PAID CONTENT

While the year 2020 will be remembered for many things, it will also be remembered as a year of action on climate change. In particular, the past year saw a rise in government and corporate commitments to net-zero emissions targets. This paper will explore why these commitments are being made now and how RBC Global Asset Management (RBC GAM) considers climate targets and other factors as part of the investment process.

What are net-zero emissions?

Achieving net-zero emissions refers to achieving balance between the greenhouse gas (GHG) emissions produced and those taken out of the atmosphere. The concept of net-zero emissions may also be referred to as climate or carbon neutrality.

Net-zero emissions does not mean no emissions. Under a net-zero policy, emissions can still be produced, as long as they are offset by processes or actions that reduce the emissions already in the atmosphere. Tree planting and carbon removal are two examples of such offsets.

Why do we need to reach net-zero emissions?

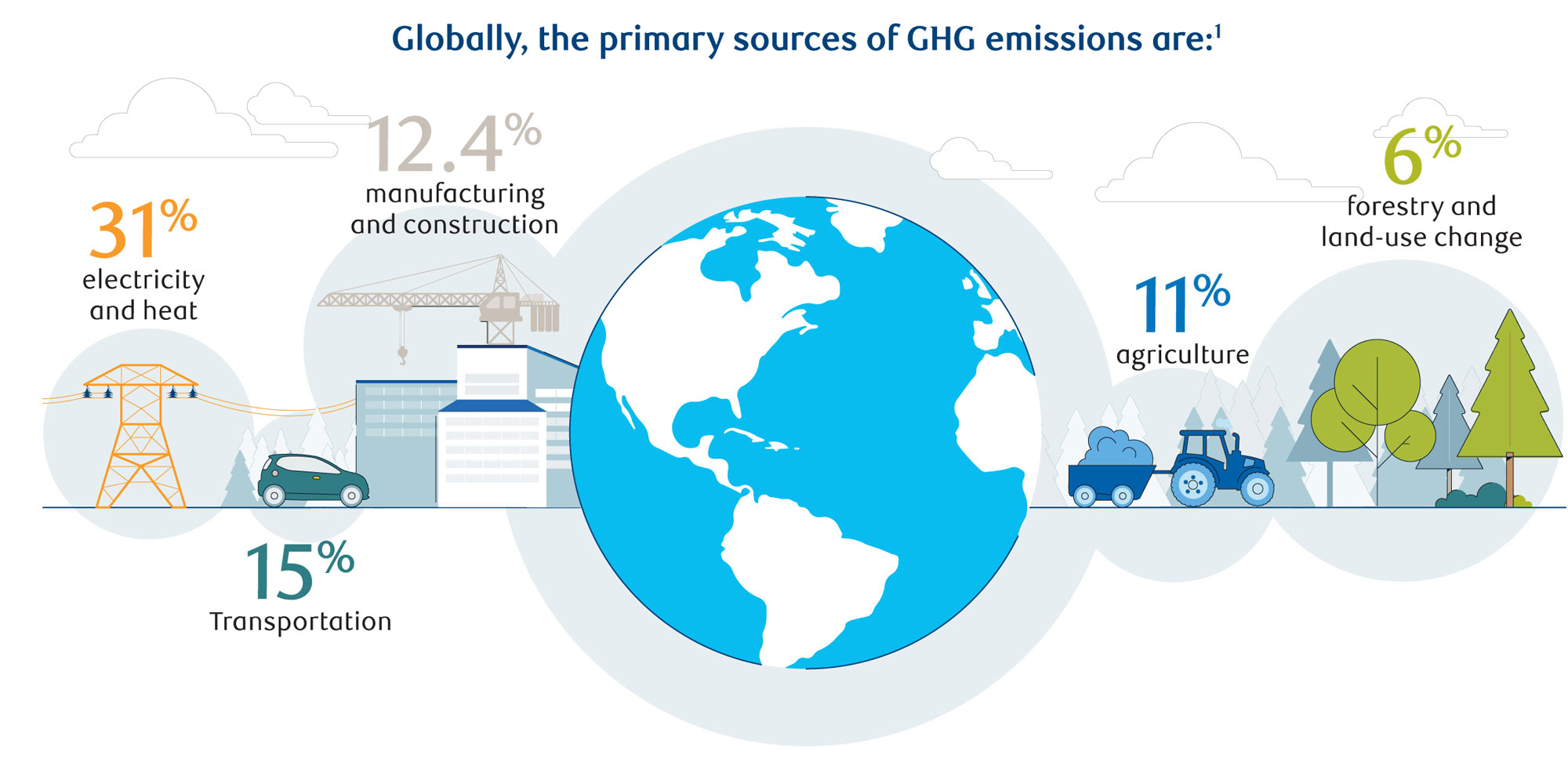

Human activities (such as the burning of fossil fuels) and land-use changes (such as deforestation) are responsible for the release of GHGs into the atmosphere. As GHG emissions accumulate, they get trapped, causing global average temperatures to increase. The result is climate change.

