PAID CONTENT

While it is hard to ignore the increased attention on climate change over the past months and years, there is another story that has been emerging alongside it: the role of biodiversity in enabling climate mitigation and enhancing climate adaptation.

The connection between biodiversity and climate change mitigation and adaptation is driving increased focus and attention on identifying, measuring, and managing nature-based risks and solutions. The year 2021 has been a pivotal year not just for climate change but for biodiversity as well, and we expect this trend to continue.

Did you know?

- The role of biodiversity and functioning ecosystems in addressing climate change is included in the Paris Agreement and will be discussed at the upcoming United Nations Climate Change Conference (COP26) in November 2021.

- A new global biodiversity framework has been released by the United Nations Convention on Biological Diversity and is expected to be adopted at the UN Biodiversity Conference (CBD COP 15) CBD conference (COP15) in two parts, in October 2021 and April-May 2022.

- Biodiversity loss has been identified as a top 5 global risk for two years in a row by business leaders in the annual Global Risks Report 2021.1

- The G7 Environment and Climate ministers announced in May 2021 a shared commitment to protect 30% of land and 30% of oceans by 2030 (30×30 initiative).2

Why does biodiversity matter?

Biodiversity provides the foundation and infrastructure for nature; simply put, it is the variety of all life on Earth, in all of its forms and functions. It encompasses plants, bacteria, animals and humans. According to the World Economic Forum, more than half of the world’s GDP, around US$44 trillion, is moderately or highly dependent on nature and its services.3 These services upon which economies, markets, and society depend include food, pollination, water, clean air, medicines, fuel, flood protection, carbon sequestration, and a remarkable range of goods and services that we use on a daily basis.

