Keeping it simple

Embrace indexing in its purest form. Three ETFs with broad market exposure should do the trick

- By: Dan Hallett

- April 24, 2016 November 9, 2019

- 23:00

Embrace indexing in its purest form. Three ETFs with broad market exposure should do the trick

Investment Executive senior reporter Jade Hemeon recently met with William McNabb, chairman and CEO of U.S.-based Vanguard Group Inc., for a conversation on ETFs. Vanguard…

U.S.-based firm aims to use its deep pockets and unique methods to expand in Canada

RBC started small with just a couple of ETFs. Now, it is moving ahead at full throttle.

The world of exchanged-traded funds (ETFs) in Canada just keeps getting larger and more complex. Assets under management in the industry have expanded quickly, reaching…

Pablo Fuchs, senior editor with Investment Executive, and Fiona Collie, staff writer, discuss the results of the 2016 Brokerage Report Card.

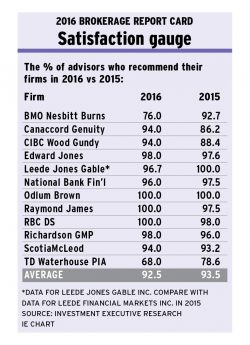

The brokerage business is going through profound change, and advisors are counting on their firms to help them navigate through the new twists and turns

As social media gains prominence as a marketing tool for advisors, access is more critical than ever. The firms that provide access to the online…

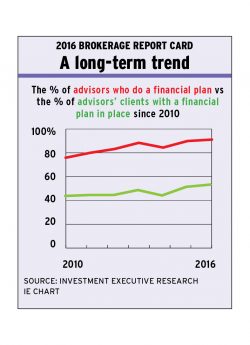

Advisors consider financial planning to be more important than ever, and more advisors are creating financial plans with their clients. However, challenges remain in getting…

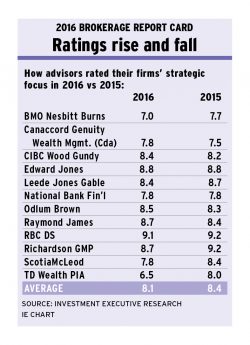

With strategic focus becoming more important for advisors, many are questioning their firm's efforts to attract and serve high net-worth clients while other advisors praise…

Quick response times, consistency, reliability and a client- and advisor-focused approach by back office staff are critical

Firms' greater focus on operating within a fee-based compensation model makes the transition easier for advisors

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds

The wrong side of history

Editorial