With financial markets continuing to defy gravity in their rise over the past year, the businesses of Canada’s investment advisors also are soaring. The question: “How long can this last?”

This year’s edition of Investment Executive‘s Brokerage Report Card reveals that the average advisor’s assets under management (AUM) continue to accumulate as the composition of the average book shifts to higher-value accounts, which now make up a growing proportion of the average book. This is happening on the strength of continued market gains over the past year: the major equities markets in both Canada and the U.S. have enjoyed double-digit returns, as have returns for stocks in Europe and Asia.

But markets aren’t the only force that’s evident in the Report Card data this year. Shifts in client investment preferences and regulatory prospects also appear to be having an impact: asset allocation and industry compensation models continue to evolve.

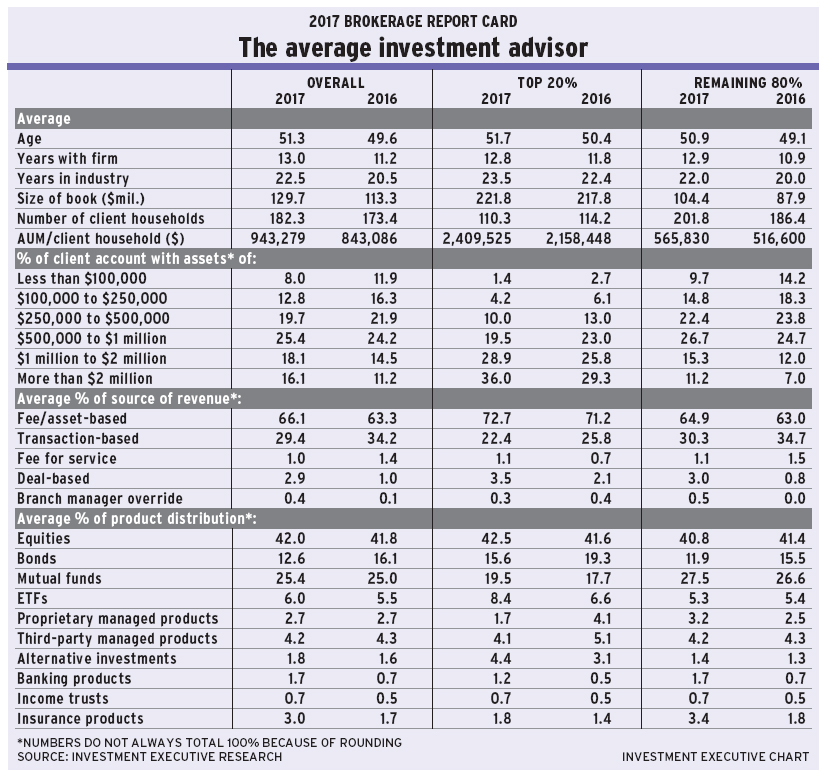

Yet, even though the retail brokerage business is evolving, the demographic makeup of the frontline advisor population is stable, if not stagnant. There’s little fresh blood entering the business: the average age of the advisors in this year’s survey was 51.3 years of age, up from 49.6 years of age in last year’s survey.

At the same time, this year, the average advisor reported that he or she has been in the business for 22.5 years and with his or her current firm for 13 years. Both of these metrics rose by about two years vs last year’s survey, which indicates that the experience of the advisors who participated in this year’s survey was skewed to industry veterans even more than last year.

As noted earlier, those veterans are enjoying strong growth in their books of business: average AUM rose by 14.5% year-over-year to $129.7 million from $113.3 million in 2016. In addition to market gains, some of that increase is a result of a modest climb in client numbers: advisors now serve 182.3 client households, on average, up from 173.4 last year.

The rise in both advisors’ books and total client numbers has resulted in the average AUM/client household increasing by more than $100,000 to $943,279 this year vs $843,086 in 2016. Notably, a shift in client account distribution has led to this ramp-up in productivity, with a year-over-year decline in client accounts with investible assets under the $500,000 threshold in the average book. Conversely, the share of book for all account segments above the $500,000 threshold rose.

Last year, combined share of book for client account categories below the $500,000 threshold totalled 50.1%; this year, that combined share dropped to 40.5%.

As the AUM in client portfolios rises on the strength of market gains, the account distribution in an advisor’s book naturally shifts toward larger account categories. In addition, firms may be driving some of the shift as well, as they’re actively encouraging advisors to shed lower-value accounts and focus on larger clients who deliver higher revenue and enhanced productivity. (See story on page C9.)

