Gulf in corporate culture widens

The difference between how advisors with bank-owned dealers and their counterparts with independent firms feel about their corporate culture is more pronounced

- By: Jennifer Cheng

- April 28, 2017 November 9, 2019

- 00:04

The difference between how advisors with bank-owned dealers and their counterparts with independent firms feel about their corporate culture is more pronounced

A remarkable 71% of investment advisors support the CSA's proposal to introduce a best interest standard due to the need to elevate industry standards across…

There is growing sentiment that financial advice is increasingly available only to high net-worth investors

The enhanced performance and fee disclosure included in client account statements have yet to make the impact many advisors expected - although some advisors point…

These examples reveal some of the tactics that hackers use and the steep costs they can have for firms

Understanding the digital perils is the first step in protecting your practice

The introduction of restrictions to using the financial planner title as well a new statutory best interest standard will provide much needed clarity for clients

ETFs continue to capture the hearts and wallets of investors in Canada. Assets under management in the industry reached about $114 billion at the end…

Fixed income ETFs come in many flavours to help you clients handle rising rates

ETFs are attracting the interest - and the assets - of investors large and small

Sector ETFs allow investors to gain exposure to parts of the market that they believe could outperform

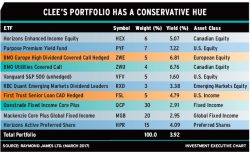

Zeroing in on your top investment bets

ETF specialists do their best in building sample portfolios

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds