SPECIAL SPONSORED CONTENT

Gertjan van der Geer,

Senior Investment Manager

Thematic Equities Team

Pictet Asset Management SA

Countries across the globe are wrestling with the problem of shrinking water supplies.

Fast-growing metropolitan cities are looking to build taller and more advanced buildings that use proportionally less energy.

Developing-market nations with burgeoning urban populations are looking for solutions to help protect vital and strategic infrastructure.

What do these three issues have to do with constructing an investment portfolio? Perhaps everything, according to Gertjan van der Geer, Senior Investment Manager with the Thematic Equities Team at Pictet Asset Management SA. Along with Hans Peter Portner, van der Geer serves as Co-Lead Manager of Manulife’s Global Thematic Opportunities Fund, and as part of Pictet’s Thematic Equities Team, is a specialist in “thematic investing.”

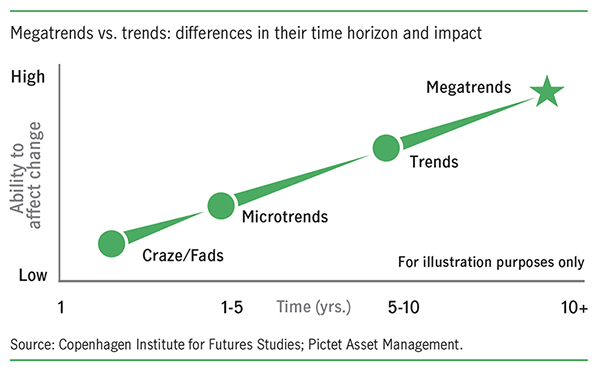

Thematic investing is an emerging investment philosophy that focuses on secular and structural changes going on across the world that are expected to shape future economic and social development. These changes are known as “megatrends.”

Megatrends versus trends

So, what’s the difference between a fad, a trend and a megatrend? How would you characterize environmental sustainability, cannabis and/or technological development? How do you invest in the future without becoming ensnared in the next big asset bubble?

It begins with distilling megatrends from mere trends and other shorter-term phenomena. The Copenhagen Institute for Futures Studies (“CIFS”) is a globally recognized authority on defining megatrends, and utilizes three key criteria to help identify when trends or fads are actually megatrends:

- A broad scope, with the potential to impact businesses, economies, cultures and personal lives globally.

- A long time horizon of at least 10 years.

- A significantly large potential effect, representing a seismic shift in economics, politics, technology and/or the environment.

“Megatrends have to be broad-based, and they have to be long term in nature,” says van der Geer. “Otherwise, the risk of being wrong is too high. Long-term, broad-based secular trends influence society and the economy for a long time. That’s what the CIFS is looking for when defining megatrends”.

For example, cannabis, which has attracted much attention recently, is too narrow to qualify as a megatrend under the CIFS criteria. The CIFS has identified 14 megatrends that are expected to drive long-term secular growth around the world over a decades-long time horizon:

- Sustainability

- Demographic development

- Focus on health

- Commercialization

- Economic growth

- Technology development

- Acceleration and complexity

- Globalization

- Democratization

- Individualization

- Immaterialization

- Polarization

- Knowledge and production society

- Network economy

Megatrends can be harnessed as powerful tools for investment managers. By analyzing these megatrends, skilled portfolio specialists can identify actionable investment strategies based on structural drivers of economic and market growth. These drivers transcend traditional economic cycles or equity market benchmarks. And this emerging investment style, which is still relatively new to Canada, is known as thematic investing.

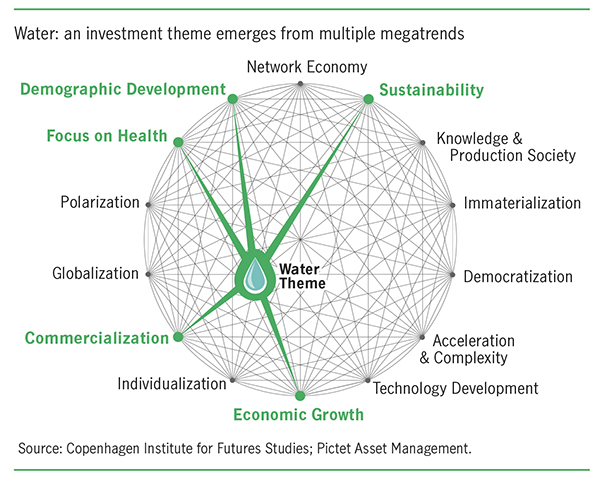

Water: how megatrend analysis creates an investment theme

Thematic investing that harnesses the power of megatrends represents a next-level approach to active equity investing, and can generate viable and diverse investment opportunities that reflect the extent of constant change of today’s world. For example, we can refer back to one of our earlier examples: the global water supply. Van der Geer cites water supply as one key theme that emerges from the combined analysis of multiple CIFS-defined megatrends. Water is a sustainability issue. And as one of the essential commodities needed for human life and agriculture, it is part of the focus on health megatrend as well. Additionally, as populations grow and governments look toward private enterprise for solutions for their water needs, the megatrends of demographic development, commercialization and economic growth come into play.

