Although financial advisors surveyed for this year’s Report Card on Banks and Credit Unions are happier than they’ve ever been when it comes to their firms’ compensation packages, the deposit-taking institutions still have a long way to go to meet advisors’ high expectations.

These themes were evident in the ratings advisors bestowed upon the six banks and one credit union in the “firm’s total compensation” category; most hit all-time highs this year, boosting the overall average performance rating to 8.0 from 7.5 last year. That said, the importance that advisors place on compensation also has increased to an overall average of 9.0, compared with 8.8 last year, which makes it even harder for firms to rise to the occasion.

“The compensation isn’t unfair compared with what other banks are offering,” says an advisor in British Columbia with Montreal-based National Bank of Canada. “But it would be nice if there were larger bonuses for reps who close larger accounts.”

“Compensation is not the highest in the industry,” says an advisor in Ontario with Toronto-based TD Canada Trust. “But compensation levels have always been stable – even in the recession, during which other firms cut back levels and got rid of their bonuses altogether.”

The overall satisfaction gap – measured by the difference between the overall average importance and performance ratings – in the compensation category was the third-widest in the survey, following “technology tools and advisor desktop” and “back office and administrative support.” And although all firms have satisfaction gaps in this category, some firms have far more work to do than others.

TD, for instance, had the smallest such gap, with only half a point separating its performance rating, 8.7, and the importance TD advisors gave to the category, at 9.2. Furthermore, TD’s performance rating was tops in this year’s Report Card. The bank’s rating has bounced back after a major setback last year, in which it dropped to 7.6 from 8.2 in 2010.

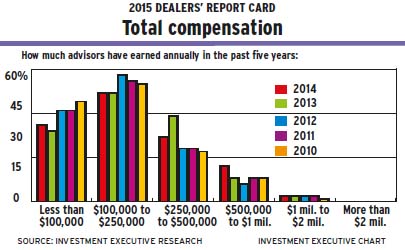

There were plenty of reasons for this improvement. For one, TD advisors reported an increase in their total compensation, including bonuses, with 27.3% of those surveyed now earning between $100,000 and $250,000 compared with 17.9% of advisors surveyed in 2011. (The rest are earning less than $100,000.)

In addition, TD advisors were quite enthusiastic with the firm’s rewards and recognition program. Says a TD advisor in Alberta: “Our bonus structure is the best on the Street because of its creativity. There are trips, merchandise, appreciation events – you name it.”

Adds a colleague in Ontario: “What I like most is that our bonuses aren’t tied to production. There’s a large part that comes from client feedback. That way, people really are focused on providing a great client experience.”

Edmonton-based Servus Credit Union Ltd., for its part, had made changes to its compensation structure at the beginning of 2011, and advisors are more than thrilled as a result. The firm’s compensation rating leapt to 8.4 from 6.9 last year, moving the credit union into the top three from last place in 2011.

“This was really about putting together what we thought was the best compensation program that was comparable in the industry,” says Randy Biberdorf, vice president of wealth management with Servus. “And, after its first year, the feedback has been very positive. So, it seems to be working very well.”

Servus, the product of an amalgamation of three credit unions in 2008, has had the task of merging three compensation structures into one. The credit union, which has three tiers of financial advisors (based on their total assets under management), has been able to develop a program that works for everyone.

“Compensation is now more stable and fair,” says a Servus advisor in Alberta, “as it accounts for the lower volume associated with working at smaller branches.”

In contrast to TD and Servus, Toronto-based Bank of Montreal (BMO) has slipped to the bottom of the pack this year, with its compensation rating dipping to 7.1 from 7.2 last year. As well, the bank had the highest satisfaction gap for this category in the survey, at 1.6.

BMO advisors complain of low base salaries, poor incentives and unrealistic targets that are impossible to hit. In addition, advisors’ take-home pay had dropped this year, with 28.9% of advisors reporting income of between $100,000 and $250,000, compared with 43.9% of advisors last year.

“They pay you for 37.5 hours a week, but you can’t hit the targets in that time unless you are one of those Dwight Schrute types [from the TV show, The Office],” says a BMO advisor in Atlantic Canada. “And, maybe, then you end up selling more than actually helping clients.”

Meanwhile, Bank of Nova Scotia and Canadian Imperial Bank of Commerce (CIBC), both based in Toronto, saw increases in their compensation ratings, although both continue to struggle to meet their advisors’ expectations.

“The compensation model is one aspect that needs to improve,” says a Scotiabank advisor in Ontario. “It needs to stay competitive with other banks, in terms of salary and bonuses. At other banks, they have a commissions structure. [Scotiabank’s] model doesn’t promote retention, whereas there is more stability in the models in which there are trailers.”

Scotiabank’s compensation package is reviewed on an annual basis and consists of base pay, incentive pay, a pension plan and a series of benefits, including health and life insurance, says James McPhedran, senior vice president, customer experience and distribution strategy, with the bank.

As for CIBC advisors, they repeatedly pointed out compensation as an aspect that needs improvement. Despite the firm’s major improvement in its rating – to 7.7 from 7.1 in 2011 – CIBC advisors still aren’t pleased.

“The firm’s expectations [for hitting sales targets] are a little high,” says a CIBC advisor in Atlantic Canada. “I’m in an economically depressed area, but I still have to produce at the same level as when things were going well.”

© 2012 Investment Executive. All rights reserved.