The big six banks may be the 800-pound gorillas of the Canadian financial services sector, but these gorillas are hobbling in the retail investment space as branch-based financial advisors watch their books of business shrink.

The results of Investment Executive‘s (IE) 2017 Report Card on Banks reveal that banks’ front-line sales forces are in retreat at a time when investment markets are expanding steadily. Although a rising tide tends to lift all boats, this appears not to be the case where the banks are concerned. Instead, forces apart from frothy markets are exerting a bigger influence over the banking channel’s advisor sales force.

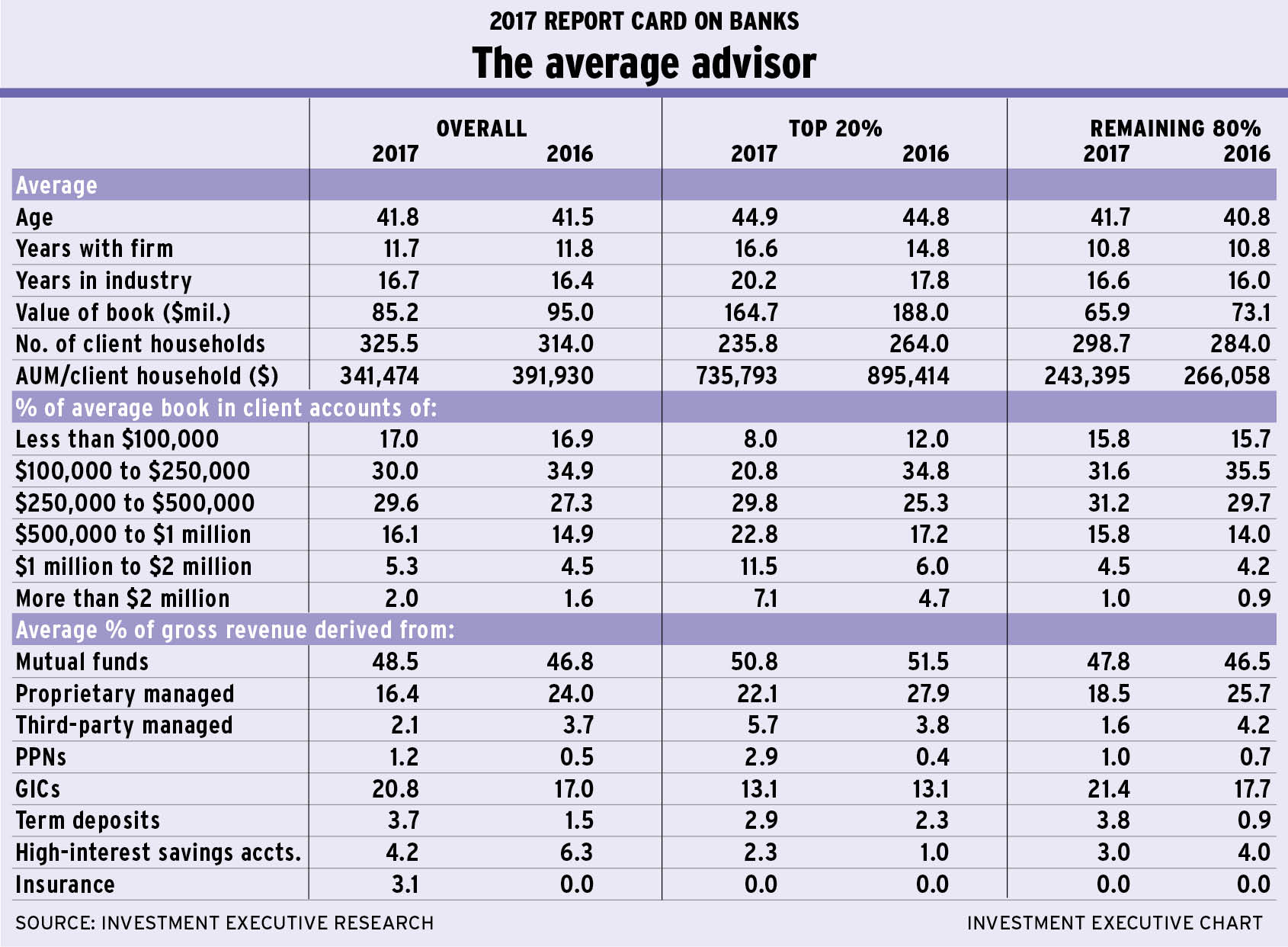

Ordinarily, recent market conditions would be expected to fuel easy gains in assets under management (AUM); and stock markets have been surging over the past 12 months. Yet, against this backdrop of strong organic growth, the average advisor participating in IE’s survey has seen his or her AUM drop to $85.2 million this year from $95 million in 2016.

There probably are several reasons for this trend, including the evolving competitive landscape and sales force demographics. But branch-based advisors also have come under particular scrutiny in the past several months amid public reports of aggressive sales practices at the banks, which prompted an ongoing inquiry by the federal Standing Committee on Finance, and heightened scrutiny from the Financial Consumer Agency of Canada.

Although how much of the reported decline in average AUM is due to client concern about industry sales practices is impossible to determine, this is a negative factor that’s specific to the banks and their advisors. So, there is likely to be some link between the two events.