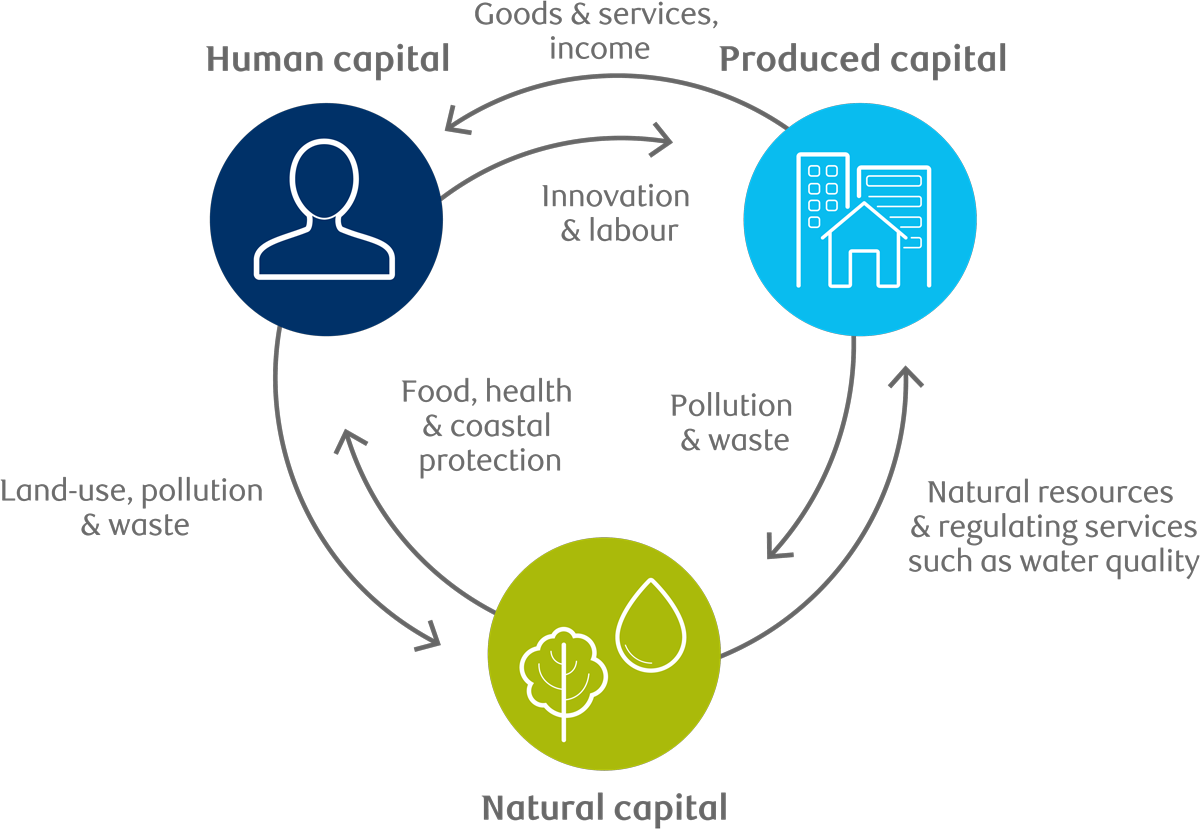

The value and contributions of nature and biodiversity to the economy is garnering increased attention from governments, economists, companies, and investors. In 2019, the U.K. government commissioned an independent global review on the economics of biodiversity with the resulting report (The Dasgupta Review4) published in February 2021. This report demonstrates in painstaking detail the direct and close connection between nature and economic prosperity. One of the report’s key insights lies in its description of “natural capital” – which includes all of the benefits and services provided by biodiversity – as an economic asset, much like produced or human capital (see diagram5). Just as the loss of human capital can lead to tangible financial loss, the report argues that the loss of natural capital has a material macroeconomic and financial impact to economies.

Threats to natural capital include food production, over exploitation of natural resources, pollution, population growth, and climate change. Agricultural expansion and intensification are the main causes of biodiversity loss, and are expected to increase as the demand for food and bioenergy grows alongside a rapidly growing population. The dynamics of trade and supply chains are also among the key contributors to biodiversity loss, as production often shifts from developed countries with environmental regulations in place, to developing countries, which are often home to higher biodiversity and fewer restrictions. Research suggests that 33% of biodiversity impacts in Central and South America and 26% in Africa are driven by consumption in other regions.6

How does biodiversity impact climate change and vice versa?

The connection between biodiversity and climate change goes both ways. Biodiversity contributes to and enhances climate mitigation and adaptation while climate change can lead to degradation and loss of land and marine biodiversity. This connection is the basis for growing emphasis on maintaining and restoring biodiversity and ecosystems as part of broader climate change targets and objectives.

| Impacts of biodiversity on climate change: | Impacts of climate change on biodiversity: |

|---|---|

|

• Biodiversity is important for carbon sequestration with carbon stored in trees, soil, peatlands and other terrestrial landmasses. • Marine ecosystems play an important role in absorbing emissions and heat, thereby helping to mitigate climate change. The ocean is estimated to have absorbed approximately 30% of human-made emissions.7 • Healthy and biodiverse ecosystems improve the ability to adapt and be resilient to natural disasters. E.g. floodplains and wetlands offer protection from floods; coral reefs, seagrass and mangroves buffer coastlines from waves and storms; forested slopes protect against landslides, and more. |

• Rising temperatures and changes in precipitation shift animal and plant habitats, growing seasons, and population size, leading to species die-off and extinctions. • Ocean warming and acidification affects fisheries, coral reefs and other marine life upon which businesses and communities depend. • Changing climate patterns lead to an increasing frequency of pest and disease outbreaks (e.g. Mountain Pine Beetle, Lyme disease). • Climate change affects the diversity of crops, yields and growing seasons with significant potential impacts on the agriculture sector and global food security.8 |

How does biodiversity impact companies and profits?

The profitability and long-term survival of a number of business sectors and activities depend directly on biodiverse and well-functioning ecosystems.9 For example, fresh water is critical to many businesses, including agriculture, mining, and food retailing; genetic diversity in nature is critical to the pharmaceutical industry; and intact wetlands and forests protect buildings and infrastructure from flooding, storms, and natural disasters.

Examples of biodiversity’s contribution to key industries include:

- Pollination services for agricultural industries: US$235-577 billion worth of annual global food production relies on the direct contributions of pollinators.10

- Forest products for the timber, pulp, and paper industries: Forest products account for US$247 billion in global trade exports.11

- Water supply for consumer goods industries: The garment and footwear industry is responsible for (and depends upon) around 20% of global wastewater use.12

- Coral reefs for ecotourism industries: Well-functioning coral reefs have generated US$36 billion in global tourism value per year.13

Biodiversity-related risks to businesses manifest themselves primarily through the dependency and impacts businesses have on biodiversity, described in more detail in the list below.14 These risks can affect value chains, increase the cost of inputs and raw materials, disrupt operations, result in legal fines or liabilities, and ultimately affect operations and profitability.

