Editor’s note: John Gabriel is an ETF strategist with Morningstar, responsible for Canadian ETF research.

A few decades ago, retirees could reasonably hunker down in GICs and other safe investments and generate a livable income. But that formula has been turned on its head for today’s retirees. With cash and bond yields as low as they are, as well as the fact that many retirees could be drawing on their portfolios for a few decades or more, sticking with the safe stuff just isn’t going to cut it unless you have a very high level of wealth.

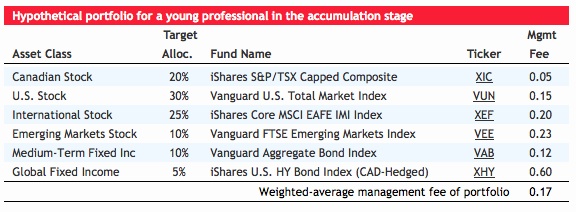

As such, I wanted to share a more aggressive hypothetical ETF portfolio for younger investors in the accumulation stage of their investment lifecycle. Investors should take advantage of their youth by taking more risk early on. Time is on your side for compounding wealth and recovering from any downturns. After all, nobody wants to find themselves in a position where they feel forced to take on excessive risks a couple years away from retirement. The earliest years in the investment lifecycle is the time to take on more risk in an effort to capture greater returns.

During this accumulation stage investors should have bigger appetites for capital appreciation — and the ability to stomach the higher volatility and the potential for outright losses that come along with a higher dose of stocks. If you’re nodding in agreement, then this relatively aggressive model ETF portfolio could be for you.

But first — why ETFs? For starters, ETFs are extremely low-cost and easily accessible to investors, and now many brokerage firms are allowing commission-free trades to boot. There’s also that small fact that a lot of active funds have underperformed their benchmark over time. But perhaps the key benefit of ETFs or index funds in retirement portfolios is the ability to set it and forget it. Using exchange-traded funds gives you a high degree of control over asset allocation. As a result, it’s easy to shift into more conservative investments over time, and you don’t have to worry about hidden risks because the portfolios are fully transparent.

Morningstar research also indicates that ETFs have the edge over traditional mutual funds when it comes to tax efficiency. Of course, there’s no avoiding taxes if you pocket an income or dividend distribution from an investment, whether it’s from an ETF or some other vehicle. But for those who are holding ETFs inside taxable accounts, our analysis of the data indicates that ETFs have done a very good job of limiting taxable capital gains — a better job, in fact, than conventional index mutual funds, which are quite tax-efficient in and of themselves.

Finally, because young investors tend to be interested in many other activities besides overseeing their portfolios, ETFs’ ease of use is a huge benefit. Nearly all ETFs track market benchmarks, so it’s easy to assemble a portfolio that precisely matches your target asset allocation and to rebalance it when it gets off track. Without active managers in the mix, you won’t have to worry about issues like style drift, manager changes, or the chance that an active bet will skew your portfolio in one direction or another. You can also readily assemble a well-diversified portfolio with very few individual ETFs — a key advantage if you’re looking to reduce your portfolio-monitoring time as well as the amount of paperwork flowing into your house.

With all of those benefits in mind, we put together some ETF-focused model portfolios for retirees and pre-retirees. This article showcases the aggressive version for younger investors and pre-retirees with a high risk tolerance. It can be an appropriate model for investors with time horizons of at least 20 years to retirement, for whom capital appreciation is the number one goal. (You can see our moderate ETF portfolio for investors in their peak earning years here, and our conservative ETF portfolio for retirees here.)

A total-return approach

This aggressive ETF portfolio is comprised mostly of stocks, with just a 15% stake in bonds. Truly aggressive pre-retirees — such as those whose living expenses will be fully covered with income from a pension or a business — should be fairly comfortable with such a hefty position in equities. Moreover, the long time horizon that younger investors near the beginning of their investment lifecycle enjoy allows them to be more tolerant to stock market volatility.

The key to being compensated for assuming greater equity risk is staying the course. That’s the beauty of growing and compounding wealth over the long-term. But those who succumb to emotions and sell when things look ugly and invest when things look rosy are bound for lacklustre returns, regardless of how many years away from retirement they are. Along with stomaching volatility and riding out downturns, the assumption is that investors will use a total-return approach and periodically shift some of their investment assets to more conservative investments, including fixed income and cash, as they approach retirement.

This portfolio’s fixed income allocation provides some stability and diversification benefits. I’ve used Vanguard Aggregate Bond Index VAB as a cheap way to access the investment-grade Canadian bond market. A small complimentary position in iShares U.S. High Yield Bond Index (CAD-Hedged) XHY can further improve diversification while bolstering the portfolio’s yield. The non-investment-grade corporate bond market is likely to endure some volatile periods, but over the long term the asset class has delivered exceptional risk-adjusted returns.

The main goal of the portfolio’s equity allocation is capital appreciation. For the four equity asset classes outlined in the portfolio I tried to go with the most comprehensive and lowest cost passive options available. I decided to use non-currency-hedged ETFs for the U.S. and international stock allocations.

Over the long term currency fluctuations tend to net out, and the additional costs and tracking error associated with currency hedging are just a drag on performance, which is why I prefer unhedged versions when available. Given the long investment horizon for this particular model portfolio, I’ve opted to avoid currency hedging, as there is plenty of time for mean reversion in foreign exchange markets to run its course.

The role of cash

While not included in the model portfolio, a cash position is often required in order to fulfill investors’ income needs. A cash stake can also improve the portfolio’s overall risk/return characteristics. The amount of cash you hold will be highly dependent on your personal situation, including your spending needs, whether you’re receiving income from other sources, and the size of your overall portfolio.

The traditional rule of thumb is for pre-retirees to keep at least six months’ worth of living expenses in cash. But given ultralow yields on cash, investors might also consider building a two-part short-term fund composed of true cash (money markets and GICs) as well as a high-quality short-term bond fund.

No such thing as “one-size-fits-all”

There is nothing scientific or written in stone here. Target allocations will obviously vary. Some investors may prefer further simplification by using global ETFs that allow them to reduce the number of funds required to build a broadly diversified portfolio. Others may prefer more granularity (thematic, sector, strategic beta, etc.) and rebalancing flexibility with their portfolios.