The $500,000-$1 million client account category continues to represent the single-largest share of the average advisor’s book, rising to 25.4% this year from 24.2% in 2016. Yet, larger account categories are recording even bigger gains in share. The average advisor now has 18.1% of his or her accounts in the $1 million-$2 million category and 16.1% in the $2 million-plus category; those figures rose from 14.5% and 11.2%, respectively, in last year’s survey.

Conversely, the smallest client account category – those worth $100,000 or less – now comprise only 8% of the average book, down from 11.9% in 2016. Similarly, the share for the $100,000-$250,000 category has declined to 12.8% from 16.3% year-over-year.

Moreover, the data show that productivity gains were experienced by both the top performers and the remaining group of advisors. (IE divides the advisor population into the top 20% and the remaining 80% based on AUM/client household.) Both advisor segments had productivity gains over the past year. Among the top 20%, average AUM/client household rose to $2.4 million from less than $2.2 million last year. At the same time, the remaining 80% of advisors’ AUM/client household also climbed – to $565,830 this year from $516,600 in 2016.

Average AUM also rose year-over-year for both segments of the advisor population. Among top producers, average AUM is up to $221.8 million this year from $217.8 million in 2016. The remaining 80% of advisors’ average AUM also rose to above the $100-million threshold this year, reaching $104.4 million, up from $87.9 million in the previous year.

Although average AUM and productivity rose for both the top 20% of advisors and the remaining 80%, the trends in the number of client households that the two advisor segments serve are heading in opposite directions. Top performers trimmed their client rosters slightly during the past year and now serve an average of just 110.3 client households, down from 114.2 last year. Conversely, the remaining 80% of advisors are bulking up their client numbers and now serve 201.8 client households, up from 186.4 in 2016.

For the top 20% of advisors, the drop in the number of client households – and, consequently, the increase in productivity – also is reflected in the account distribution data. Among these advisors, accounts worth more than $1 million now represent 64.9% of the average book, up from 55.1% a year ago. Within that account segment, the $2 million-plus category now represents 36% of the average top performer’s book, up from 29.3% in 2016.

For the remaining 80% of advisors, the shift in account distribution mirrors the overall trend skewing toward higher-value accounts: those worth more than $500,000 captured a greater share of the average book among these advisors.

Along with these overall trends in AUM, productivity and account distribution, this year’s data also show that a long-standing shift in the brokerage industry’s revenue models – that is, toward fee- and asset-based sources of revenue and away from transactions – continues unabated. Now, fee- and asset-based revenue accounts for 66.1% of total revenue for all advisors, on average, up from 63.3% in 2016. At the same time, transactions dropped to 29.4% of revenue from 34.2% last year.

This trend has been in place for some time. Stable and predictable fees continue to supplant more volatile commissions as the preferred source of revenue in the retail investment business. As well, increased regulatory attention to industry compensation models also play a part in the evolving revenue mix as firms seek structures that better align the interests of both clients and advisors.

Again, this trend is evident among both the top 20% of advisors and the remaining 80%. For top performers, fee- and asset-based sources now account for 72.7% of their topline revenue while transactions contribute just 22.4% of revenue. Among the remaining 80% of advisors, fee- and asset-based sources comprise 64.9% of total revenue while transactions account for 30.3%.

Asset mix also is changing in response to both competitive and regulatory forces. Equities remain, far and away, the most popular investment vehicle for all advisors surveyed, accounting for 42% of the average book, which was virtually unchanged from 41.8% a year ago.

Mutual funds ranked second, at 25.4%, and also rose slightly vs a year ago, at 25%. However, bonds dropped to 12.6% from 16.1% year-over-year. ETFs now account for 6% of the average book, up from 5.5% last year.

Although the allocation, overall, to ETFs in the average advisor’s book has not grown significantly over the past year, the numbers carry more weight within the two advisor populations. Notably, the top performers drove the growth in ETF allocation; that advisor segment reported that 8.4% of their average book is allocated to ETFs vs 6.6% last year. In contrast, the remaining 80% of advisors devoted 5.3% of their books to ETFs, which was essentially unchanged from 5.4% last year.

This higher, increasing use of ETFs among top performers suggests that these products no longer are primarily the preserve of do-it-yourself investors pursuing cost-effective, passive investments. Rather, the fact that top-producing advisors are using more ETFs may indicate that an underlying shift to low-cost, passive investments is taking hold among some full-service clients as well.

Meanwhile, the remaining 80% of advisors made more use of banking and insurance products than their higher-performing colleagues did. Allocations to these assets by the average lower- performing advisor rose notably year-over-year.

Indeed, the brokerage industry, overall, reported greater use of both of these products, which may betray some concern about how much longer the strong markets that are powering industry growth are going to last.

© 2017 Investment Executive. All rights reserved.