Insurance advisors’ investment businesses appear to be on the upswing once again this year. Several forces are likely to be behind this resurgence.

The results of Investment Executive‘s (IE) 2017 Insurance Advisors’ Report Card reveals some dramatic differences in the advisor populations surveyed compared with 2016’s survey. The average insurance advisor this year is notably older and the investment component of his or her book is significantly larger – substantial shifts that also have major implications for other aspects of the average advisor’s business, such as revenue and product mix.

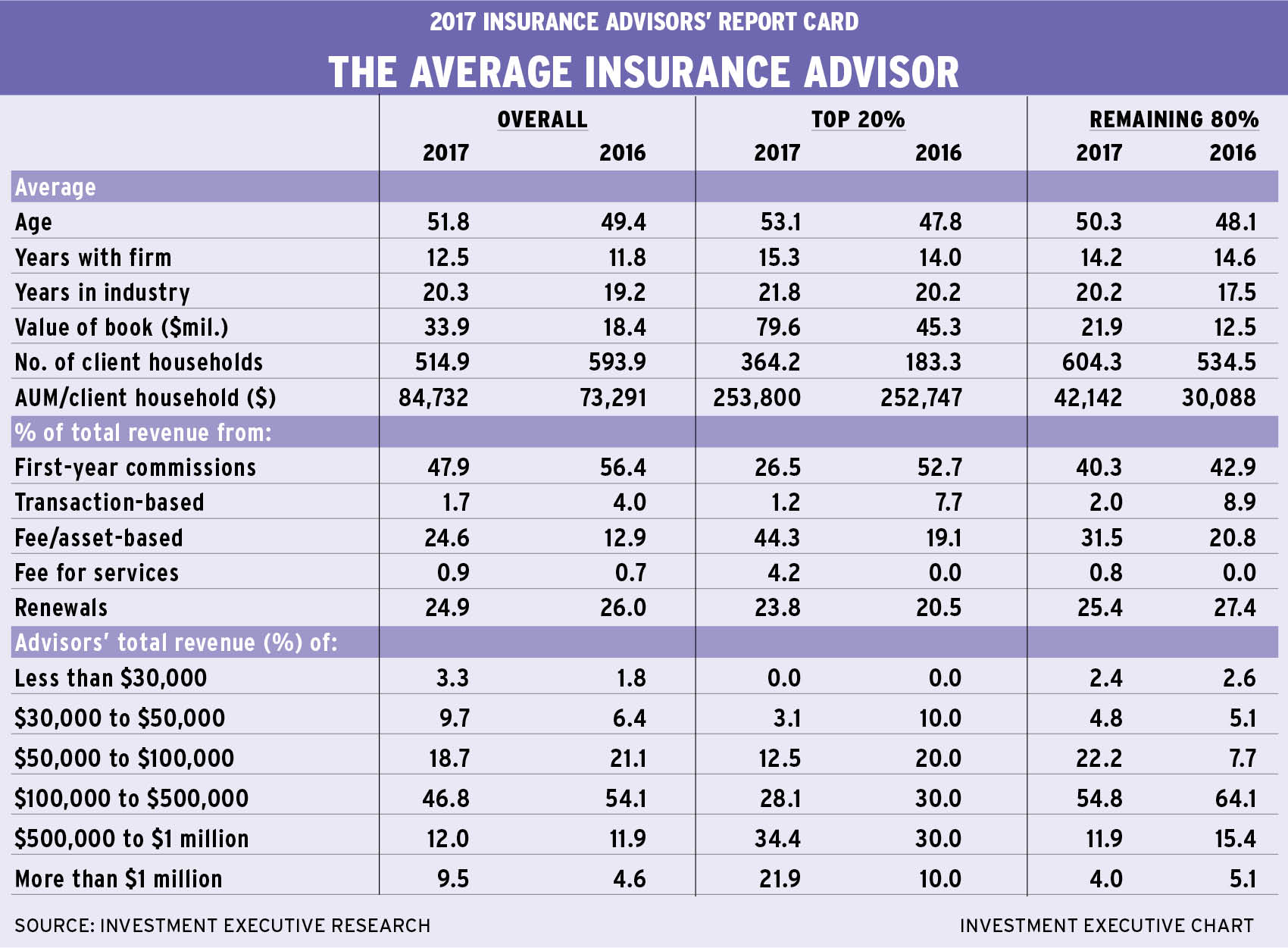

One of the most remarkable changes in this year’s survey is the large increase in the assets under management (AUM) the average insurance rep in IE‘s survey reported. This year, average AUM rose to $33.9 million, almost double the $18.4 million in average AUM that advisors reported in last year’s survey. This rise in average AUM also puts the average insurance rep almost on par with the average mutual fund dealer rep, according to IE‘s research.

