Continued economic and financial market uncertainty has kept financial advisors playing defence for much of the past year. But, for the most part, it’s a challenge that they have met.

The latest wave of Investment Executive‘s Report Cards on the financial services industry appears to show that the ongoing market turmoil has kept most advisors running in place. The headline industry metrics have held up, for the most part, but there are signs that plenty of hard work has gone into maintaining them.

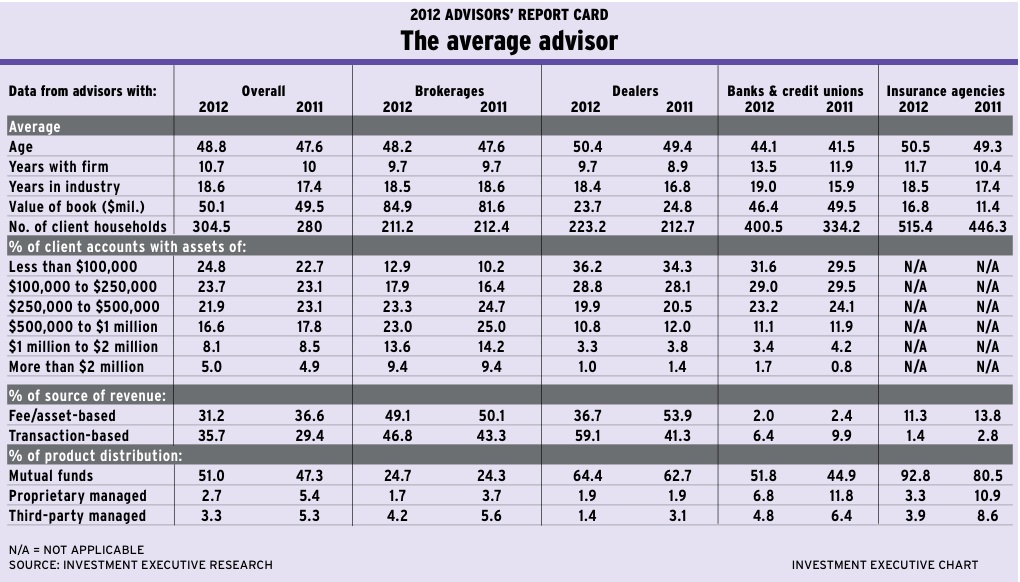

For example, average assets under management (AUM) across all four channels (brokerages, dealers, banks and credit unions, and insurance agencies) combined is more or less unchanged from last year – creeping up to $50.1 million from $49.5 million in 2011. Yet, the number of client households that the average advisor is serving has risen to 304.5 this year from 280 in 2011, which suggests that advisors have had to expand their client rosters in order to maintain their AUM.

This is hardly surprising, given the condition of the markets over the past year. As well, the economic recovery has been weaker than expected; financial markets in general have been under strain; and Canadian equities markets, in particular, have lagged over the past 12 months. At the same time, interest rates have remained at historically low levels, undermining fixed-income returns, too. Unlike in the heyday of the bull market, there are no easy asset gains for advisors or their clients.

All this means advisors have had to bolster their businesses the hard way: by winning more clients amid both exceptional market uncertainty and intense skepticism directed toward the financial services industry.

Of course, these basic trends are playing out differently in each channel. Brokers for example, which traditionally have the largest books in terms of AUM, have managed to grow their industry-leading AUM – to $84.9 million from $81.6 – while their client totals remained essentially unchanged.

In contrast, advisors with both the deposit-taking institutions and the dealers saw their average AUM decline a little bit year-over-year while their client numbers have increased. These two channels are the source of the overall increase in average client numbers, even as their AUM has dropped.

This is particularly evident among advisors with the deposit-taking institutions, who saw average AUM drop by $3.1 million (to $46.4 million this year from $49.5 million last year) yet also report that their average client rosters jumped to 400.5 households this year from 334.2 households in 2011.

AUM is a less meaningful, more volatile metric for insurance advisors. Still, there is evidence within this channel that advisors have had to add to their client numbers in order to bolster their books, with the average book growing to 515.4 households this time around from 446.3 households last year.

The sense that advisors are working hard to add clients in order to maintain their books – rather than gathering more assets from their most valuable clients or growing AUM through market performance – also is evident in the overall account distribution breakdown. The smallest accounts (those worth less than $100,000) now account for the largest share of the average advisor’s book, at 24.8%, up from 22.7% a year ago.

