The results of the 2011 Brokerage Report Card reveal that financial advisors in the brokerage channel have done a splendid job of navigating the bumpy road created by the global financial crisis, and they now have a clear road ahead as the recovery gains further traction.

“The view down the road is that it’s going to do nothing but get better,” says an advi-sor in British Columbia with Toronto-based Macquarie Private Wealth Inc.

Adds an advisor in Ontario with Toronto-based Richardson GMP Ltd. : “[Things are] where I need them to be now.”

The fact that advisors are back in business is evident: advisors have seen a boost in the average size of their books of business, which are almost back to pre-recessionary levels. Furthermore, their insurance revenue is also up, and advisors are steering away from selling safer investments, such as banking products and segregated funds, and moving back toward selling more traditional investments, such as equities and mutual funds. (See Lower-end advisors lead rebound.

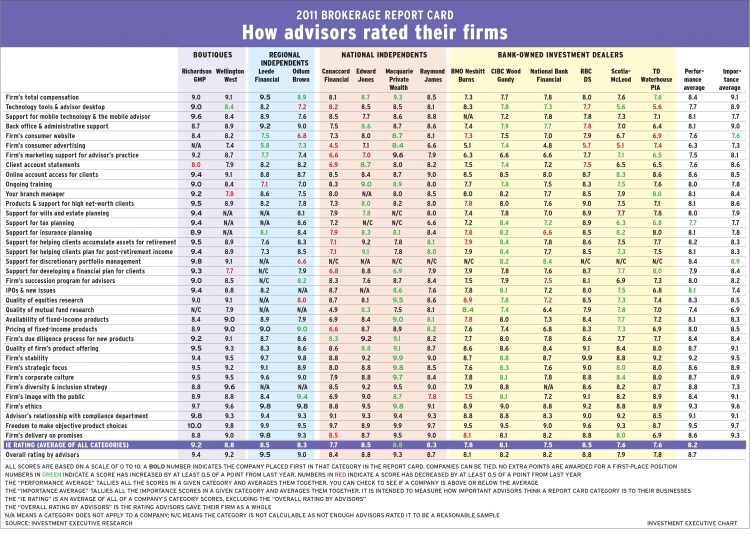

For many of the 629 advisors at 14 retail brokerages surveyed for this year’s Report Card by Investment Executive researchers Olivia Li, Ayah-Victoria McKhail and Laura Urmoneit, getting back up to speed has been the theme. (See table on page C4.)

That’s why two new categories that focus on advisors and firms getting back to building their businesses — “support for mobile technology and the mobile advisor” and “firm’s diversity and inclusion strategy” — were added to this year’s Report Card. (See stories on page C14.)

Advisors were asked to give these two new topics — as well as the 34 pre-existing categories — two ratings: one for their firm’s performance in the area; another to specify the importance of that category to their businesses. Ratings were based on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.”

Individual ratings were then averaged for each of the 36 categories, both firmwide and Report Card-wide. The “IE rating” indicates the average of all categories for each firm. An additional category, the “overall rating by advisors” is how advisors rated their firms out of 10, on average.

The ratings indicate both the level of advisors’ satisfaction with their firms and what advisors value most: “freedom to make objective product choices”; “firm’s ethics”; and “firm’s stability.” These three categories rank highest in importance year after year, regardless of the prevailing economic conditions.

That’s why an advisor in Alberta with Richardson GMP lauds his firm: “There’s the autonomy, support and ethics, which are most important because products come and go.”

Thus, advisors praise the firms that maintain their focus on stability through the good times and the bad. “We limit our products, we’re very cautious,” says an advisor in B.C. with Vancouver-based Odlum Brown Ltd. “We’re not trying to blow the doors off every year.”

Adds an advisor in the same province with Calgary-based Leede Financial Markets Inc. : “As we’re a small firm, the focus is on moderate but safe growth.”

The financial backing of a major bank also can provide a measure of comfort. Case in point: advisors with Toronto-based RBC Dominion Securities Inc. feel the parent bank’s brand speaks for itself. “It’s the big reason why clients come to us,” says a DS advisor in Ontario. “They feel confident that we’ll still be standing when times get tough.”

But it’s not just their firm’s stability that advisors value; many say that stability in leadership is just as important. “We’re financially stable, but leadership made a lot of mistakes,” says an advisor in Alberta with Toronto-based ScotiaMcLeod Inc. “We’re a weak follower, with poor execution at best.”

