in “support for developing a financial plan for clients,” which was tied for the third-highest importance rating in the Report Card. This should come as no surprise, given that the vast majority of survey participants hold the title of financial planner.

As well, many of the banks have been looking to beef up their support in this category with new software – although sometimes advisors’ feelings were mixed on this point, particularly when there is lack of support or training in how to use the program.

“[The bank] has come out with new software to do financial planning,” says a Scotiabank advisor in Alberta regarding the bank’s new Mapping Tomorrow financial planning platform. “[But] we just got the bare necessities on how to use it.” (See Major focus on financial planning.)

Despite these shortcomings, advisors believe that their banks are ready to deal with some larger trends. For example, advisors participating in the survey were asked two supplementary questions in this year’s poll: did advisors believe that new digital asset- allocation services (a.k.a. robo- advisors) are a threat to their business; and how well prepared their firms are to deal with the unique issues relating to aging and senior clients. (See Are robo-advisors a looming threat? and Seniors’ issues take centre stage, respectively.)

Regarding the recent emergence of robo-advisor platforms, advisors were confident that they can maintain face-to-face client relationships – at least, in the short term.

“In some ways, [the rise of robo-advisors] is concerning,” says an advisor in British Columbia with Toronto-based Canadian Imperial Bank of Commerce. “But, on the other hand, I feel there will always be a need for that [client/advisor] relationship.”

In the matter of aging clientele, advisors believe they are prepared to deal with the changing needs of this demographic because of the procedures and training initiatives their banks have put in place.

“We recently had a workshop on the issue [of senior clients],” says a National Bank advisor in Ontario. “I’ve seen issues like this with clients. We always watch out for them.”

In addition to the revised criteria for survey participants and the new supplementary questions, there were other notable changes in this year’s Report Card. A big one is the name of the Report Card itself as a result of a change in the deposit-taking institutions included in the survey. Previously, the Report Card on Banks and Credit Unions included two or more credit unions as part of the survey. However, credit unions were removed from the survey for this Report Card cycle due to a lack of advisor participation.

There were two other notable changes to the main table: the “support for constructing a deaccumulation strategy for retired clients” was removed because it was considered to be redundant, while the “firm’s image with the public” category was revised to the “firm’s reputation with clients and/or perspective clients” to make a stronger distinction between reputation and a bank’s advertising efforts.

© 2016 Investment Executive. All rights reserved.