Having a financial advisor helps. That’s the conclusion arising from recent research showing that high net-worth (HNW) clients who work with an advisor are much more likely to understand the importance of holding an appropriate level of risk within an investment portfolio compared with wealthy investors who don’t work with an advisor.

The research was conducted by Mississauga, Ont.-based Credo Consulting Inc. for the ongoing Financial Comfort Zone Study, a national consumer survey conducted in partnership with Montreal-based TC Media’s investment group. (TC Media publishes Investment Executive.)

The research also reveals that persuading HNW clients to take on more risk clearly isn’t always easy – for reasons that are understandable. As Sean Messing, first vice president and portfolio manager with CIBC Wood Gundy in Calgary, says: “A lot of clients take financial risk in their business; that’s where they take a dollar and try to grow it – by doing what they do well. When they take money out of their business or sell their business, then [the concern] is more about ‘I need to know this money is going to be OK for generations’.”

Still, the research also suggests that a significant percentage of HNW clients are open to hearing about the potential returns of higher-risk products. On average, HNW investors who worked with an advisor were 35% more likely to say that they strongly agreed with the statement: “I take financial risks” compared with surveyed Canadians, overall. In contrast, HNW Canadians who did not work with an advisor were half as likely to strongly agree with the same statement compared with those who worked with an advisor.

The current extended period of low returns on fixed-income is influencing HNW investors’ outlook regarding their portfolios. As a result, many HNW clients are more open to asset classes sometimes viewed as being riskier than public markets: alternative investments such as real estate, private equity and others.

“Interest rates have come down so far,” Messing says, “that high net-worth investors are almost being driven to take what is perceived to be more financial risk in order to get [an adequate] return to make sure that they don’t erode the money that they worked so hard to generate.”

Indeed, Credo’s research suggests that HNW Canadians, whether they work with an advisor or not, are more likely to invest in a broader array of products relative to less wealthy investors’ investments. Among the HNW investors who worked with an advisor and participated in Credo’s survey, 70% indicated that they owned individual stocks, 35% reported owning real estate investments and 8% reported owning private equity. In comparison, among survey participants with less than $1 million in investible assets, 21% reported owning individual stocks, 7% reported owning real estate investments and 1% reported owning private equity.

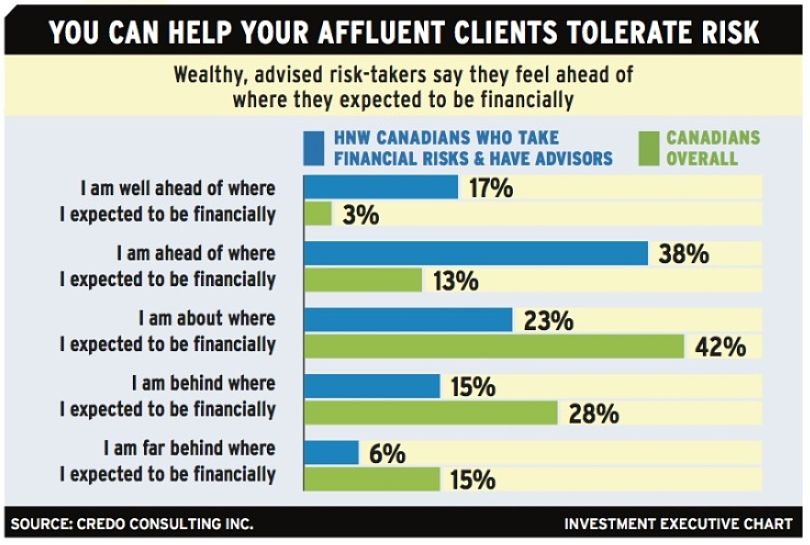

Wealthy investors who choose to work with advisors appear to be pleased with the results, according to Credo’s research. In fact, 55% of HNW risk-takers who work with an advisor indicated that they were ahead or well ahead of where they expected to be financially, as opposed to only 16% of Canadians who don’t work with an advisor.

Todd Degelman, vice chairman, national sales manager and co-founder of Wellington-Altus Private Wealth Inc. in Saskatoon, says he strives to understand the true risk tolerance levels of his HNW clients in order to calibrate their portfolios accordingly. Degelman makes a point of directing his clients’ attention to monthly performance figures during months when markets drop. Says Degelman: “That’s the only way I’ve found that you can help clients get comfortable with their risk tolerance. Otherwise, it’s all smoke and mirrors to them.”

David Serber, vice president, portfolio manager and wealth advisor with RBC Dominion Securities Inc. in Toronto, agrees that it is sometimes difficult for a client to gauge his or her own risk tolerance.

One difference Serber has noticed between mass affluent and HNW clients is their reaction when markets drop by 20% or more. Although many investors will panic and sell or be very tempted to sell, HNW clients – particularly those with $10 million-plus in investible assets – often have an easier time enduring such a drop because they aren’t as likely to feel that their standard of living is under threat.

“People think they have a certain risk tolerance, but it’s not a constant; it changes,” Serber says. “Part of my job is to keep people as far away from that point at which they would panic as possible, both now and all the way through.”

© 2017 Investment Executive. All rights reserved.