Faced with intensifying competition and ongoing regulatory reform, the mutual fund dealer business appears to be in the midst of a challenging period as financial advisors are seeing their average assets under management (AUM) and productivity decline overall — even as markets climb and mutual fund assets accumulate. However, these trends are being felt more acutely at some firms more than others.

This year, Investment Executive (IE) is looking under these headline trends to break down the data for each individual firm in the Dealers’ Report Card. At some firms, there’s pressure on advisors’ assets, which is, in turn, impacting their compensation negatively and also often affecting advisors’ views of their firms (as measured by their readiness to recommend their firm to another advisor).

However, this experience is not universal. Advisors at some firms are seeing their AUM and compensation rise. In addition, advisors at the more independent firms typically report the highest satisfaction levels — regardless of the size of the book or the trends in compensation.

View the slideshow to explore the average advisor data for each firm:

-

How the average advisor at each dealer is performing

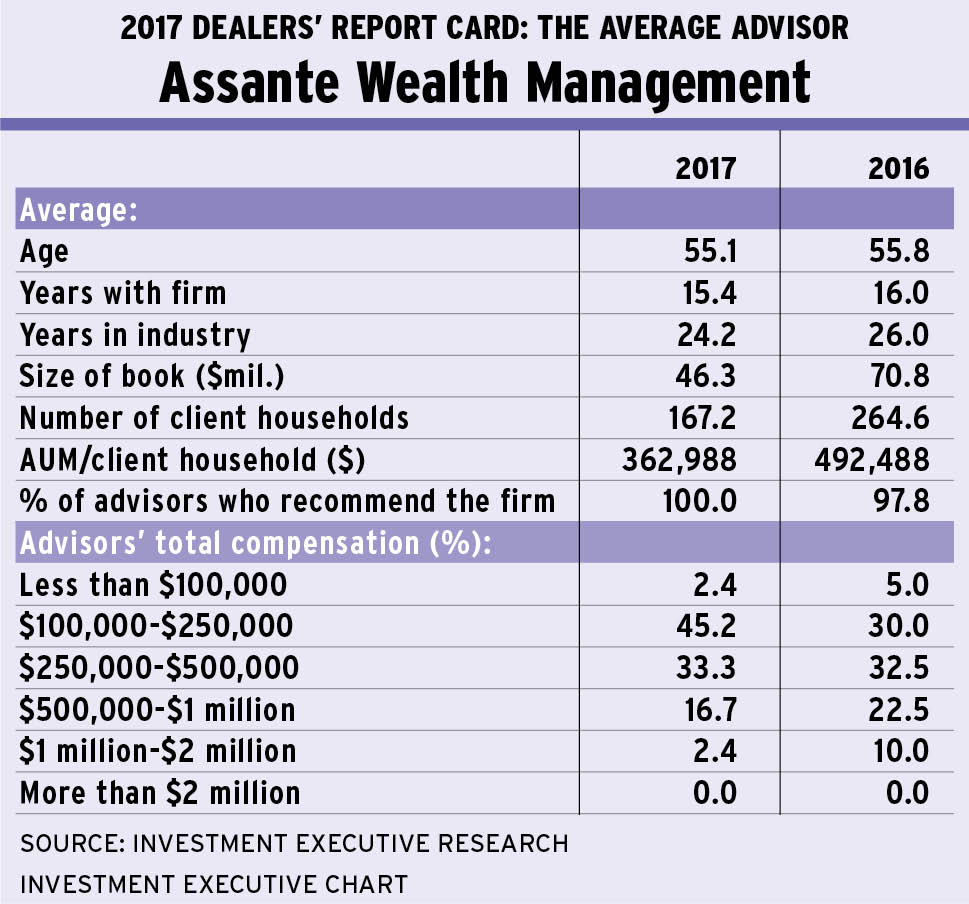

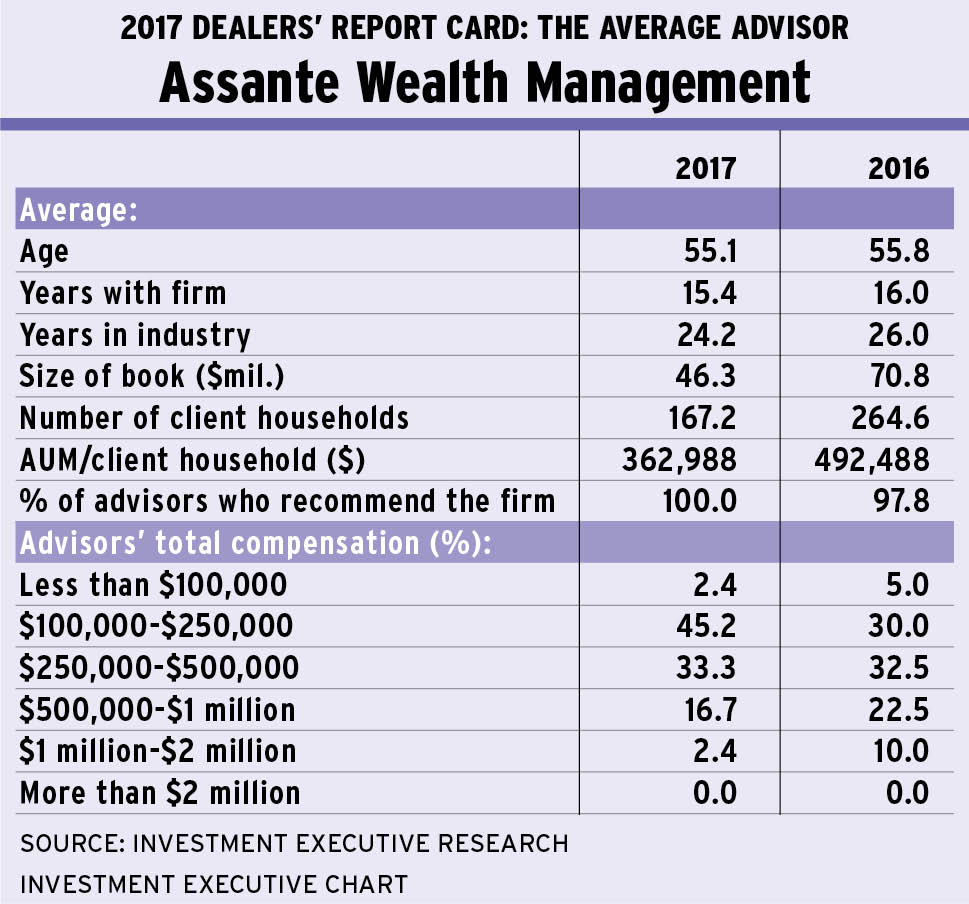

Assante Wealth Management

Assante advisors are some of the most experienced in the Report Card, averaging 55.1 years of age and 24.2 years in the business. But both of these demographic indicators are down from the previous year, indicating that the firm’s sales force is getting younger as some of the most experienced reps retire or otherwise leave the business. This, in turn, is reflected in a substantial drop in average AUM and productivity. Nevertheless, despite these trends, advisors’ satisfaction with Assante remains sky high as all of those surveyed would recommend their firm.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

