The results of this year’s Insurance Advisors’ Report Card are in and the message from insurance advisors is clear: insurance agencies need to do more to support their advisors.

The main ratings table for this year’s Report Card (see page 12) is overwhelmingly red: more than 60 categories declined by half a point or more compared with 2016. In fact, with the exception of Waterloo, Ont.-based Sun Life Financial (Canada) Inc., advisors with every insurance agency in the survey rated their firm lower by this margin in at least one category – if not in many more.

Read: Insurance Advisors’ Report Card 2017 main chart

Advisors have several issues on their minds this year: from problems with their contact- management system (CMS) to their limited access (at times) to wealth-management experts, including financial planning specialists. More generally, advisors simply are looking to their firms to help build their businesses.

“Obviously, we serve our customers; we run our own businesses. [But] we look to [the firm] for certain things to make our job easier,” says an advisor on the Prairies with Winnipeg-based Great-West Life Assurance Co.’s (GWL) Gold Key distribution network.

Three firms, in particular – Kitchener, Ont.-based Financial Horizons Inc., London, Ont.-based Freedom 55 Financial and Woodbridge, Ont.-based Hub Financial Inc. – garnered ratings that dropped by half a point or more vs last year’s survey in various categories in this year’s Report Card, as well as in their IE ratings, which are the average of all the ratings the firms received. (Many of Calgary-based PPI Solutions Inc.’s ratings dropped by a similar margin, although the managing general agency’s [MGA] IE rating dropped by 0.4 of a point.)

Advisors at these firms took issue with several elements pertinent to their firms: from the back office to wealth-management support, from their firm’s strategic focus to the marketing support. Specifically, Financial Horizons saw its ratings drop by half a point or more in 16 of the 25 categories in which it received a rating, including “firm’s/MGA’s strategic focus” and “firm’s/MGA’s marketing support for advisor’s practice.”

Read: Big shifts in four firms’ ratings

Some of the uncertainty that Financial Horizons advisors feel, particularly concerning the MGA’s strategic focus, may have to do with the timing of when the research for this year’s Report Card was conducted: in May, GWL’s parent, Winnipeg-based Great-West Lifeco Inc., announced that it had acquired Financial Horizons. At that time, Investment Executive was in the process of conducting surveys for the Report Card. As a result, many Financial Horizons advisors mentioned that they were unsure about what the future held for themselves and their MGA.

“We just got bought out, but they didn’t tell us. Nobody knew,” says a Financial Horizons advisor in Quebec. “We found out the day of [the deal. Financial Horizons] must have a good [strategy], but we don’t know it.”

However, subsequent to the announcement of the deal, John Hamilton, president and CEO of Financial Horizons, has spent a lot of time talking with that MGA’s advisor sales force to assure them that everything will be business as usual for the firm.

