PAID CONTENT

Reflecting over the past three years, it’s starting to sink in that we are not a new dealer anymore. While we may not have disrupted the investment industry, we have found a way to compete outside of existing industry boundaries. For instance, we are neither a DIY online platform, nor are we a traditional dealer. When we started, we decided to differentiate and create a new model for advisors. As a result, we compete against both DIY online platforms and traditional financial institutions through innovative technology and low advisor fees.

In the past few years, there were new problems to solve in the industry resulting from innovative technology and Covid-19. For example, DIY platforms can help clients open accounts in 5 minutes. However, like DIY online platforms, our advisors can also onboard clients in a matter of minutes. Further, since we started in Covid, our advisor interface is fully digital, with the fastest KYC process in the country, ensuring client’s life changes can be immediately taken into consideration while managing their portfolio, and supervising accounts.

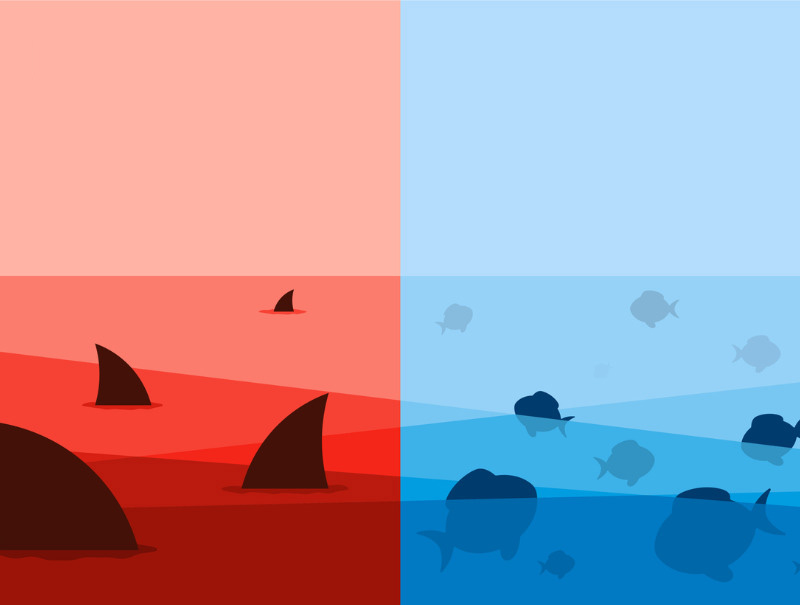

We’ve created a brand-new opportunity for advisors that want a smooth transition to an independent dealer that offers high service, low cost, both customization and flexibility, and full transparency regarding key operational and strategic issues. We believe this is a must-have to lead the next era of investment professionals. Let’s consider our millennial generation to reflect on how a blue ocean strategy is imperative.

Our online portal, which also includes an app available on Apple Apps and Google Play, gives clients easy to digest information, easy access to statements and puts a client’s account at their fingertips. However, it doesn’t overwhelm. Millennial advisors are familiar with the applications, and need to ensure both they, and their clients, don’t feel their accounts and related information is hard to get to. Simultaneously, they know what’s it’s like to be overwhelmed. In the portal, there are different performance views, different navigation options, but not so much information that the client is calling their advisor regularly because of too much or too confusing information.

Younger advisors are looking for both speed and access to information since they grew up around more technology with information accessible and answers they can easily find. As a dealer, we understand that prompt action, response time, and service need to align with that. Our account opening is the fastest in the business, trading is easy, and staff understand technology in a way that our younger advisor base needs. Younger advisors want to feel that they have both the feel of innovation, matched with the stability of proven systems. Millennial advisors have had enough experience watching Generation X ahead of them and their tried-and-true ways, while also witnessing how the Generation Z cohort create disruption with their mobilization of ideas and momentum driven by technology. Millennials are seeking the best of what’s been done before, while sampling parts of what future generations have yet to fully develop. As a result, we offer speed, access, flexibility and stability. Philosophically, we have focused on including these characteristics in delivering as an investment dealer.

At present, we talk with dozens of advisors at other dealers, week after week. While Boomer advisors are still seeking a strong dealer partnership, they are taking into consideration looking at ways to crystallize the value of their practice through succession planning, or they are less inclined to want to learn completely new systems. Valid considerations, which we address through our support and transition team. However, our millennial advisor conversations are focused on what the future has to offer – building their practice for the future. They are focused on testing out new technology, and getting a fast and sleek experience, without hesitating about the learning curve, after all, they are used to this pace in everyday life. They are eager to embrace the possibilities of working with us, because we want to see our future, and their future build together.

In summary, we have a keen eye out for the advisors embracing a new era. While change takes time, acknowledgement, exploration, and collaboration will take the millennial advisor to new heights – which is exactly what we provide.