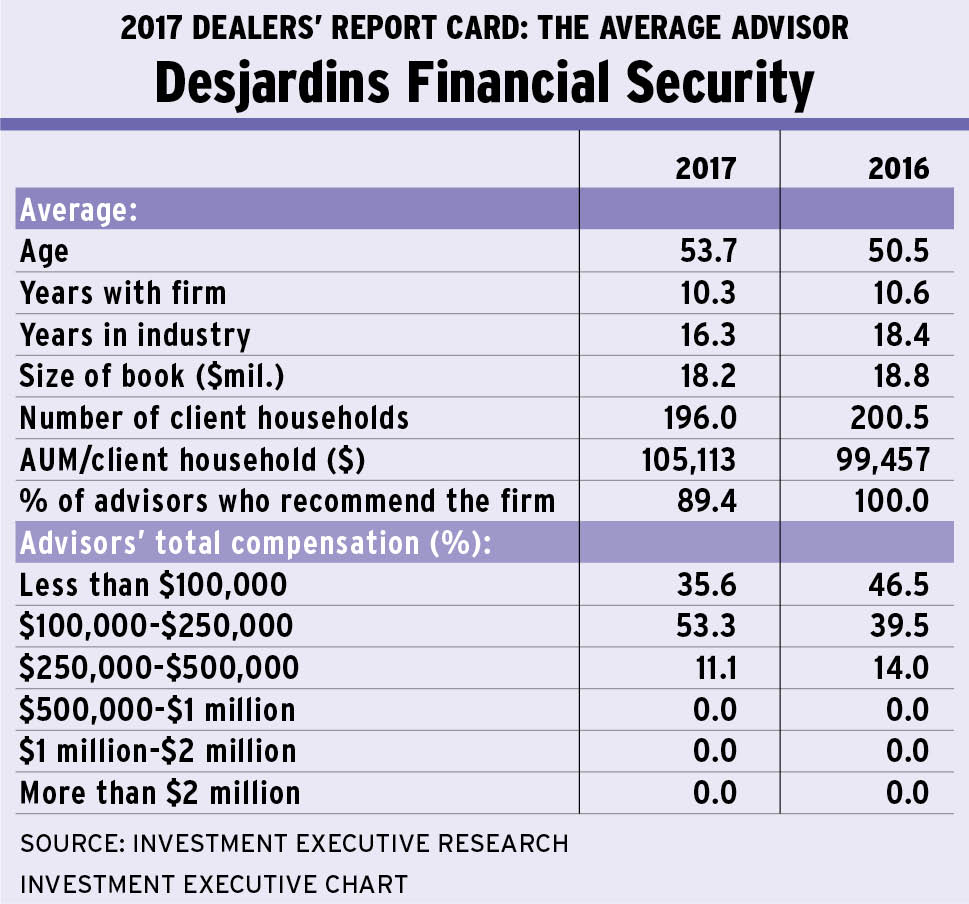

Desjardins Financial Security

Advisors with Desjardins have some of the smallest books in the Report Card with average AUM of just $18.2 million and AUM/client household at $105,113. These numbers are also fairly stable over the past year. Yet, it appears that Desjardins’ advisors’ compensation is trending up as 53.3% of the firm’s reps now report that they earn between $100,000 and $250,000 a year, up from 39.5% in last year’s survey.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