In 2011, accounts in both the $100,000-$250,000 range and the $250,000-$500,000 range shared the top spot, each boasting a 23.1% share of the average book. This year, the smaller category has grown a bit, while the larger account category ($250,000-$500,000) has slipped. Indeed, accounts of up to $250,000 now account for almost half of the average advisor’s book, at 48.5%, vs 45.8% a year ago.

This trend in favour of smaller account sizes is evident across the financial services industry. (Although, for advisors with the deposit-taking institutions, who seem to have faced the greatest struggles over the past year, the cutoff is the $100,000 mark – with all account categories of more than $100,000 representing a smaller share of the average book – except for the very largest accounts, which saw an increase in share vs last year.)

The effort to add new clients, and the apparent willingness to take on smaller accounts in order to do so, seems to be affecting the average advisor’s revenue mix, too. Notably, there appears to be a reversion to transactions as a source of advisor revenue, as well as a decline in the importance of fees and asset-based charges.

When markets were rising and advisors were cutting back their client numbers to focus on their most valuable clients, advisors increasingly had relied on fees and asset-based revenue. Now that advisors are boosting client numbers and relying on smaller accounts, it appears that transactions once again are playing an increasingly prominent role in the average advisor’s revenue mix.

In fact, fees and transactions have effectively traded places in the hierarchy of advisor revenue sources over the past year. Across all four channels, average revenue from fee- and asset-based sources is down to 31.2% this year from 36.6% in 2011, whereas transaction-based revenue is up to 35.7% from 29.4% year-over-year.

This shift is most evident among advisors with the dealer firms – although also among the brokers, too. For advisors with the deposit-taking institutions and insurance agencies, the comparison isn’t as meaningful as both fees and transactions are merely secondary revenue sources.

That said, another possible cause of this general shift away from fees and toward transactions is evident across all four channels. And that is reflected in the change in the asset mix of the average book – away from managed products and toward mutual funds. Although a change in advisor strategy is one possible explanation for the shift in revenue mix, there may be a good reason for it from the client’s point of view as well.

In headier times, clients could easily absorb an annual asset-based fee – paying 1% or 2% a year in fees was no big deal when returns commonly were in the double digits. But now that equities markets are weak and fixed-income returns are almost non-existent, these once seemingly modest fees can now easily consume most, if not all of a client’s return.

This increasing cost-consciousness among both advisors and their clients appears evident in the changing asset mix that was reported in this year’s Report Cards. Across all channels, mutual funds saw their share of the average book rise to 51% this year from 47.3% last year. At the same time, the market share for both proprietary and third-party managed accounts has plunged. The reported market share for proprietary products has been slashed in half, to 2.7% from 5.4%. And the share for third-party products is down sharply, too, to 3.3% from 5.3% year-over-year.

This is not a case of a very strong trend in one channel of the industry driving a shift in the overall numbers; it’s a common theme in all four channels – albeit to different degrees. The shift is most dramatic among insurance advisors – for whom the share for proprietary managed accounts has plunged to just 3.3% this year from almost 11% last year, the share for third-party products has dropped by more than half and mutual funds have risen to almost 93% of the average book.

That said, this trend is starkly evident in the three other advisory channels as well. In such a low-return environment, both advisors and clients can no longer be cavalier about the impact of fees.

Although this may be bad news for product manufacturers, an increasing sensitivity to investment costs does not appear to be hurting advisors’ bottom lines. For the industry overall, the proportion of advisors who report earning less than $100,000 a year is down to 28.8% from 31%. Along those lines, the share of advisors who put themselves in each compensation category above the $100,000 mark is up year-over-year, with most of the gains coming among the highest-earning advisors. Although the share of advisors who report earning $100,000-$500,000 a year is little changed, those who say they earn $500,000-$1 million a year is up to 12% from 11.2%; and those who say they are earning more than $1 million is up by even more, to 5.7% from 4.5%.

However, this is not a trend that’s reflected across all four channels. Although advisors with brokerages and dealers both report that a smaller proportion are earning less than $100,000, that’s not the case for advisors with the deposit-taking institutions and the insurance agencies. In those industry channels, the proportion of advisors earning less than six figures is up year-over-year and the number of high earners has dropped, too. Indeed, there are no advisors with the deposit-taking institutions who report earning as much as $500,000; and the proportion of insurance agents who say they do is down to 15.3% from 22.4%.

So, while the hard work that advisors have put in to maintain their books over the past year has seemingly paid off for those with the brokerages and dealers, it has been less rewarding for those with the deposit-taking institutions and the insurance agencies. Still, given the hostile conditions all advisors have faced over the past year, there’s no shame in simply holding their own.

© 2012 Investment Executive. All rights reserved.