Nevertheless, there may well be other factors that help explain the drop in advisors’ AUM. For one, the demographics of IE’s survey indicate that the banks’ sales forces may be continuing to see infusions of younger advisors with less industry experience, which typically equates to smaller asset bases.

For example, the average age of the advisors surveyed for this year’s Report Card, 41.8 years old, is virtually unchanged from last year’s 41.5 years of age. Similarly, the average industry tenure barely changed, at 16.7 years vs 16.4 last year, and the average advisor has been with his or her bank for 11.7 years vs 11.8 years reported in 2016.

If the advisor population is static, these numbers should be climbing. Instead, the fact that the average advisor’s demographic profile is more or less unchanged from 2016 indicates that banks may be bringing on more novice advisors, which could be weighing on the size of their books.

The highly competitive retail investment environment probably plays a part in the decline in the average book. The emergence of new players in the retail market, such as robo-advisors, also may be capturing their fair share of business from the banks.

For the Big Six banks, there also is the ever-present prospect of internal competition. As the banks jockey with one another for business and shift their retail strategies, AUM can leave the branch-based advisor channel for another part of the bank. So, although the advisors surveyed are seeing their AUM decline, the assets may be retained elsewhere within the bank.

Whatever the combination of factors that explains the reported decline in average AUM among advisors, it’s not because they’re simply losing clients. In fact, the average advisor’s number of client households served rose slightly year-over-year, to 325.5 from 314.

Moreover, this combination of a drop in average AUM and an increase in client households is pushing down advisors’ productivity, as measured by AUM/household, to $341,474 from $391,930 in 2016.

This drop in AUM and productivity applies to both the banks’ top-performing advisors (defined as the top 20% by AUM/household) and the remaining 80% of banks’ branch-based sales forces.

The reported results from the two segments of advisors surveyed were slightly different. The top 20% of advisors reported that AUM, client numbers and productivity all dropped year-over-year. For the remaining 80% of advisors, AUM and productivity also dropped year-over- year, but client numbers rose slightly.

Of the two segments of the advisor population, it’s the top performers who are taking a stiffer blow. For these advisors, average AUM dropped to $164.7 million this year from $188 million last year and average productivity dropped to just $735,793 from $895,414.

The falloff is much shallower for the remaining 80% of advisors, for whom average AUM dropped to $65.9 million in this year’s survey from $73.1 million in 2016 and average AUM/client household slipped to $243,395 from $266,058. Yet, this segment of the banks’ advisor population is adding clients, in contrast to the top-performing advisors.

Another indication of some of the forces that are at play for advisors in this year’s Report Card is evident in the asset-allocation data. Although mutual funds remain the top product for the average advisor, accounting for an estimated 48.5% of AUM, allocations to proprietary managed products dropped notably, to 16.4% from 24% in 2016.

Both the top 20% of advisors and the remaining 80% reported that their allocations to proprietary managed products has declined year-over-year. Among the top performers, the share of book for these products dropped to 22.1% this year from 27.9% last year. For the remaining 80% of advisors, the drop was even sharper – with advisors now reporting that 18.5% of their AUM is held in these products, down from 25.7% last year.

Once again, although the causes for the decline in share of book for in-house managed investment products is difficult to determine with any certainty, they may be among the primary casualties of heightened concern regarding banks’ sales practices and their push to sell proprietary products. Amid this decline in the use of proprietary products, advisors are turning to a variety of alternatives, including different deposit products.

Among the top 20% of advisors, their use of principal-protected notes jumped to 2.9% of the average book from just 0.4% last year. The use of third-party managed products also rose a bit year-over-year; however, at just 5.7% of average AUM, these products represent a much smaller share of the average book among the top 20% of advisors than proprietary products do.

Meanwhile, the remaining 80% of advisors participating in this year’s survey have turned away from managed products in general, as allocations to third-party managed products also declined year-over-year, to 1.6% this year from 4.2% last year.

At the same time, the use of guaranteed investment certificates among the lower-producing advisors jumped to 21.4% in 2017 from 17.7% in 2016 and term deposits use climbed to 3.8% from 0.9% year-over-year.

Some of these shifts may reflect client’s concerns about stock market valuations and represent a flight to safety. But given that mutual fund allocations are holding up so well, factors other than pure market calls are likely to be at play.

Despite the negative headline trends in AUM and productivity, the situation is not all doom and gloom for the banks’ sales forces participating in this year’s Report Card. In fact, the account distribution data indicate that advisors are not suffering an exodus of their higher-value clients. On the contrary, allocations to accounts worth more than $250,000 rose a bit year-over-year.

This trend was common to both segments of the advisor population, although it was particularly significant among the top 20%.

As well, in last year’s survey, accounts worth less than $250,000 represented 46.8% of the average top performer’s book; this year, that allocation dropped to 28.8%. So, while advisors certainly saw their average AUM diminish, they nevertheless are holding up fairly well with their higher-value clients.

That said, there’s no question that bank branch-based advisors’ AUM is under pressure, given the investment markets’ upward momentum. A deterioration in client trust, among other factors, may be to blame.

© 2017 Investment Executive. All rights reserved.