An advisor in Nova Scotia with Toronto-based BMO Nesbitt Burns Inc. shares similar sentiments: “I’m not concerned if the firm will go under, because it won’t. But I would prefer stronger leadership. It’s the same old dogs with newer barks each year.”

Another bank-owned firm, Toronto-based TD Waterhouse Private Investment Advice, faltered in one of the categories most important to advisors — freedom to make objective product choices. In fact, TD Waterhouse was the only bank-owned firm to receive a rating of less than 9.0 in the category. The reason? “They’re overly guarded on everything,” says a TD Waterhouse advisor in Ontario. “We’re usually the last firm on the Street to be able to get something that’s new and good.”@page_break@On the flip side, independent and boutique firms usually stand out regarding this topic — and this year is no exception. Says an advisor in Ontario with Winnipeg-based Wellington West Capital Inc. : “The individuality that they afford us, it’s critical.”

Adds an advisor in Ontario with Toronto-based Raymond James Ltd. : “You truly have the freedom to shop the market. That autonomy means a lot to me.”

Although some advisors at the independent firms were quick to point out that this is the difference that stands between them and the bank-owned investment dealers, the sentiment doesn’t always ring true. “It really depends on the style of [the advisors’] businesses,” says Richard Mills, co-head of Nesbitt’s private client division. “The ones who are portfolio managers would probably focus on our research; the ones who are fee-based would probably like our unique offerings, such as our unified managed accounts; some who are interested in running larger books would say our technology is what’s key.”

Independent and boutique firms don’t have proprietary products, so advisors with those firms can choose what to sell to their clients. But that autonomy is also a priority for those at some bank-owned firms. In fact, advisors with Montreal-based National Bank Financial Ltd. , gave the highest rating they conferred on their firm for the freedom to make objective product choices.

“We don’t have a specific layout in terms of asset mix,” says Gordon Gibson, NBF’s senior vice president and managing director. “We want [advisors] to generate enough to cover their costs and be profitable.”

However, the importance advisors allocate to such flexibility usually goes hand in hand with the firm’s ethics and its due diligence on new products.

“We have very high standards for compliance, and everyone knows that,” says Terry Hetherington, Raymond James’ executive vice president and head of its private client group. “It’s a big drawing card for people.”

It should come as no surprise, then, that the firms that perform best in these categories are the firms whose advisors are most satisfied. Case in point: Macquarie — which had the highest ratings in stability, strategic focus, corporate culture and ethics — not only saw its ratings increase by at least half a point in 16 categories, but it also saw its IE rating increase by the same margin. In fact, the firm is now among the highest rated in the survey. (See story on page C6.)

Many Macquarie advisors cite the firm’s new ownership and its commitment to advisors as the reason for their satisfaction. (In late 2009, Australia-based Macquarie Group purchased Blackmont Capital Inc.’s brokerage retail operations from Toronto-based CI Financial Corp.)

“We went to a 10.0 from a 4.0 [in stability],” says a Macquarie advisor in B.C., citing the rating he gave his firm in the category, “thanks to strong leadership.”

Says a colleague in Ontario: “They’ve spent a ton of money on infrastructure, research and training.”

“When we look back at the past year,” says Earl Evans, Macquarie’s CEO and head, “it was phenomenally successful and far exceeded [our expectations] — from an integration point of view, from a recruitment point of view and also from a profitability point of view. We are well ahead of where we thought we would be.”

Another firm whose advisors are very satisfied is Richardson GMP, as it received exclusive top scores in 17 of the categories — as well as the highest IE rating. Although the fact that its advisors are equity owners in the firm plays a part, the firm’s advi-sors cited “strength of management” when they were asked to rate the firm in a supplementary question, “Your firm’s support for you and your business in coming out of the recession.”

Says a Richardson GMP advisor in Alberta: “It’s easy to provide leadership when things are going well, but the amount of visibility we got from management and stakeholders during the 2008-10 period was what made this firm a differentiator.”

If communication was a pillar in coming out of the recession, advisors at other firms didn’t see much support in this subcategory. Advisors with ScotiaMcLeod, TD Waterhouse and NBF rated their firms lowest on this question.

“We had clients asking a lot of questions about where the market was heading,” says an NBF advisor in B.C. “But the firm was muted on the recession and [on] finding solutions.” IE