Financial advisors across the four distribution channels in the financial services sector – brokerages, mutual fund and full-service dealers, banks and credit unions, and insurance sales agencies – are entering uncharted territory with the implementation of the second phase of the client relationship model (a.k.a. CRM2).

Although the impact of this new regulatory regime won’t be known for some time, change is in the air. Advisors surveyed for Investment Executive‘s (IE) 2015 Report Card series said they are making the necessary adjustments to their businesses in preparation for the new disclosure requirements coming into effect within a couple of years.

Advisors are dealing with this change at a time when business has never been better. The average book of business hit a new record level in 2015 of $66 million in assets under management (AUM).

This growth continues an upward trend seen since 2010, when the average book rebounded to $47 million after dropping to $45.3 million in 2009 as a result of the global financial crisis and the ensuing recession. Last year, the average book had $60.7 million in AUM. (See story on page C4.)

Given the combination of growing books of business and a changing regulatory landscape, advisors are adopting different compensation structures. For example, the data obtained in this year’s Report Card series reveal a marked increase in revenue from fee-based business models. Case in point: advisors reported that 49.5% of their gross revenue came from either the fee-for-service or fee/asset-based model compared with 42% in 2014. (See page C7.)

In large part, advisors said they are making the switch in response to CRM2. The new regulations, which are being phased in over a three-year period, will require firms and advisors to provide enhanced cost disclosure and performance reporting to clients.

“We’ve already been taking the bull by the horns; our fee-based platform is already in place,” says an advisor in Ontario with Toronto-based Assante Wealth Management (Canada) Ltd. “Clients know what we take and what the dealer takes.”

To gauge how advisors felt about the impact that the implementation of CRM2 will have on their business, IE introduced a supplementary question in this year’s Report Card series that asked advisors to rate that anticipated impact on a scale of one to five, with one representing “not at all” and five representing “completely.”

Of the advisors surveyed, 57.6% said they expect CRM2 would have little to no impact on their business. This optimism is based largely on the fact that many advisors said they have either made the transition to a fee-based model or they are in the process of doing so – or that they have been discussing fees with clients for some time.

“We have been working on transparency for years in advance,” says an advisor in Ontario with Toronto-based BMO Nesbitt Burns Inc. “As a firm, we are not embarrassed about what we charge. There is a cost for high-quality work.”

Most advisors view CRM2 as a positive influence on their business and the industry, as a whole, because the regulatory changes represent an opportunity to strengthen relationships with clients and to take business away from ill-prepared advisors.

“CRM2 will open the floodgates to a lot of competition,” says an advisor in Ontario with Mississauga, Ont.-based Edward Jones. “I now see an opportunity to seize clients.”

Compensation models and competition are not the only things changing as a result of CRM2. Advisors expect to see improvements in their firm’s client account statements.

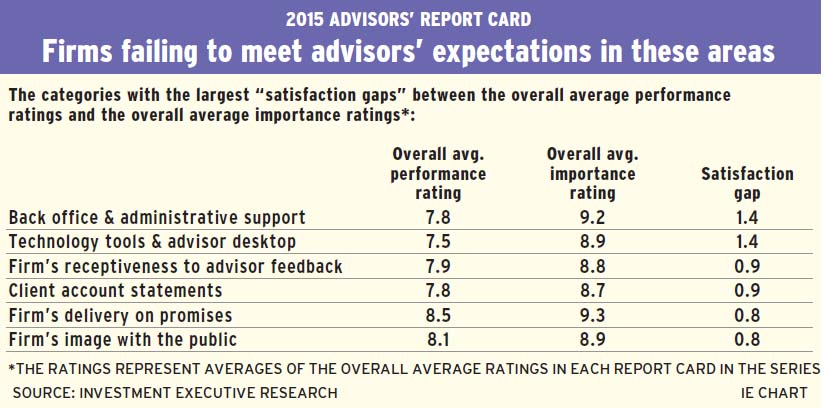

The “client account statements” category has long been a source of frustration for advisors, and that remained the case in 2015. This category was tied for the second-highest “satisfaction gap” – the difference between the overall average performance and importance ratings – in this year’s Report Card series. (See page C7.)

Many advisors complained that statements are hard for clients to decipher. Says an advisor in Ontario with Toronto-based Royal Bank of Canada: “Nobody can understand or read them. The layout/presentation is confusing. Clients don’t know [their portfolio’s] return.”

However, advisors hope that the implementation of CRM2 will help to modernize and improve the reporting documents. “Clients don’t like the statements,” says an advisor in British Columbia with Toronto-based Bank of Nova Scotia. “With the CRM reforms coming through, maybe things will get better.”

Account statements was not the only category in which advisors were dissatisfied with their firms’ efforts. Regardless of the distribution channel, advisors said their firms still fail to meet expectations in “back office and administrative support” and “technology tools and advisor desktop.” Those two categories were tied for the largest satisfaction gap among all the categories in the Report Card series.

Regarding back-office support, advisors complained of overworked staff, processing errors and delayed response times, all of which have a negative impact on their relationships with clients and, therefore, their business.

“[Back-office staff] make too many errors, and that ends up costing us money,” says an advisor in B.C. with Toronto-based HollisWealth Inc.

As for technology, advisors complained about outdated tools and software, glitch-filled rollouts, slow networks and lack of integration among tech tools.

“We need more up-to-date technology,” says an advisor in Ontario with Toronto-based Bank of Montreal. “There are lots of systems that overlap and don’t talk to each other.”

Despite the dissatisfaction in these categories, there are some firms that have found the magic formula to deliver exactly what their advisors need in the back office and technology. (See page C8.)

Of course, firms also are delivering in many other categories – especially the ones that matter most to advisors: “firm’s ethics,” “freedom to make objective product choices” and “firm’s stability.”

That firms are meeting advisor expectations where it counts most is a big reason why advisors were willing to overlook faults when IE asked them whether they would recommend their firm to another advisor.

Every year, a significant proportion of advisors say they would. And that trend continued this year, as 93.7% of advisors said they would recommend their firm – albeit with some stipulations. (See page C10.)

How we did it

The goal of investment executive’s (IE) annual Advisors’ Report Card is to explore the major trends and themes within the financial services sector, as a whole, that advisors across the four distribution channels – brokerages, mutual fund and full-service dealers, banks and credit unions, and insurance sales agencies – say are having an impact on their business.

This year, the results of the Report Card series revealed an advisory industry that’s preparing and adapting to meet the new regulatory requirements that are part of the second phase of the client relationship model (a.k.a. CRM2).

In addition, advisors across the entire industry were quick to mention their continued dissatisfaction with their firms’ back-office and technology trends. But despite continued challenges, many advisors said they’re still more than willing to recommend their firms to other advisors – although with some stipulations.

To get a sense of these trends, IE researchers Joy Blenman, Kevin Philipupillai, Kelsey Rolfe and Anne-Marie Vettorel spoke with 1,548 advisors at 40 firms from early January to mid-June.

Advisors were asked to give two ratings for each category in their respective surveys – one for the firm’s performance in that category and another for the importance of that category to their business – on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

© 2015 Investment Executive. All rights reserved.