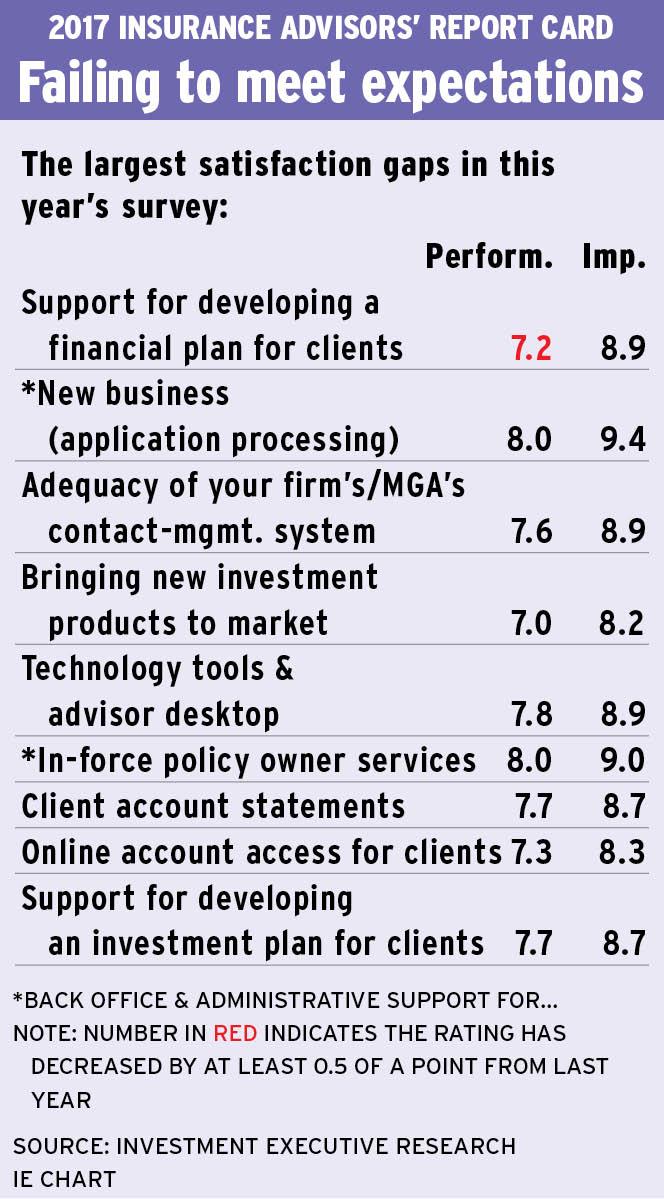

Another category in which advisors with Financial Horizons advisors and other firms raised concerns was in the “firm’s support for developing a financial plan for clients” category. In fact, the category had the largest drop in the year-over-year overall average performance rating of any category, to 7.2 from 7.9 in 2016.

Furthermore, when compared with the overall average importance rating of 8.9 for the category, this represents the largest “satisfaction gap” in the survey at 1.7 points. That difference between a category’s overall performance and importance ratings reveals that advisors’ expectations are far from being met.

Freedom 55 advisors were particularly displeased with the financial planning support available to them, saying that experts aren’t available for face-to-face discussions.

“I’ve been advocating for a specialist for years,” says a Freedom 55 advisor in Ontario. “We don’t have the same kind of support we had years ago. Now, they just give us a 1-800 number.” (See story on page 16.)

Read: Work to do on financial planning

Technology platforms also were a thorn in the sides of many advisors. Case in point: advisors with Freedom 55, Mississauga, Ont.-based RBC Life Insurance Co. and Calgary-based PPI Solutions Inc. rated their firms lower by half a point or more in the “adequacy of your firm’s/MGA’s contact-management system” category because the advisors considered their CMS platform to be antiquated and cumbersome.

“There are way too many systems, and it would be nice if they were all amalgamated into one instead of having to enter information into many systems,” says an RBC Life advisor in British Columbia.

Another ongoing concern for advisors is their back-office support, particularly as it pertains to support for new business. The standout issue for advisors, many of whom gave their firms a lower rating in the “back office and administrative support for new business (application processing)” category, is the sluggish turnaround times for processing applications.

Read: Application processing still a big concern

“[The back office] is very slow. It’s terrible,” says a GWL advisor in Atlantic Canada. “The system has gotten better, but there’s a ton of delays in the underwriting process.”

These concerns and low ratings all point to an advisor force that saw significant room for improvement at their firms. However, even the gloomiest advisor still gave credit where credit is due.

For example, advisors rated their firms highly in the “freedom to make objective product choices for clients,” resulting in an overall average performance rating of 9.3. Survey participants praised firms that have deep product shelves and allow advisors to select what they feel is best for their clients. (See story on page 16.)

“From a product point of view, [the firm] lets you do what you think you should do for the client,” says an advisor in Atlantic Canada with Mississauga-based IDC Worldsource Insurance Network Inc.

Another positive note in this year’s Report Card is that the investment components in advisors’ books of business appear to be growing: average assets under management rose to $33.9 million from $18.4 million year-over-year. In part, this could be because this year’s survey participants were an older crowd: the average advisor in this year’s Report Card was 51.8 years of age compared with 49.4 last year.

How we did it

Investment Executive research journalists Sophie Allen-Barron, Charles Bossy and Jennifer Cheng spoke with 386 insurance advisors at nine insurance agencies to gather the data for this year’s Insurance Advisors’ Report Card.

The firms included in this year’s Report Card are divided on the main table on page 12 based on their business model: dedicated sales agency; personal producing general agency (PPGA); and managing general agency (MGA).

To reflect the differences in these insurance agencies, survey participants were asked slightly different questions, depending on which business model their firm employs.

For example, advisors with the dedicated sales agencies were asked to rate their “firm’s corporate culture” because these advisors tend to work in branches with other advisors and employees. In contrast, advisors with MGAs run their own offices and would not have a sense of their MGA’s overall corporate culture.

As well, it’s important to note that Winnipeg-based Great-West Life Assurance Co. (GWL) was added to the new PPGA category for this year’s Report Card. Advisors who work in GWL’s Gold Key distribution network, which now falls under GWL’s parent firm’s wealth and insurance solutions enterprise (WISE) network, are independent contractors but work exclusively through GWL.

The reason for the new business model category: in the past, although GWL was included among the independent sales agencies, its advisors rated the firm in the same categories as the dedicated sales agencies. This year, GWL was placed in its own PPGA category to reflect its unique model better, although GWL advisors still rated their firm in the same categories as the dedicated sales agencies.

All survey participants provided two ratings for each category in the main ratings table: one for the firm’s performance and one for the importance of that category to the advisor’s business. Each rating is on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

A number in green in the main table indicates that a firm’s rating has increased by a margin of half a point or more compared with last year. A number in red indicates that the firm’s rating in that category has declined by the same margin year-over-year.

© 2017 Investment Executive. All rights reserved.