U.S. equities: Managers find bright spots amid the gloom

Part one of a three-part U.S. equity roundtable

- By: Sonita Horvitch

- February 16, 2016 November 9, 2019

- 10:20

Part one of a three-part U.S. equity roundtable

The financial services sector still battles its reputation as an unfriendly environment for women, especially at senior levels. But the tide is turning, with both…

Rebecca Horwood was only the second woman to be hired at Canada Life's main office in Toronto. Before that, she worked in the fashion industry.…

Erin Roy has excelled running her own business in a small town. Flexibility is key to her success, at work and at home

A seasoned executive says women need more confidence about balancing jobs and family

The prime minister set a shining example when he named his cabinet, 50% of whom are women. But while financial services regulators are taking steps…

A growing number of working women say that they dream of opening their own shop. Although that route can be a solid alternative on-ramp to…

The days when many clients wouldn't entrust a woman with their finances are long gone. And the growing wealth of women as a group can…

Several firms are taking steps to recruit and support women in financial advisory positions. Those initiatives are not just the right thing to do they…

While technology can seem like something that makes work ever-present, the adept use of mobile connections also can be the working mom's best friend. Just…

Managing a successful financial advisory career while raising a family is not easy. Three women offer advice on what works for them

In a once overwhelmingly male-dominated business, women are proving to possess the attributes of an ideal advisor

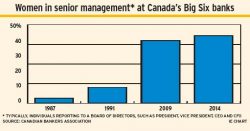

The Canadian banking industry has been at the leading edge in hiring and developing the careers of women. "It's great for business," says one executive

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds