Although insurance agencies’ training efforts are becoming more and more important to insurance advisors, there’s a real difference between how this is being delivered by managing general agencies (MGAs) and dedicated sales agencies, according to the results of this year’s Insurance Advisors’ Report Card.

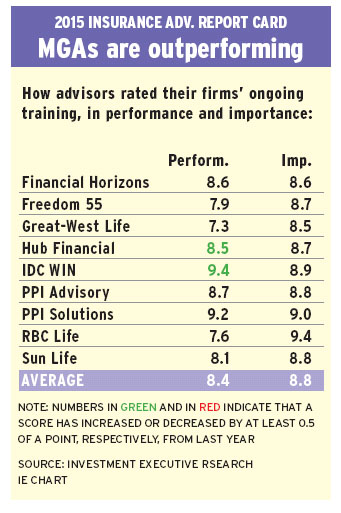

Specifically, advisors surveyed for this year’s Report Card gave the “ongoing training” category an overall average importance rating of 8.8, up slightly from 8.6 last year, with some advisors going as far as saying that it’s the “lifeblood” of the insurance industry. However, advisors reported that MGAs are doing a much better job than the dedicated sales agencies are.

Advisors with Mississauga, Ont.-based RBC Life Insurance Co., London, Ont.-based Freedom 55 Financial, and Waterloo, Ont.-based Sun Life Financial (Canada) Inc. and Winnipeg-based Great-West Life Assurance Co. (GWL, whose independent advisors on the Gold Key distribution network operate on a platform similar to that of the dedicated agencies), gave their firms the lowest performance ratings in the category, at an average of 7.7.

MGAs, on the other hand, were rated very well, at an average performance rating of 8.9, for their forward-thinking, tailored approach to ongoing training. Says an advisor on the Prairies with Calgary-based PPI Solutions Inc. of the MGA’s ongoing training: “They’re progressive and proactive. They identified where the market is changing and how that could affect our businesses.”

Adds an advisor in Ontario with Woodbridge, Ont.-based Hub Financial Inc.: “We have a broad range of training. [The firm] segments advisors according to their needs and educational opportunities to meet the requirements of each practice.”

Advisors with Mississauga, Ont.-based IDC WorldSource Insurance Network Inc. (IDC WIN) were particularly pleased with their MGA’s ongoing training support, giving the MGA a survey-high performance rating of 9.4, up from 8.5 last year.

“[IDC WIN] is really trying to help advisors meet their maximum potential,” says an IDC WIN advisor in Ontario. “There’s training available every week.”

IDC WIN takes ongoing training seriously. The MGA is proactive in promoting the opportunities it makes available to advisors, says Ron Madzia, IDC WIN’s president.

“Every one of our events is pre-organized for the upcoming year,” he says. “Our full array of educational events is out in front of our advisors come Jan. 1. [Advisors can] work around their own personal or business schedules so they can make sure they can attend.”

In contrast, advisors with the dedicated sales agencies said their firms aren’t putting enough thought or planning into ongoing training.

“It comes and goes,” says an advisor in Ontario with RBC Life. “If we speak up, it happens. Otherwise, they just might not even think of it.”

Adds a Sun Life advisor in Ontario: “We know more than the trainers, and training is done kind of on an ad hoc basis.”

Meanwhile, advisors with Freedom 55 said their firm’s training notifications are too little and arrive too late.

“[Management] needs to find out from advisors what they want training in, and to make the training schedule at the beginning of the year so advisors can actually get their training done. We get very little warning about sessions now,” says a Freedom 55 advisor in Atlantic Canada.

Adds a colleague in Ontario: “I’d prefer to see a schedule. The centre I’m attached to doesn’t do that, and then they turn around and say, ‘There’s mandatory mutual fund meeting in three days.’ They expect us to just drop everything – and that just doesn’t work in my world.”

Even when training does take place, advisors with the dedicated sales agencies said, it leaves much to be desired. For example, Sun Life advisors said the bulk of their training is targeted toward new recruits.

“[The firm] focuses on younger advisors,” says a Sun Life advisor in Ontario. “After being in the industry for so long, you’re looking for some advanced training.”

On the other hand, RBC Life advisors said that new advisors are struggling because of the lack of orientation support and sophisticated sales training.

“[Trainers] just tell new advisors to make phone calls,” says an RBC Life advisor in Ontario.

Adds a colleague on the Prairies: “The ‘onboarding’ training is haphazard. If I had not had previous business, finance and sales experience when I came on board, I likely would not still be here. It’s like: ‘You passed your [life licence qualification program]. Go nuts’.”

In response, Mike Hamilton, RBC Life’s senior vice president of sales and distribution, says a 90-day orientation program was introduced in November 2014 in response to an internal survey.

Specifically, he says, the program goes beyond traditional web training to include face-to-face role-playing and other hands-on techniques to teach new advisors the nuances of running a day-to-day practice.

© 2015 Investment Executive. All rights reserved.