Following much turmoil in the financial markets and the financial services industry, and with fundamental regulatory reforms in the pipeline, it’s no surprise that compliance officers’ (COs) and company executives’ views of their regulators are shifting as well. And although opinions on the securities sector’s biggest regulators have slipped, mutual fund dealers actually are somewhat happier with their oversight.

Seemingly endless regulatory reform has become a fact of life in the Canadian financial services business, and the global financial crisis further entrenched this reality. Yet, in the past year, the focus on fundamental aspects of the retail side of the industry has intensified, with the Canadian Securities Administrators examining the prospect of a statutory fiduciary duty for retail financial advisors and considering an overhaul of the mutual fund sector’s fee structure.

Concerns regarding these possible seismic shifts have come amid the ongoing implementation of other fundamental reforms and the struggle for profits in much of the industry. Thus, it’s not surprising that dealers’ appraisals of many aspects of their regulators also are changing.

The overriding caveat to Investment Executive‘s (IE) Regulators’ Report Card is that it reflects just one side of the ledger – the dealers’ view of the regulators. Of course, this is only one aspect of the regulators’ audience; regulators have broader responsibilities, including to issuers, investors and the overall market. So, higher Report Card scores aren’t unambiguously positive; they only represent the views of the dealers’ COs and executives.

That said, the dealers do constitute a vital portion of the market, and they are in a position to assess the regulators’ performance. And their opinions of the regulatory bodies that oversee them certainly have evolved over the past year.

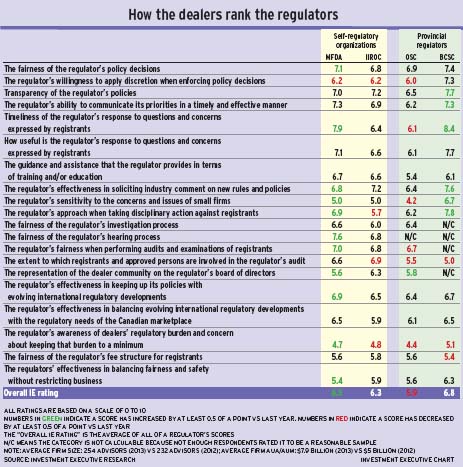

For one thing, there has been a basic shift in the firms’ views of the self-regulatory organizations (SROs), with most of the ratings for the Mutual Fund Dealers Association of Canada (MFDA) notably on the rise and surpassing those of the Investment Industry Regulatory Organization of Canada (IIROC) for the first time since IE began publishing this Report Card in 2009.

Indeed, the MFDA saw its ratings rise in almost every category this year. Its ratings went up in 15 of 17 categories and down in just two areas compared with its 2012 ratings. (There also are three new questions in the survey.) As a result, the MFDA’s overall average rating – its “overall IE rating” is higher by half a point year-over-year, pushing it past IIROC.

Moreover, in a number of important areas, these higher scores are up significantly from the previous year. The MFDA’s rating in “the fairness of the regulator’s policy decisions” is up by more than a full point from last year. In addition, the MFDA saw significant jumps in its scores for a wide range of categories, from the “timeliness of the regulator’s response to questions and concerns expressed by registrants” to “the regulator’s sensitivity to the concerns and issues of small firms” and “the fairness of the regulator’s hearing process.”

“[The MFDA has] come a long way,” says a CO with an Ontario-based mutual fund dealer, “moving from a confrontational approach to working with dealers.”

As a result of these higher scores, the MFDA’s ratings are now equivalent to or higher than IIROC’s scores in 13 of the 20 categories. That’s not to say that dealers are saying that the MFDA is doing a better job than IIROC. (The SROs are rated independently by different populations.) However, the Report Card results do indicate that the MFDA’s stock is rising in the eyes of its members and that fund dealers now view the MFDA in a way that is similar how the investment dealers view IIROC.

