Despite being battered by waves of competition, rising regulatory tides and maelstroms of market volatility, Canada’s investment advisors appear to be weathering the storms. In fact, the securities industry’s upper echelon is displaying surprising confidence.

The latest edition of Investment Executive’s (IE) Brokerage Report Card reveals that the securities business appears to have changed very little, as measured by many of its basic metrics, over the past year: the industry’s advisor demographics are largely unchanged; assets under management (AUM) are holding steady; and productivity actually rose slightly as advisors trimmed their client rosters.

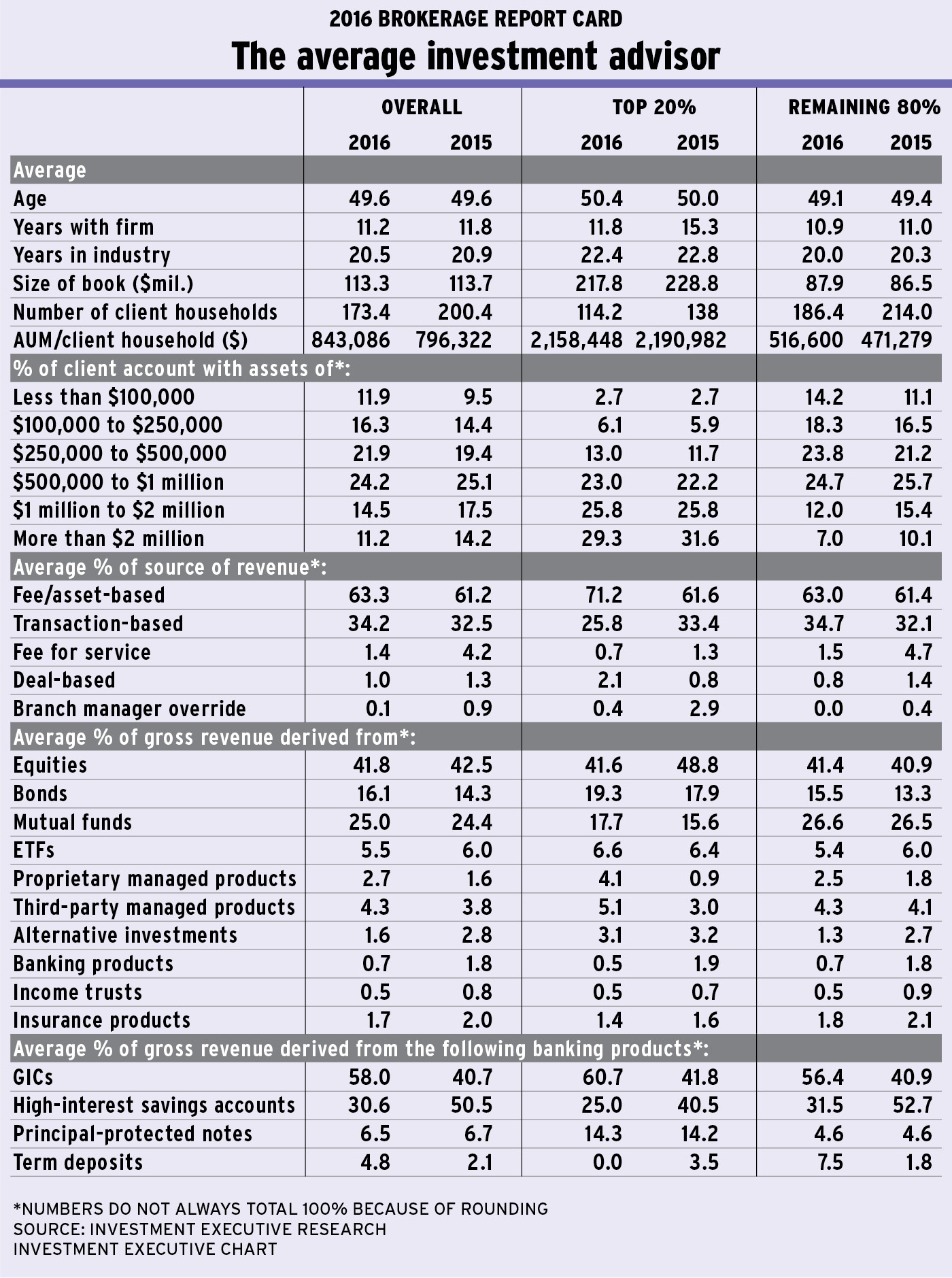

Overall, the average advisor in IE’s survey reports an average book of business of $113.3 million, essentially unchanged from $113.7 million in 2015. This lack of growth may be nothing to cheer about, but keep in mind that these results come against a background of rough markets in the past 12 months. Over that period, the S&P/TSX composite index was down by more than 9%, global equities were off by around 6% and global bond returns have been in the low single digits. Certainly, the financial markets have not been providing any forward thrust to the average advisor’s book.

This flat result in average AUM brings to an end the string of successive gains that advisors have enjoyed since the global financial crisis and worldwide recession in 2009, which inflicted major damage on advisors’ books. Since then, both advisors’ businesses and the financial markets have been recovering steadily.

The question facing the industry now is whether this recent flatline in advisors’ AUM represents a pause on a path of continued growth or a turning point that will see books of business come under pressure again? The answer to this fundamental question probably will have to come from the markets – although, at this point, advisors certainly appear to be bracing themselves for the prospect of tougher times ahead.

