Financial advisors surveyed for Investment Executive‘s 2014 Report Card on Banks and Credit Unions have high praise for their branch managers and the support, knowledge and inclusivity that these managers provide.

In particular, branch managers were lauded for their effectiveness in putting these skills together and cultivating a strong corporate culture, as well as for facilitating career growth for advisors within the firm.

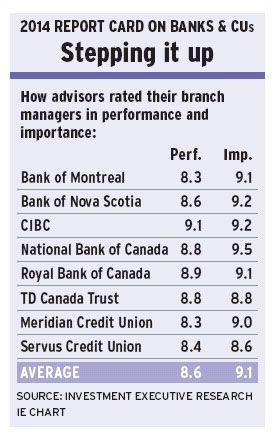

Overall, advisors gave their branch managers an average performance rating of 8.6, up from 8.3 last year. Those who ply their trade with Bank of Nova Scotia and Canadian Imperial Bank of Commerce (CIBC), both based in Toronto, as well as Montreal-based National Bank of Canada, and St. Catharines, Ont.-based Meridian Credit Union rated their firms’ higher in the “your branch manager” category by half a point or more vs 2013.

And as evidenced by the overall average importance rating of 9.1 that advisors gave the category, branch managers fulfil a critical role in providing leadership, mentorship and ongoing support. Many advisors even consider their branch managers to be “team captains” who are responsible for guiding the advisory team at the branch level.

“Branch managers are some of the most influential people I’ve met in my career,” says a CIBC advisor in Ontario. “[The branch manager] is the face of the branch, as far as relationships go. She’s there to assist both advisors and clients.”

Several CIBC advisors pointed to their branch managers’ leadership, steadfast support and encouragement as reasons for their satisfaction. But the fact that their branch managers go beyond the call of duty for their advisory teams is why these advisors gave their firm the top performance rating of 9.1 in the branch manager category this year, up dramatically from 7.7 last year.

“She fights for me in terms of pay, progression and career goals,” says a CIBC advisor in Alberta. “She makes sure everything is running smooth. She is on the ball. She got me a raise – and even more than what I expected. She exceeded my goals.”

CIBC advisors’ increasing satisfaction with their branch managers may be the result of a new leadership program the bank instituted that is entitled Breakaway. Larry Tomei, CIBC’s senior vice president, national sales and service, retail and business banking, says the program works to develop strong coaching skills, particularly in the area of activity-based management, which focuses on building relationships with clients, rather than outcome-based management, which centres on sales targets.

A similar approach to relationships, and having an adaptive leadership style, are the prime reasons why advisors with Scotiabank and National Bank also are happier with their branch managers.

“They are very accommodating when it comes to work/life balance. Managers recognize our unique needs and allow flexibility in our schedules,” says a Scotiabank advisor in Alberta. “They’re also very knowledgeable and approachable.”

A National Bank advisor in Ontario shared the same sentiment: “Our branch managers are superior because they offer a certain amount of flexibility. They nurture a spirit of learning and are here to help us achieve our goals.”

Having branch managers in place who are more approachable and knowledgeable than ever before is good for advisors and very important to banks’ overall businesses, says Annamaria Testani, National Bank’s vice president, national sales, intermediary business solutions.

“Clients’ demands today are really increasing, so our ability to not react quickly could hurt us,” she says. “So, how do you help your advisors? Well, you have to make sure the bench strength of your branch managers is at the level you want it at, so they can address concerns or issues or challenges immediately.”

Although many advisors raved about their branch managers, there remains some room for improvement, especially for Toronto-based Bank of Montreal and Meridian, which tied for the lowest rating in the category, at 8.3.

Some Meridian advisors pointed out that their branch managers were lacking in wealth-management and investment expertise, which are factors that are becoming more important to advisors’ practices.

“With respect to wealth management, there is no real knowledge or background,” says a Meridian advisor in Ontario. “The branch manager can’t offer guidance of coaching.”

Bill Whyte, senior vice president and chief of member services with Meridian in Toronto, agrees wholeheartedly that branch managers should support advisors in the wealth-management process. However, he points out that branch managers have varying degrees of background and experience – and this could be what’s causing advisors to feel that they aren’t supported.

“[Wealth management] is a key need of our members,” Whyte says. “[But] many [branch managers] are in, to be frank, different points in their careers. And while some have a wealth-management background, others never got into it. So, for those who haven’t, we’re bridging that gap for them. But it doesn’t happen overnight.”

Nevertheless, Meridian’s branch manager category rating rose by half a point over the past year – and many of the firm’s advisors pointed to their branch managers’ coaching abilities as the reason why.

“He is the type of manager that brings out the best in people and looks at the positive side,” says a Meridian advisor in Ontario. “He looks at people’s strengths, not their weaknesses. And he encourages people to work harder because of his style.”

© 2014 Investment Executive. All rights reserved.