As brokerages contend with the impact of ever-evolving business and regulatory landscapes, investment advisors surveyed for this year’s Brokerage Report Card have placed greater importance on – and have cast a critical eye toward – their “firm’s strategic focus.”

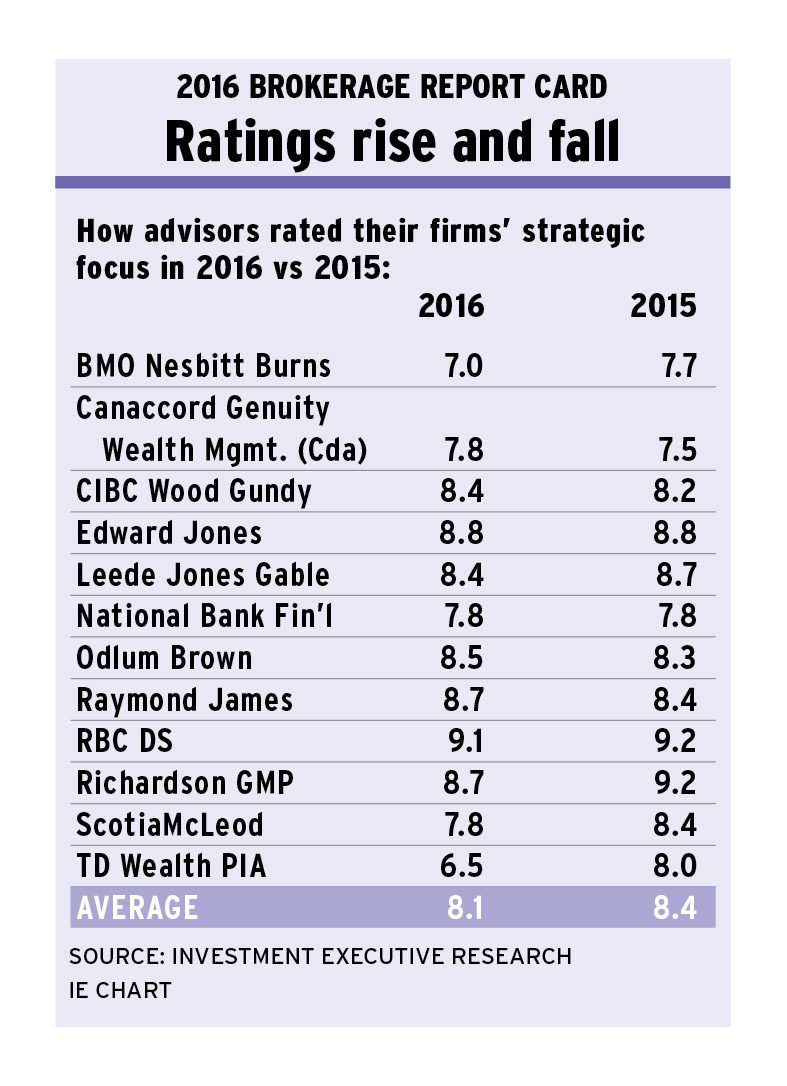

Specifically, advisors rated the category at 9.0 in importance overall, up from 8.5 last year. In contrast, advisors gave their firms an overall average performance rating of 8.1 in the category, down from 8.4 in 2015. That decline is mostly the result of ratings by advisors with BMO Nesbitt Burns Inc., TD Wealth Private Investment Advice (TD Wealth PIA), Richardson GMP Ltd. and ScotiaMcLeod Inc. (all based in Toronto), who rated their firms lower by half a point or more in the category vs last year.

Many advisors with the bank-owned brokerages in particular were concerned with their firm’s push to attract and serve high net-worth (HNW) clients while cutting ties with those clients who have $100,000 or less in investible assets. However, the way the firms are managing that transition has made a difference in whether advisors embrace the changes.

Advisors with TD Wealth PIA and Nesbitt are the most dissatisfied with their firm’s approach; not only did they rate their firms significantly lower than last year, but TD Wealth PIA (6.5) and Nesbitt Burns (7.0) received the two lowest ratings in the strategic focus category for this very reason.

Nesbitt advisors said there’s an “active effort” to refer existing clients to other models within the parent bank’s operations, such as SmartFolio, the robo-advisory platform launched in January. Although advisors understand the firm is trying to find the appropriate fit to maximize revenue, the emphasis on off- loading certain clients with whom advisors have nurtured relationships doesn’t sit well.

