PAID CONTENT

Is it a challenge for your clients to meet their retirement income needs? As inflation continues to eat away at savings, your clients may find it difficult to access the cashflow they need to live their desired lifestyle. One advantage that retired Canadians possess is home ownership. In fact, almost 70% of Canadians own their own homes, according to RE/MAX. Accessing some of that home equity can help provide the cashflow your clients need.

Tapping into home equity

For clients who want to remain in their homes without having to downsize, a home equity line of credit (HELOC) and a reverse mortgage are two of the most popular ways to access their home equity.

Take out a HELOC. HELOC lenders typically allow homeowners to access up to 65% of the value of their homes. Your clients can borrow money as they need it (up to the agreed upon amount) and are only required to make minimum monthly interest payments on the amount they’ve taken out. Unlike a mortgage, there are no scheduled payments on the loan’s principal; borrowers can pay off the line of credit when it’s convenient for them. Rates are typically lower than for other lines of credit because the loan is secured by your client’s home.

Get a reverse mortgage. The other way for homeowners to access the equity in their homes is through a reverse mortgage. The CHIP Reverse Mortgage by HomeEquity Bank allows Canadian homeowners age 55+ to access up to 55% of their home’s value and turn it into tax-free cash without having to move or sell. There are no monthly mortgage payments to make while your clients live in their homes; the full amount only becomes due when they move or sell their home or through their estate if they pass away.

Homeowners can receive the funds as a lump sum or in regular monthly deposits. They can use the cash for any financial needs, including health care costs, home renos, debt consolidation or lifestyle expenses.

Advantages of a HELOC

Some of the key benefits of a HELOC include its makeup and convenience. A HELOC is a revolving line of credit, meaning that once your clients are approved for the line of credit, they can access cash as needed. And they don’t have to start making interest payments until they withdraw money from their line of credit account. Another advantage is that when you begin to pay down the principal, the amount you can borrow from a HELOC increases to your original credit limit, providing continued access to cashflow.

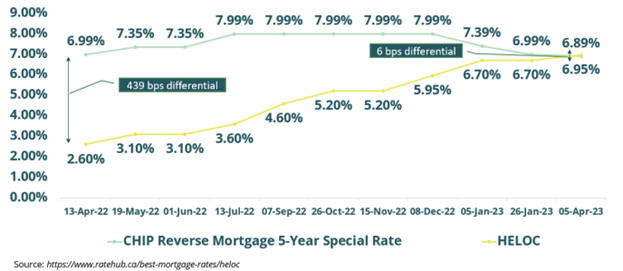

Until recently, perhaps the biggest advantage of a HELOC compared to a reverse mortgage was its lower interest rate. At the end of 2022, the average HELOC rate was about 2% less than the average reverse mortgage rate. However, the gap between the two rates has slimmed. In fact, the CHIP Reverse Mortgage 5-year Special Rate was slightly lower than the average HELOC rate in early April 2023.

Advantages of a reverse mortgage

One of the biggest advantages of the CHIP Reverse Mortgage is that there are no monthly mortgage payments – something that can make a big difference to your clients’ lives, especially in the current economic climate where cashflow is a concern. Here are some of the other benefits of the CHIP Reverse Mortgage.

- Simplified underwriting. Reverse mortgages are specifically designed for Canadians 55+ who are on a fixed income and may have difficulties qualifying for a HELOC.

- No need to requalify. A regular HELOC from a bank may subject the borrower to continuous credit score checks over time, affecting their ability to access a HELOC when needed.

- Death of a spouse does not impact a reverse mortgage. With a HELOC, the death of a spouse may trigger the bank to review the credit score of the surviving spouse.

- The reverse mortgage has fixed-term rate options and can be locked in for up to a five-year term. In contrast, the prime lending rate of a HELOC will float, as it is tied to the Bank of Canada’s prime rate. As we’ve seen recently, this can increase borrowing costs in a rising interest rate environment.

Another important factor to keep in mind is that HELOC debt can grow significantly over time if your clients don’t follow a regular payment plan.

Ready to help your clients tap into their home equity with the CHIP Reverse Mortgage? Visit us online to learn more, or contact a Business Development Manager today.