Some of this large jump in average AUM for insurance advisors may reflect organic growth in advisors’ books; some may be due to buoyant markets; and some could represent intra-industry flows (i.e., insurance advisors capturing a larger share of client assets from other financial services distribution channels, such as banks and brokers). But all that probably isn’t the full story.

Indeed, the average age of the advisors in this year’s Report Card rose by almost 2.5 years. This large jump in average age highlights the fact that the advisor populations surveyed are fundamentally different from year to year. There also is an inherent high degree of volatility in IE‘s survey, given relatively small sample sizes – particularly in the investment component of their businesses.

All of these factors combined probably contribute to the large jump in average AUM for insurance advisors. At the same time, the average number of client households that the average insurance advisor said he or she serves declined to 514.9 in this year’s survey from 593.9 last year. This combination of higher average AUM and lower client numbers on average results in an increase in the average advisor’s productivity (defined as AUM/client household). This year, average productivity rose to $84,732 from $73,291.

Segmenting the advisor population further into the top producers (defined as the top 20%, as measured by AUM/client household) and the remaining 80% also highlights the substantial underlying volatility in some of the data. For example, the average age of the top producers this year rose to 53.1 years old from 47.8 in 2016. That large jump clearly indicates that the advisors captured by IE‘s samples are starkly different year-over-year, which adds a good deal of noise to the data.

The age disparity isn’t quite as dramatic among the remaining 80% of the advisor population, for which the average age rose to 50.3 years old in this year’s survey from 48.1 years old in 2016. Nevertheless, the two-year difference indicates that there’s some fundamental differences in the samples for this segment of the population as well.

For both the top 20% and the remaining 80% of advisors, average AUM rose significantly year-over-year. Among the top producers, average AUM soared to $79.6 million from $45.3 million year-over-year. For the remaining 80% of advisors, there was a similarly strong gain in AUM, albeit from a much lower starting point, as it rose to $21.9 million from $12.5 million.

Both segments of the advisor population also saw their client numbers rise over the past year – although the jump was a lot more significant among the top performers. The top 20% of advisors in this year’s survey reported that they’re serving 364.2 client households on average, effectively double the average of 183.3 client households reported in last year’s survey.

As with the large increase in AUM, the huge jump in client household numbers probably reflects the differences in the underlying sample population – not simply the book-building efforts of the insurance industry’s top-performing advisors. This large increase in client households also effectively balances out the increase in AUM, leaving average productivity for the top 20% of advisors essentially unchanged from 2016.

For the remaining 80% of advisors, client household numbers also increased year-over-year, but the change was not as dramatic. These advisors reported that they’re serving 604.3 client households, up from 534.5 last year. Unlike for the top producers, the more modest increase in household numbers and the healthy jump in average AUM for these advisors results in higher productivity: average AUM/client household rose to $42,142 from $30,088 year-over-year.

Of course, the significant differences between the survey results in 2017 and 2016 doesn’t stop with basic metrics, such as age, AUM and productivity; they also extend to other parts of the average advisor’s practice, as captured in the Report Card.

For example, the generally older, more experienced advisors in this year’s survey who also have notably larger investment books also reported a much lower reliance on first-year commissions and greater dependence on fee/asset-based revenue. The fact that insurance advisors rely more heavily on asset-based sources of revenue makes sense, given that they reported much more investment business than in 2016.

For the insurance industry overall, advisors’ reliance on first-year commissions dropped to 47.9% from 56.4%. At the same time, advisors reported that 26.4% their revenue comes from fee/asset-based sources.

This same fundamental shift is evident among both the top- performing advisors and the remaining 80% – although the swing is much more dramatic among the top performers, reflecting the inherent volatility of the relatively smaller sample size. The top 20% of advisors in this year’s survey reported that just 26.5% of their revenue comes from first-year commissions, down from 52.7% last year. Conversely, fee/asset-based sources comprise 44.4% of their revenue this year vs 19.1% last year.

Among the remaining 80% of advisors, the same trend is evident, with first-year commissions down slightly to 40.3% this year from 42.9% last year. At the same time, fee/asset-based sources rose to 31.5% of revenue vs with 20.8% in 2016.

The revenue mix isn’t the only data that are notably different in this year’s survey. The amount of advisors’ reported revenue also shifted. A higher proportion of the advisors surveyed this year were either at the very top or the very bottom of the industry’s pay scale.

First, the good news. This year, 9.5% of advisors surveyed reported that they’re earning in excess of $1 million a year, up from 4.6% in last year’s survey.

Conversely, 13% of advisors surveyed now report that they’re earning less than $50,000 a year, including the 3.3% who report earning under $30,000. In 2016, just 8.2% advisors reported earning less than $50,000, including 1.8% of advisors who reported taking home less than $30,000.

Most of the advisors in IE‘s survey still earn between $100,000 and $500,000 a year, but the proportion who reported that they sit in this range declined to 46.8% from 54.1% year-over-year.

© 2017 Investment Executive. All rights reserved.