Year after year, the advisors surveyed for Investment Executive‘s annual Dealers’ Report Card say their firms’ back offices fail to meet advisors’ increasing demands and expectations due to lack of speed, accuracy and communication. Not surprising, the results of this year’s survey were no different.

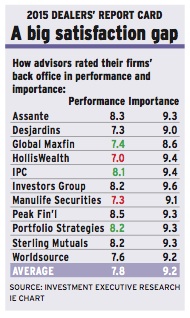

In fact, with an overall average importance rating of 9.2 and an overall average performance rating of 7.8, the “back office and administrative support” category has the highest “satisfaction gap” of all categories in the Report Card for the third straight year.

At some firms, mergers and acquisitions have resulted in growing pains in the back office. More often than not, however, the same frustrations arise each year: advisors complain about overworked staff, delayed response times and multiple processing errors.

Advisors with Oakville, Ont.-based Manulife Securities, in particular, rated their firm’s back office at 7.3 this year, down from 8.0 last year, because of those very reasons. Specifically, they said, communication from their back office often is poor or unclear and compliance staff are very slow to respond.

“A lot of what the back office deals with is compliance. When something gets funnelled back to us, sometimes it isn’t clear whether it’s a processing issue or compliance. Timeliness of responses could also improve,” says a Manulife advisor on the Prairies.

Adds a colleague in Ontario: “They’ve given me the wrong information in the past – and it’s getting worse. And if, in the past, there was an issue, they’d call you. Now, the standard protocol is email, and it takes a day or two. It takes too long.”

Advisors with Toronto-based HollisWealth Inc. gave their firms the lowest performance rating in the back office category – 7.0, down from 7.5 in 2014 – because their back-office staff often is overwhelmed and make too many errors as a result.

“They should answer the phone when we call; they should open accounts in a timely fashion; and they should make fewer mistakes,” says a HollisWealth advisor in Ontario.

Adds a colleague in the same province: “They’re nice people, but it’s hard for them. They’re overworked. Stuff doesn’t get done; and when it does, there are mistakes. I expect operational support from my dealer.”

Tuula Jalasjaa, managing director and head of the retail advisory network at HollisWealth, admits that 2014 was a challenging year for the firm’s back office due to integration initiatives and preparing for significant regulatory changes. These changes include the second phase of the client relationship model (CRM2), Canada’s anti-spam law (CASL) and the U.S. Foreign Account Tax Compliance Act (FATCA).

“CRM2, CASL and FATCA affect the back office, and a lot of [these regulations] hit at the same time. It was a temporary issue, from our perspective, and we certainly added a number of resources,” she says. “However, given the huge volume [of transactions] that our firm processes, it did take us a little time to catch up.”

The rapid rate of change in the industry has affected the back office at firms across the board – especially those that have gone through acquisitions.

“To be fair, we’ve merged many back-office systems, so these are mainly growing pains. It’s not a personnel issue, though. The firm has great personnel,” says an advisor in Ontario with Mississauga, Ont.-based Investment Planning Counsel Inc. (IPC), which has made several acquisitions in the past few years.

However, IPC advisors said, the firm finally has hit its stride in getting the back office in fine working order. Says an IPC advisor in Ontario: “The firm had been gobbling up other companies and wasn’t prepared to handle the new workload. There’s been a huge change and improvement in the past year.”

As a result of these efforts, IPC advisors gave their firm one of the highest ratings in the back office category, at 8.1, up significantly from 6.9 last year. As for other advisors who rated their firms highly in the back office category, they did so because their back offices are providing quick response times and reliability.

“There are almost never any errors. It’s to the point that I don’t even have to consider it,” says an advisor on the Prairies with Winnipeg-based Investors Group Inc.

“The back-office staff is very cordial and I can get answers quickly. They work with you. I’d give them all the accolades in the world,” says an advisor in Ontario with Toronto-based Assante Wealth Management (Canada) Ltd.

Similarly, advisors with Montreal-based Peak Financial Group, which received the highest performance rating in the category, at 8.5, praised their firm’s back office for its prompt, personable and hard-working staff.

“They’re very good communicators, very helpful and immediately respond to any questions. They’re courteous,” says a Peak advisor in Ontario.

“They have integrity above all. No one passes the responsibility or the blame, so interacting with the back office is not an anxiety-producing experience. They really go the extra mile,” adds a colleague in the same province.

One of the key reasons for Peak advisors’ satisfaction with their back-office staff is that the firm has made an effort to have experienced staff in place, says Robert Frances, Peak’s president and CEO: “Advisors are starting to feel more and more the seniority of our [back office] employees. The people that we hired three or four years ago are now [more experienced], and our [advisors] are becoming much more familiar with the [back-office staff, who] are well trained in our way of doing business.

“The learning curve [they’ve experienced has] gone through its more rapid stage, and now advisors are feeling the value.”

© 2015 Investment Executive. All rights reserved.