- Ecological risks are mainly operational risks associated with resource dependency, scarcity, and quality. They may be linked to increased raw material or resource costs, deteriorated supply chains, or disrupted business operations.

- Regulatory risks include restrictions on land and resource access, clean-up and compensation costs, procurement standards, and licensing and permitting procedures or moratoriums on new permits.

- Reputational risks relate to consumer preferences and expectations, which can lead to boycotts (e.g., palm oil, Bluefin tuna) and lost brand value.

- Market risks may arise due to changes in consumer preferences or new requirements, which impose additional risks to companies if they cannot be met.

Some industry organizations have suggested that biodiversity loss can also be viewed as a potential systemic risk.15 A systemic risk is a risk that a single event will trigger widespread impacts across financial markets, geographies, and society. The sub-prime mortgage crisis of 2008 and the COVID-19 pandemic are generally viewed as systemic risk events.

How do you measure and manage nature-related financial risks?

Approaches for measuring, monitoring, and managing natural capital and nature-related financial risks are the subject of increasing interest and attention. A significant step forward in these efforts was the establishment, in September 2020, of a new global Taskforce on Nature-Related Financial Disclosures (TNFD). The TNFD seeks to establish a framework for companies to measure and disclose their nature-related financial risks and opportunities, building off of the success of the Taskforce on Climate-Related Financial Disclosures (TCFD), released in June 2017. The TCFD recommendations are mandatory in the U.K. for financial and non-financial sectors of the economy by 2025, and have currently been applied voluntarily by 2,300+ companies from 88 countries.16

Despite this and other progress in defining nature-related financial risks, there is still much work to be done in both establishing effective metrics for measuring the financial impacts of nature-based risks and opportunities, and in collecting the required data to calculate these. For investors, considering the impact of material nature-related financial risks on the risk-return profile of investee companies, and the actions they are taking to manage and mitigate these risks, is an important part of the investment process.

What are nature-based solutions and what role do they play in climate change?

Nature-based solutions refer to any project or action that protects or restores natural ecosystems in order to address issues such as biodiversity loss, soil erosion, water scarcity, or forest degradation. Just as awareness of the connection between biodiversity and climate change has increased, so too has the focus on the role of nature-based solutions. According to the World Economic Forum, nature-based solutions could generate up to US$10.1 trillion in annual business value and create 395 million jobs by 2030.17

The role of nature in storing carbon and providing natural defences against floods, storms, and other disasters is essential to efforts to mitigate and adapt to climate change. As companies and countries seek to reduce greenhouse gas (GHG) emissions and meet their climate commitments, their goals will require enhanced investment and action to restore biodiversity and ecosystems. Given that agriculture, forestry, and land use alone account for approximately 23% of global GHG emissions,18 the potential impact from the protection, restoration, and sustainable use of forests, grasslands, wetlands is considerable.

Government collaboration and regulation is also starting to drive action on biodiversity and the advancement of nature-based solutions. The draft global biodiversity framework that is being considered at the Convention on Biodiversity will seek agreement from participating countries on the percentage of emissions reductions that each country will achieve through nature-based solutions. In the European Union (EU), regulations that were established to support the implementation of the European Green Deal include “the protection and restoration of biodiversity and ecosystems” as one of the six environmental objectives for sustainable economy activities under the EU Taxonomy.19

What is RBC GAM’s approach to integrating ESG?

At RBC Global Asset Management (RBC GAM), every investment team evaluates ESG factors as part of their investment decision-making process. This includes consideration of factors such as biodiversity and land use, natural resource use, water stress, sustainable forest management and other factors, when financially material to a sector or issuer. We also convey our views through thoughtful proxy voting and engagement, and provide details on how we vote proxies on issues in our Proxy Voting Guidelines. RBC GAM believes that being an active, engaged and responsible owner empowers us to enhance the long-term, risk-adjusted performance of our portfolios and is part of our fiduciary duty.

Read more on how we address climate-related risks or learn more about responsible investment.