Global average temperatures have already increased by ~1oC since pre-industrial times and climate impacts are already being felt around the world – extreme weather events, droughts, floods and more. In 2018, the Intergovernmental Panel on Climate Change (IPCC) made clear that any increase in warming beyond 1.5oC by the end of the century would have significant implications. According to the IPCC, to achieve this goal, the world needs to halve carbon dioxide emissions by approximately 2030 and reach net-zero carbon emissions by 2050.

While the IPCC report was a catalyst in establishing the science and timeline behind net-zero emissions targets, it was the Paris Agreement’s ambition, set in 2015, to limit global warming to “well-below 2oC” that set the stage. With 197 signatories, the Paris Agreement acknowledged the need to achieve a balance between emissions produced and removed, and by setting a temperature target it launched deeper analysis of the emissions level required to limit global warming.

How do we get there?

In short, to minimize the impact of climate change, net emissions need to fall to zero by the middle of the century. This will require significant transformation across industries in order to reduce the amount of new carbon emissions. This will also require the removal of carbon that is already in the atmosphere, through the deployment of carbon removal technologies and activities that store carbon, such as tree planting or land-use management. It will also entail changes in policy, technology, and human behavior.

According to the IPCC’s report, limiting global warming to 1.5°C will require “rapid and far-reaching” transitions in land, energy, industry, buildings, transport, and cities.

In order to achieve net-zero emissions, de-carbonization will need to take place across all of these sectors.

In many sectors, technologies and strategies already exist that can bring emissions down – such as renewable power, energy storage, carbon capture and storage, and soil management for carbon sequestration. To meet global net-zero emissions targets, however, these will need to be rolled out on a broader scale, and new technologies and strategies will still be required. Some of the challenges that many sectors and technologies face is the intransigence of legacy systems (e.g., gasoline cars and related infrastructure, carbon-based heating and cooling systems), the misalignment of price signals in some markets (e.g., price on carbon), and the lack of cost competitiveness for incumbent technologies. To achieve net-zero emissions, most economies and sectors will also need to implement carbon removal technologies, nature-based solutions (e.g. restoring forests, boosting soil uptake) and carbon offsets. The need for carbon removal is due to the persistence of GHG emissions in the atmosphere for tens of hundreds of years after they are produced. It is also due to the reality that emissions will continue to be produced from both natural and human-based systems.

Who is making commitments to net-zero emissions?

Several factors have been driving the recent attention and focus on net-zero emissions by governments and companies. They include the rising financial and human costs of extreme weather events, legislative action on climate change in key jurisdictions (European Union, China), and changing corporate perspectives on the role of businesses to address climate change.

The past year has been marked by government action on climate change, with more than half of the global economy covered by net-zero commitments. Those making such pledges include the European Union, the U.K., Canada, and China. The European Union’s Climate Law was proposed in March 2020 and proposes a legally binding target of net-zero GHG emissions by 2050. Canada presented proposed legislation in November 2020, to establish interim targets and achieve net-zero emissions by 2050. China’s goal of reaching net-zero emissions by 2060 is notable given the country’s significant contribution to emissions (28% of global emission)2 and the effort that this will require (~90% reduction in emissions).3 It is also noteworthy due to the country’s current demand, investment, and production of low-carbon technologies. China leads the world in the production of solar panels, wind turbines, batteries and electric vehicles.4

As of early 2021, fourteen countries around the world have either passed or proposed legislation to establish net-zero emissions (most by 2050), while another fourteen have made a similar commitment in policy.5 According to the same report, an additional 100 countries are discussing net-zero targets, with plans to announce these in the coming year, in the lead-up to the annual United Nations Conference on Climate Change in November 2021.

The 197 signatories of 2015’s Paris Agreement committed to submitting updated and more ambitious climate targets, called Nationally Determined Contributions (NDCs), every five-years. The first step-up in commitments came due in 2020. Hours after President Biden’s inauguration, the U.S. confirmed it would re-enter the Paris Agreement, effective on February 19th 2021, requiring the U.S. to set its own targets.