The average advisor has been trimming his or her client roster over the past year to 173.4 client households from 200.4 client households in 2015. This paring down suggests that many advisors are stepping up their focus on their most valuable clients, which may better position those advisors to ride out future market turmoil.

The combined impact of unchanged AUM totals and smaller client lists also means that average productivity (as measured by AUM/client households) rose smartly over the past year. Average AUM/client household rose to $843,086 from $796,322 year-over-year.

Drilling down through the headline numbers, though, this increase in productivity clearly came primarily from the industry’s weaker producers. The top 20% of survey participants actually saw their productivity edge down slightly in this year’s survey to $2.16 million from $2.19 million in 2015.

This dip in productivity came as this segment of the advisor population saw their average AUM erode a bit, sliding to $217.8 million this year from $228.8 million last year. However, these top performers still hold a significant edge in average AUM compared with the remaining 80% of advisors, for whom average AUM rose slightly to $87.9 million from $86.5 million in 2015.

The result of these divergent trends in AUM is that although productivity dipped a little for the top performers, it increased for the rest of the industry. For the remaining 80% of advisors, average AUM/client now sits at $516,600, up from $471,279 in 2015.

At first blush, it would appear that the industry’s so-called “top performers” have been outperformed by the rest of the advisor population over the past year, which seems to be an odd result. But one possible explanation for this outcome is that the top 20% also appear to have been more willing to change firms in the past year.

IE’s survey found that although the basic demographic profile of the top-performing advisors hasn’t really changed from last year – they are about 50 years old and have more than 22 years of experience in the industry – the average time spent with their current firm dropped to 11.8 years from 15.3 years over the past year.

This noticeable decline in average tenure for the top 20% of advisors suggests that they have been changing firms more actively than the rest of the advisors in the industry, for which average tenure with their current firm remains unchanged at 11 years. When advisors change firms, some loss of AUM is inevitable, which may at least partly explain why average production is down for the top 20% – on both an absolute basis and relative to the remaining 80% of advisors.

This increased willingness to move firms by the top 20% comes on the heels of several years of strong growth for both segments of advisors and may represent a vote of confidence in the future. The fact that top performers appear to be jumping ship more willingly than the remaining 80% of advisors suggests that the former group anticipates decent markets and industry conditions ahead.

Whether this faith will be rewarded or if this confidence proves to be misplaced remains to be seen. At this point, the markets’ direction in the short term is not clear. Although this year opened on a very rocky note, the markets have recovered their footing through the first three months of the year for the most part. The S&P/TSX composite index is up by about 3.7%; U.S. equities have recovered their early losses to eke out small gains; and global equities are more or less back where they started before that market’s slide. However, underlying economic growth remains weak; uncertainties abound (including the trajectory for interest rates and the health of emerging markets); and geopolitical risks still are heightened. Nevertheless, top-performing advisors appear to be voting with their feet – and their production – in favour of market resilience.

These same top performers also reported a dramatic swing toward fee/asset-based compensation arrangements. This trend has been underway for a long time, and fees have long since overtaken transactions as the primary source of advisor revenue. However, in this year’s survey, the trend is even more striking.

The top 20% of advisors reported that 71.2% of their revenue now comes from fees, up from 61.6% in 2015. At the same time, this advisor segment’s reliance on transactions has dropped to just 25.8% of revenue from 33.4% over the past year.

The remaining 80% of advisors also reported increased reliance on fees, now up to 63% from 61.4% year-over-year. However, these advisors’ use of transactions edged upward to 34.7% of revenue from 32.1% during that time. The increase in allocations to both of the primary sources of revenue for the remaining 80% appears to be at the expense of “fee for service” arrangements, which accounted for almost 5% of revenue in 2015, but are down to just 1.5% in this year’s survey.

Overall, the average advisor now generates about one-third of revenue from transactions and slightly less than two-thirds of revenue from fees, with a mere 2.5% coming from other sources.

The recent increase in mobility among top-performing advisors also appears to be affecting their asset allocation. The top 20% of advisors reported that their use of proprietary managed products has jumped to 4.1% in this year’s survey from 0.9% last year. Although these advisors also increased their use of third-party managed products to 5.1% from 3%, the big jump in their usage of proprietary managed products may be another consequence of increasing movement between firms. That’s because advisors may seek out firms with better in-house offerings or be more willing to make use of the products offered by the new firm rather than use the same merchandise that was available at the former shop.

Along with the increasing use of managed products, other notable shifts in asset allocation appear to indicate a rise in risk aversion. The top 20% of advisors reported that they have trimmed their exposure to equities to 41.6% from 48.8% in 2015. At the same time, the allocation to bonds in the books of these advisors has ticked upward slightly to 19.3% from 17.9% last year. Within the portion of these advisors’ books allocated to banking products, there is a dramatic shift into guaranteed investment certificates (GICs), with an estimated 60.7% of banking products now held in these products, up from 41.8% last year. The top-performing advisors also reported that they have increased their use of mutual funds, with allocations rising to 17.7% from 15.6% in 2015.

Among the remaining 80% of advisors, their books’ exposure to equities and their use of mutual funds barely changed from last year’s survey, at 41.4% and 26.6%, respectively. The allocation to bonds rose to 15.5% this year from 13.3% in 2015, and the use of GICs also jumped to 56.4% this year from 40.9% last year, indicating increasing caution among these advisors.

The remaining 80% of advisors also made slightly greater use of managed products (both proprietary and third-party offerings), but the increases were not as significant as the shift reported by the top-performing advisors.

© 2016 Investment Executive. All rights reserved.