At the same time, the investment dealers’ assessment of IIROC slipped a bit in the past year. It received lower scores in 11 categories; in six areas, its ratings were either unchanged or up slightly. Thus, including the three new categories, IIROC’s overall rating is down marginally from 2012.

In most of the areas in which IIROC saw its scores go down, the declines were modest, but the regulator did see a notable drop of more than a full point in “the regulator’s willingness to apply discretion when enforcing policy decisions.” IIROC also saw meaningfully lower marks in: “the regulator’s approach when taking disciplinary action against registrants”; “the extent to which registrants and approved persons are involved in the regulator’s audit”; and “the regulator’s awareness of dealers’ regulatory burden and concern about keeping that burden to a minimum.”

“[IIROC personnel] pay lip service to the concern about regulatory burden,” says a CO with an Ontario-based investment dealer. “If the higher-ups are concerned about it, that doesn’t flow down to the front-line people.”

This feeling isn’t unanimous, however; some dealers believe that IIROC is genuinely concerned about the impact of regulation, but that rising regulatory demands may be largely beyond its control.

“IIROC is concerned about the burden, and it’s trying to minimize it,” suggests a CO with a British Columbia-based firm. “There is more regulatory burden now than ever before, but that’s not coming from IIROC necessarily. [IIROC is facing] pressure from outside organizations, [such as] the U.S. government.”

This concern about the growing regulatory burden also is evident among the ratings for provincial regulators. Ratings in this category dropped sharply year-over-year for both the Ontario Securities Commission (OSC) and the B.C. Securities Commission (BCSC).

(In an effort to drill a little deeper into the financial services industry’s perception of individual regulators, IE has broken out the scores for Ontario and B.C. this year instead of providing an overall average score for the provincial regulators. Smaller sample sizes prevent breaking out scores for some of the other provincial securities commissions.)

The provincial regulators’ ratings in this category, which were down by more than a full point for both the OSC and the BCSC compared with 2012, indicate that COs and company executives have decidedly dimmer views of the provincial regulators’ efforts in minimizing the regulatory burden. Indeed, this is a category in which those surveyed gave low ratings to all of the regulators; although MFDA saw its rating in this category rise significantly year-over-year, this rating still is low.

The OSC got the lowest mark among the four regulators in this area. And the inference that the OSC has become increasingly indifferent to the cost of regulation is echoed by the big drop in its score in “the regulator’s sensitivity to the concerns and issues of small firms” category, which dropped by 1.8 points year-over-year, resulting in the lowest rating among all four regulators in this category.

Although it’s tough to pinpoint exactly why the view of the OSC’s constituency regarding the regulator’s sensitivity to the needs of small dealers dropped so dramatically, it may be that the OSC is paying a price for its decision to raise fees at a time when many small firms are struggling to break even. (See story on page 24.)

However, the revisions to the OSC’s fee model did incorporate measures to reduce the impact on small firms and the regulator has depleted its surplus in the past few years in order to prevent fee increases. Still, the industry appears to be less than impressed with the OSC’s efforts.

“[The OSC is] aware of the burden, but I get the feeling that it’s not very concerned,” says a CO with an Ontario-based dealer. “As a small firm, it can be very tough sometimes.”

This isn’t the only area in which the OSC’s scores suffered. The regulator saw its ratings decline in 12 categories compared with last year. Some of the bigger drops were in areas such as its willingness to apply discretion when enforcing policy decisions and firms’ involvement with the regulator’s audits.

Coupled with smaller declines in many other categories, the OSC’s overall rating is down by half a point from last year, which makes it the lowest-rated among the four regulators in the Report Card this year. Again, this reflects the opinion of only one segment of the OSC’s realm, but it’s clear that the regulator’s popularity with that constituency has taken a hit over the past year.

By comparison, the BCSC got a more neutral review from dealers. Its scores rose in six categories and dropped in six vs the previous year. As well, the BCSC’s overall rating is essentially unchanged and almost a full point higher than that of the OSC. The BCSC is at the top of the class among the four regulators overall.

© 2013 Investment Executive. All rights reserved.