“What we do in thematic investing is combine several megatrends and see how they interact,” van der Geer explains. “Water is a fantastic and extremely long-term growth business. A lot of water supplies are state-controlled and require an enormous amount of investment, almost US$1 trillion a year. That’s a great driver for privatization.”

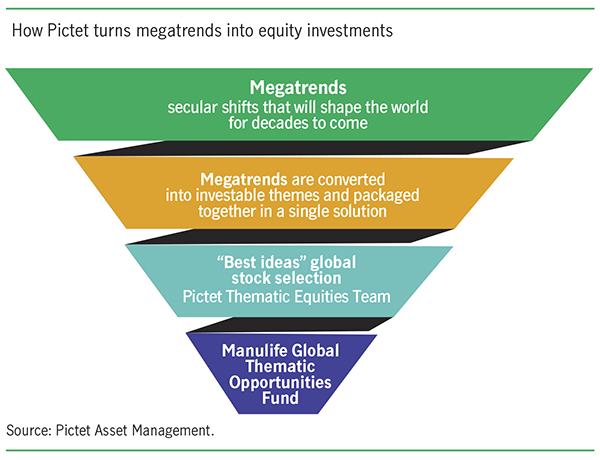

Turning megatrends and themes into investment portfolios

Although megatrends and thematic investing represent a game-changing way of looking at active management, many of the same basic principles of traditional investing still apply: careful defininition of an investment universe, diligent research and analysis of individual company fundamentals to arrive at stocks that represent alpha opportunities. Pictet’s Thematic Equities Team works in collaboration with the CIFS in leveraging the latter’s identified megatrends to identify specific investment themes, such as the previous example of the water theme, which is one of Pictet’s underlying thematic strategies. “If we combine some of these megatrends, we can see how they influence parts of the investable market,” explains van der Geer. “Once we determine a sufficiently large and identifiable universe that we believe can outperform the MSCI World Index, we’re well-positioned to launch an underlying thematic strategy.”

Including the water theme, Pictet’s investment specialists work on identifying equity opportunities in 15 thematic strategies. These thematic strategies represent a diverse array of current secular drivers of change – from robotics to smart cities to security to premium brands – yet are managed by Pictet using the same proven process:

- Construct an investment universe: A theme becomes investable when a concentrated investment universe of approximately 250 stocks can be derived representing companies that are positioned to benefit from that theme.

- Identify the “pure-play” businesses: Within this universe of stocks, Pictet assesses which ones offer the optimal level of “thematic purity,” or undiluted exposure to the given investment theme. For example, a large global conglomerate with some exposure to water will likely be considered less favourable than a mid-capitalization company specifically focused on this industry.

- Analyze individual stocks: Each of Pictet’s thematic strategies has a dedicated, specialized investment team that diligently researches and assesses the individual fundamentals of each potential investment to generate a high-conviction portfolio. Risk analysis plays a vital role in this step, which includes an assessment based on environmental, social and governance (“ESG”) criteria.

Specialized expertise is critically important in thematic investing, van der Geer points out. Using the past boom-to-bust cycle of solar power companies and other green energy plays as an example, thematic specialists are often best positioned to assess the genuine risks posed by factors such as subsidies, regulation and unsustainable valuations.

“We want the companies we invest in to be profitable. We’re focused on the thematic winners, meaning companies with sustainable competitive advantages,” says van der Geer.

“Growth is one thing. Profitable growth is another. We’re looking for companies that have a competitive moat around their business, and that can protect and even enhance their value. We think this is the best way to benefit from megatrends, and that this approach pays off in the form of alpha.”

While thematic investing is a potentially complex and still-emerging segment of the Canadian market, an effective way for Canadian investors to gain exposure to future market drivers is through a diversified and actively managed solution. Manulife Global Thematic Opportunities Fund, launched in Canada in late 2018, is sub-advised by Pictet and leverages the expertise of the firm’s dedicated thematic strategy teams. The result is a concentrated and high-conviction core portfolio of 50-70 stocks in a solution that is unconstrained by regions, sectors or the MSCI World Index. This is a portfolio that can deliver genuine diversification and uncorrelated long-term returns relative to major equity benchmarks.

“Thematic investing is about thinking long term, and looking at secular growth areas instead of fads,” says van der Geer. “We invest in themes that will support stock prices today and for decades to come.”

For more information about thematic investing, visit http://www.manulifeim.ca/gto or contact a Manulife sales representative at 1-888-588-7999.

Manulife Funds are managed by Manulife Investments, a division of Manulife Asset Management Limited. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts as well as the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Manulife, Manulife & Stylized M Design, Stylized M Design and Manulife Investments are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.