“We’re basically saying the past 25 years are of no value,” says a Nesbitt advisor on the Prairies.

Adds a colleague in Ontario: “I feel concerned about my employer trying to take my job. I’m supposed to send people to robo-advisors? Are they nuts?”

However, advisors are being asked to assess who is best served by the brokerage so the advisors can tend to clients with more complex needs, says Charyl Galpin, head of Nesbitt: “We’re not specifically asking investment advisors to divest themselves of smaller clients and move them to SmartFolio. We’re asking [advisors] to divest themselves of clients that don’t fit Nesbitt and look to the other channels.”

Meanwhile, Toronto-Dominion Bank’s (TD) effort to rebrand its HNW wealth-management business, which brings three divisions (including TD Wealth PIA) under a single entity known as TD Wealth Private Wealth Management (TD Wealth PWM), has drawn much criticism from among TD Wealth PIA advisors. The most common complaint was the rapid succession of changes to the firm’s name and structure, with advisors decrying the lack of communication.

These advisors said the rebranding efforts have muddled their outlook on how the firm will achieve its targets, one of which is to focus on HNW Canadians with investible assets of $750,000 or more.

“TD has made it clear that they want us to move to the HNW clientele market, but I feel they’re pressing this issue too quickly and making the organization vulnerable to competition,” says a TD Wealth PIA advisor in British Columbia.

Dave Kelly, senior vice president with TD Wealth PWM, acknowledges there is still work to be done to get everyone on board: “The HNW strategy has a lot of moving parts, [but] I don’t think it’s complex. We’ve been working to simplify the strategy to a one-page document” that outlines the opportunities for advisors as part of TD Wealth PWM.

Similarly, advisors with ScotiaMcLeod, who rated their firm at 7.8 in strategic focus, down from 8.4 last year, said they’re also under pressure to build up their HNW client base in a rapid manner.

“They’re trying to stream us toward HNW clients in a very short period of time,” says a ScotiaMcLeod advisor in Ontario. “It’s challenging.”

In contrast, advisors with Toronto-based RBC Dominion Securities Inc. (DS), for whom serving HNW clients has long been a focus, gave their firm the highest rating in the strategic focus category, at 9.1.

DS also is focusing on having advisors reduce the number of smaller accounts they serve so they can concentrate on better serving HNW clients. DS advisors said that challenge is one they’re ready for because the proper support is in place to help them.

“They’ve been focusing on higher net-worth clients and they have given us a lot of resources to be able to do that,” says DS advisor in B.C.

Adds a colleague in Alberta: “It’s not a bad thing. You need to have that vision to remain on top.”

Meanwhile, instead of setting advisors’ sights on expanding their HNW client rosters, independent brokerages such as Vancouver-based Canaccord Genuity Wealth Management (Canada) and Toronto-based Raymond James Ltd. are making efforts to expand geographically – and that’s a strategic focus that their advisors approve of.

For example, Raymond James advisors rated their firm relatively high in the category, at 8.7, up from 8.4 in 2015. Some lauded their firm’s efforts to increase the number of female advisors; others praised Raymond James’ focus on growing its business in Quebec.

“They’re doing all the right things, such as focusing on Quebec,” says a Raymond James advisor in Quebec. “I’ll have to see longer term how well that works out, but it’s promising.”

Specifically, Raymond James is spending $4.5 million to shore up its francophone employee base, so that advisors and clients can have access to resources and services in French, says Richard Rousseau, the firm’s executive vice president, head of wealth management. Furthermore, plans are afoot to recruit more francophone advisors this summer.

Even though Canaccord advisors point to various changes in management over the past few years as cause for concern, many advisors support the firm’s key priorities of expanding globally and growing the wealth-management division, rating their firm slightly higher in strategic focus this year, at 7.8 vs 7.5 in 2015.

“We’ve been growing internationally, and that’s diversified our suite of offerings,” says a Canaccord advisor in Ontario.

Although Canaccord’s parent, Canaccord Genuity Corp., recently had to scale down its operations in the U.K. as a result of weak markets, those cutbacks are limited to its capital markets business in the U.K. Thus, the firm’s wealth-management business still is poised for growth, says Stuart Raftus, president of Canaccord Genuity Wealth Management (Canada).

“In Canada, most of our cutbacks were limited in wealth management,” Raftus says. “And we’re looking to grow this business strategically through competitive recruiting or through acquisitions.”

© 2016 Investment Executive. All rights reserved.