1. The Global Risks Report 2021, World Economic Forum, January 2021

2. UK secures historic G7 commitments to tackle climate change and halt biodiversity loss by 2030, G7 UK 2021, May 2021

3. Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy, World Economic Forum, January 2020

4. The Economics of Biodiversity: The Dasgupta Review, Government of United Kingdom, February 2, 2021

5. The Economics of Biodiversity: The Dasgupta Review, Government of United Kingdom, February 2, 2021

6. Increasing impacts of land use on biodiversity and carbon sequestration driven by population and economic growth, Nature Ecology & Evolution volume 3, pages 628–637 (2019)

7. Oceans absorb about 1/3 of global CO2 emissions, but at what cost?, World Economic Forum, March 2019

8. UN/DESA. Policy Brief #102: Population, food security, nutrition and sustainable development, United Nations, April 2021

9. Biodiversity: Finance and the Economic and Business Case for Action, Prepared by the OECD for the French G7 Presidency and the G7 Environment Ministers’ Meeting, 5-6 May 2019

10. Assessment Report on Pollinators, Pollination and Food Production, IPBES, 2016

11. FAOSTA, Forestry database, 2017,

12. UN launches drive to highlight environmental cost of staying fashionable, United Nations, 2019

13. Mapping the global value and distribution of coral reef tourism, Marine Policy, Volume 82, 2017, Pages 104-113

14. Biodiversity: Finance and the Economic and Business Case for Action, Prepared by the OECD for the French G7 Presidency and the G7 Environment Ministers’ Meeting, 5-6 May 2019

15. Investor action on biodiversity: A discussion paper, UN PRI, September 2020

16. Taskforce on climate-related financial disclosures, accessed August 6, 2021

17. New Nature Economy Report II: The Future of Nature and Business, World Economic Forum, July 2020

18. IPCC Special Report on Climate Change, Desertification, Land Degradation, Sustainable Land Management, Food Security, and Greenhouse gas fluxes in Terrestrial Ecosystems, 2019

19. EU taxonomy for sustainable activities, European Commission

This document is provided by RBC Global Asset Management (RBC GAM) for informational purposes only and may not be reproduced, distributed or published without the written consent of RBC GAM or its affiliated entities listed herein. This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax, or other advice and such information should not be relied or acted upon for providing such advice. This document is not available for distribution to investors in jurisdictions where such distribution would be prohibited.

RBC GAM is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management Inc., RBC Global Asset Management (U.S.) Inc., RBC Global Asset Management (UK) Limited, RBC Global Asset Management (Asia) Limited, and BlueBay Asset Management LLP, which are separate, but affiliated subsidiaries of RBC.

In Canada, this document is provided by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. In the United States, this document is provided by RBC Global Asset Management (U.S.) Inc., a federally registered investment adviser. In Europe this document is provided by RBC Global Asset Management (UK) Limited, which is authorised and regulated by the UK Financial Conduct Authority. In Asia, this document is provided by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong.

Additional information about RBC GAM may be found at http://www.rbcgam.com.

This document has not been reviewed by, and is not registered with any securities or other regulatory authority, and may, where appropriate and permissible, be distributed by the above-listed entities in their respective jurisdictions.

Any investment and economic outlook information contained in this document has been compiled by RBC GAM from various sources. Information obtained from third parties is believed to be reliable, but no representation or warranty, express or implied, is made by RBC GAM, its affiliates or any other person as to its accuracy, completeness or correctness. RBC GAM and its affiliates assume no responsibility for any errors or omissions.

Opinions contained herein reflect the judgment and thought leadership of RBC GAM and are subject to change at any time. Such opinions are for informational purposes only and are not intended to be investment or financial advice and should not be relied or acted upon for providing such advice. RBC GAM does not undertake any obligation or responsibility to update such opinions.

RBC GAM reserves the right at any time and without notice to change, amend or cease publication of this information.

Past performance is not indicative of future results. With all investments there is a risk of loss of all or a portion of the amount invested. Where return estimates are shown, these are provided for illustrative purposes only and should not be construed as a prediction of returns; actual returns may be higher or lower than those shown and may vary substantially, especially over shorter time periods. It is not possible to invest directly in an index.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future results or events. Forward-looking statements are not guarantees of future performance or events and involve risks and uncertainties. Do not place undue reliance on these statements because actual results or events may differ materially from those described in such forward-looking statements as a result of various factors. Before making any investment decisions, we encourage you to consider all relevant factors carefully.

® / TM Trademark(s) of Royal Bank of Canada. Used under licence.

© RBC Global Asset Management Inc., 2021

Publication date: October 6, 2021