For better or for worse

Spousal RRSPs can be a simple and effective tax-saving strategy for married and common-law couples. But these accounts are not for everyone - and have…

- By: donalee Moulton

- November 14, 2017 November 9, 2019

- 00:50

Spousal RRSPs can be a simple and effective tax-saving strategy for married and common-law couples. But these accounts are not for everyone - and have…

Clients seeking to access the value held in their homes during retirement often are faced with a difficult choice: should they sell and downsize, or…

With interest rates beginning to inch higher after ultra-low levels over the past several years, generating decent returns from a fixed-income portfolio remains a challenge

Women are very concerned about maintaining support for their families. They also are more likely than men to be single later in life and to…

Technology can help older clients manage both long-term assets and daily finances

Many clients rely on the Canada Pension Plan to form at least part of their guaranteed retirement income. But deciding when to take the benefit,…

Many affluent families worry that a large inheritance will rob their children of motivation. There also are concerns about how they will handle the money.…

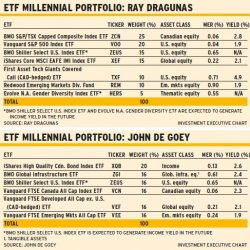

Millennial clients who begin a low-cost plan of saving for retirement now will reap the benefits over time. We asked two portfolio managers with ETF…

Kevin Wark explains the discussions you need to have with clients to protect them from longevity risk

The regulator will begin sending out questionnaires to some advisors who are deemed to be higher risk to determine if they need a more in-depth…

Infractions range from the use of blank forms signed in advance by the client to actively signing the client’s name

IFB Academy gives financial professionals the opportunity to earn CE credits by taking online courses

With investors growing cautious toward historically expensive risk assets, defensive sectors are attracting renewed capital inflows. Skyline breaks down the current environment and explains why…

Choosing the right investment management partners can help you make confident recommendations — even in unpredictable times.

Building Resilient Portfolios for a New Era

Have You Thought About What Season Your Practice is in?

HNW clients want guidance on the complex challenges that wealth can bring

Referrals are key to boosting your roster of HNW clients

The nature of private apartment funds means they can complement your client’s traditional investment portfolio.

Boosting advisor productivity in Canada through integration, innovation, and global best practices.

Head of Compliance for WFGIAC April Stadnek shares her perspective on the growing need for financial protection among Canadians, and how WFG supports its advisors…

A video breakdown of the 2025 Report Card on Banks themes

Paying the bills and growing their careers were priorities for the Big Six’s branch planners

But banks’ big mutual fund fees are, investor advocate says

Regulator requests monetary penalties, disgorgement, costs and market bans

Insurance advisors answered multiple-choice questions about their industry experience for this inaugural research

Housing costs are a growing worry, BMO index finds