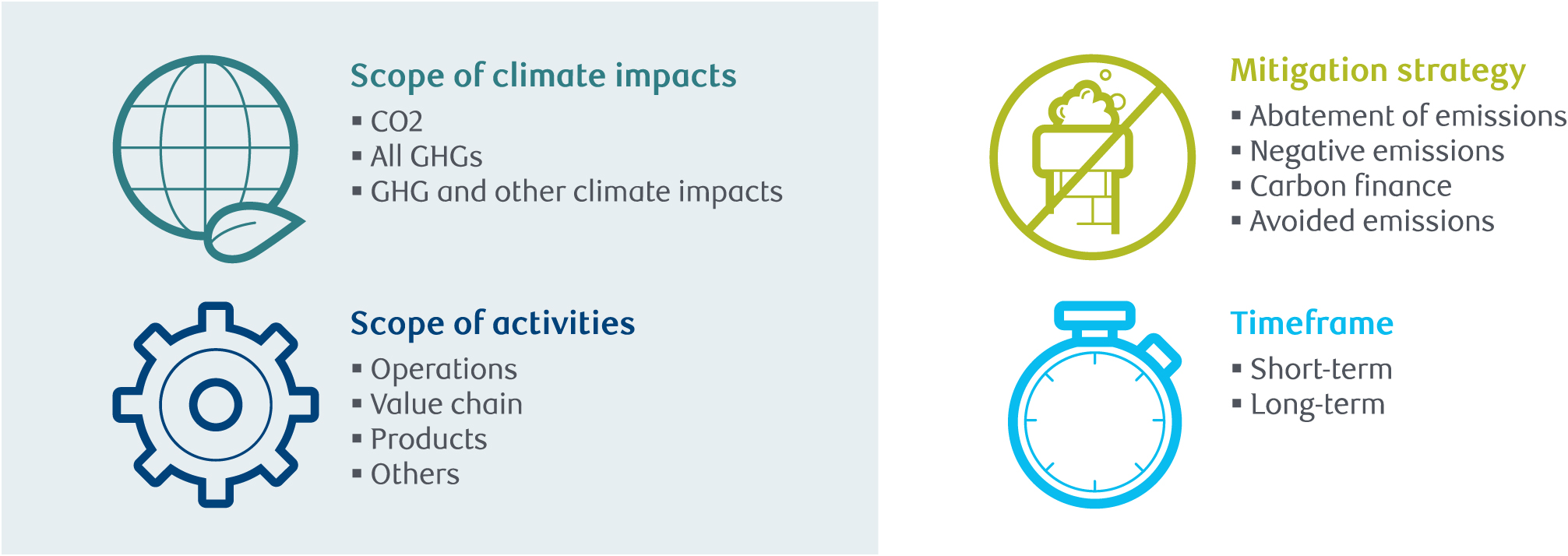

This past year also saw the number and scope of corporate net-zero emissions targets continue to grow. This includes commitments from BP,6 Ford Motor Company,7 Walmart,8 American Airlines,9 Apple,10 Microsoft,11 Cemex,12 and more. Corporate net-zero emissions targets typically vary across three key dimensions: the scope of climate impacts and activities that are captured by the target; the timeframe for achieving the target; and the strategy or approach for reaching net-zero (see Diagram).13 The ease and manner in which a given target can be met will depend in large part on how the company has defined their target in relation to these key dimensions. For example, since the bulk of emissions from energy companies are due to customer use of their products (i.e., Scope 3 emissions), meeting net-zero emissions targets that are inclusive of these emissions is challenging and will likely require greater emphasis on carbon removal technologies. For automobile manufacturers, while their emissions also come from the use of their products, most of the focus is on changing the type of product (e.g. electric vehicles) available.

Key dimensions in corporate net-zero targets

How does RBC GAM consider climate change in our investment process?

RBC GAM recognizes and supports the need to achieve a just transition to a low-carbon economy that boosts economic prosperity while safeguarding equality for all. We believe that considering the financial impacts of climate change in our investment approach is a material factor in enhancing long-term, risk-adjusted returns. It is for this reason that we consider within our investment process whether companies have effective governance structures, comprehensive climate targets, strategic integration of climate risks and opportunities, and transparent disclosure on how climate risks and opportunities are integrated into decision-making. We make investment decisions on a case-by-case basis and use stewardship activities to motivate companies to implement strategies and take actions that enable climate mitigation and adaptation.

We have long had a focus on responsible investment, which includes climate change. In 2020 we took the additional step of formalizing our strategic approach. Our approach to climate change is built upon the three pillars established in our approach to responsible investment and sets the foundation for our commitments and actions to address climate-related risks and opportunities.

- Fully integrated ESG: We integrate climate-related risks and opportunities in our investment process by using advanced climate data and analytics and climate scenario analysis as inputs to the decision-making process. This includes our assessment of an issuer’s climate change strategy, governance oversight, targets and performance.

- Active stewardship: Using proxy voting, direct engagement, and collaboration with like-minded investors, we encourage issuers and regulators to consider climate mitigation and adaptation in their activities. We seek to motivate corporate issuers to take action through effective governance oversight of climate change, establishment of targets and strategies to reduce GHG emissions, and disclosures on related activities and outcomes.

- Client-driven solutions and reporting: We also work with clients to develop solutions that meet their needs, and provide transparent and effective reporting on how we consider climate-related risks and opportunities as part of our investment process.

1. Global emissions, Centre for Climate and Energy Solutions, accessed November 26, 2020

2. China Says It Will Stop Releasing CO2 within 40 Years, Scientific American, September 2020

3. What China’s plan for net-zero emissions by 2060 means for the climate, The Guardian, October 5, 2020

4. What China’s plan for net-zero emissions by 2060 means for the climate, The Guardian, October 5, 2020

5. Energy and Climate Intelligence Unit, Net-zero emissions tracker, accessed February 4th, 2021

6. BP sets ambition for net zero by 2050, fundamentally changing organisation to deliver, February 12, 2020

7. Ford expands climate change goals, sets target to become carbon neutral by 2050, June 24, 2020

8. Walmart sets goal to become a regenerative company, September 21, 2020

9. American Airlines Publishes 2019-2020 ESG Report, October 15, 2020

10. Apple commits to be 100 percent carbon neutral for its supply chain and products by 2030, July 21, 2020

11. Microsoft will be carbon negative by 2030, January 16, 2020

12. Climate Action, February 19, 2020

13. Foundations for science-based net-zero target setting in the corporate sector, Science-based Targets Initiative, September 2020

This document is provided by RBC Global Asset Management (RBC GAM) for informational purposes only and may not be reproduced, distributed or published without the written consent of RBC GAM or its affiliated entities listed herein. This document does not constitute an offer or a solicitation to buy or to sell any security, product or service in any jurisdiction; nor is it intended to provide investment, financial, legal, accounting, tax, or other advice and such information should not be relied or acted upon for providing such advice. This document is not available for distribution to investors in jurisdictions where such distribution would be prohibited.

RBC GAM is the asset management division of Royal Bank of Canada (RBC) which includes RBC Global Asset Management Inc., RBC Global Asset Management (U.S.) Inc., RBC Global Asset Management (UK) Limited, RBC Global Asset Management (Asia) Limited, and BlueBay Asset Management LLP, which are separate, but affiliated subsidiaries of RBC.

In Canada, this document is provided by RBC Global Asset Management Inc. (including PH&N Institutional) which is regulated by each provincial and territorial securities commission with which it is registered. In the United States, this document is provided by RBC Global Asset Management (U.S.) Inc., a federally registered investment adviser. In Europe this document is provided by RBC Global Asset Management (UK) Limited, which is authorised and regulated by the UK Financial Conduct Authority. In Asia, this document is provided by RBC Global Asset Management (Asia) Limited, which is registered with the Securities and Futures Commission (SFC) in Hong Kong.

Additional information about RBC GAM may be found at http://www.rbcgam.com.

This document has not been reviewed by, and is not registered with any securities or other regulatory authority, and may, where appropriate and permissible, be distributed by the above-listed entities in their respective jurisdictions.

Any investment and economic outlook information contained in this document has been compiled by RBC GAM from various sources. Information obtained from third parties is believed to be reliable, but no representation or warranty, express or implied, is made by RBC GAM, its affiliates or any other person as to its accuracy, completeness or correctness. RBC GAM and its affiliates assume no responsibility for any errors or omissions.

Opinions contained herein reflect the judgment and thought leadership of RBC GAM and are subject to change at any time. Such opinions are for informational purposes only and are not intended to be investment or financial advice and should not be relied or acted upon for providing such advice. RBC GAM does not undertake any obligation or responsibility to update such opinions.

RBC GAM reserves the right at any time and without notice to change, amend or cease publication of this information.

Past performance is not indicative of future results. With all investments there is a risk of loss of all or a portion of the amount invested. Where return estimates are shown, these are provided for illustrative purposes only and should not be construed as a prediction of returns; actual returns may be higher or lower than those shown and may vary substantially, especially over shorter time periods. It is not possible to invest directly in an index.

Some of the statements contained in this document may be considered forward-looking statements which provide current expectations or forecasts of future results or events. Forward-looking statements are not guarantees of future performance or events and involve risks and uncertainties. Do not place undue reliance on these statements because actual results or events may differ materially from those described in such forward-looking statements as a result of various factors. Before making any investment decisions, we encourage you to consider all relevant factors carefully.

® / TM Trademark(s) of Royal Bank of Canada. Used under licence.

© RBC Global Asset Management Inc., 2021

Publication date: February 26, 2021