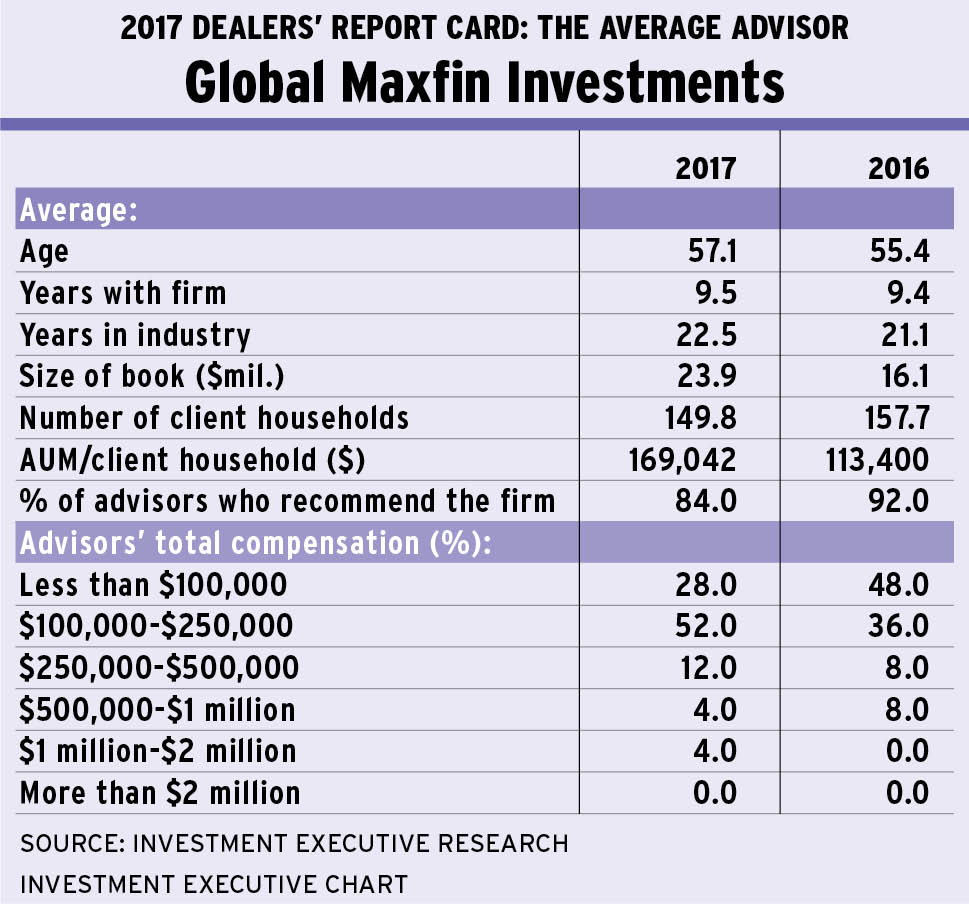

Global Maxfin Investments

Global Maxfin advisors are among those at one of the few firms reporting strong growth in AUM over the past year — even though they started from a relatively low level. Furthermore, the firm’s reps appear to be generating these AUM gains without adding to client numbers, which translates in to a healthy jump in average advisor productivity. These gains in AUM and productivity are also reflected in advisors’ compensation distribution, which has shifted to 52% earning between $100,000 and $250,000 from 48% who earned less than $100,000 a year in last year’s survey.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

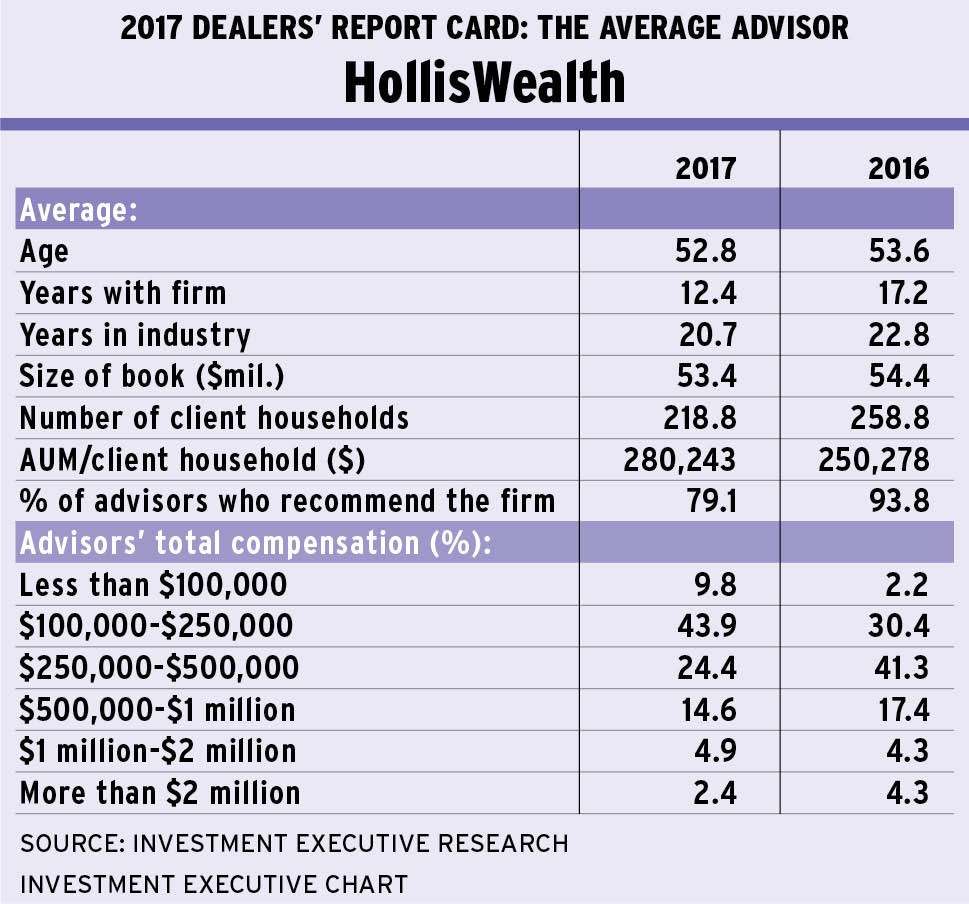

HollisWealth

HollisWealth is another firm that appears to be seeing some turnover in its salesforce, with the average age of advisors declining to 52.8 from 53.6 year-over-year. Industry experience and tenure with the firm are also down notably during this time. Amid this apparent shift in the composition of HollisWealth’s sales force, average AUM has also declined a little, suggesting that there has been some attrition among clients as well. As a result, the compensation distribution has shifted a bit toward the lower end while advisor satisfaction has also dropped.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

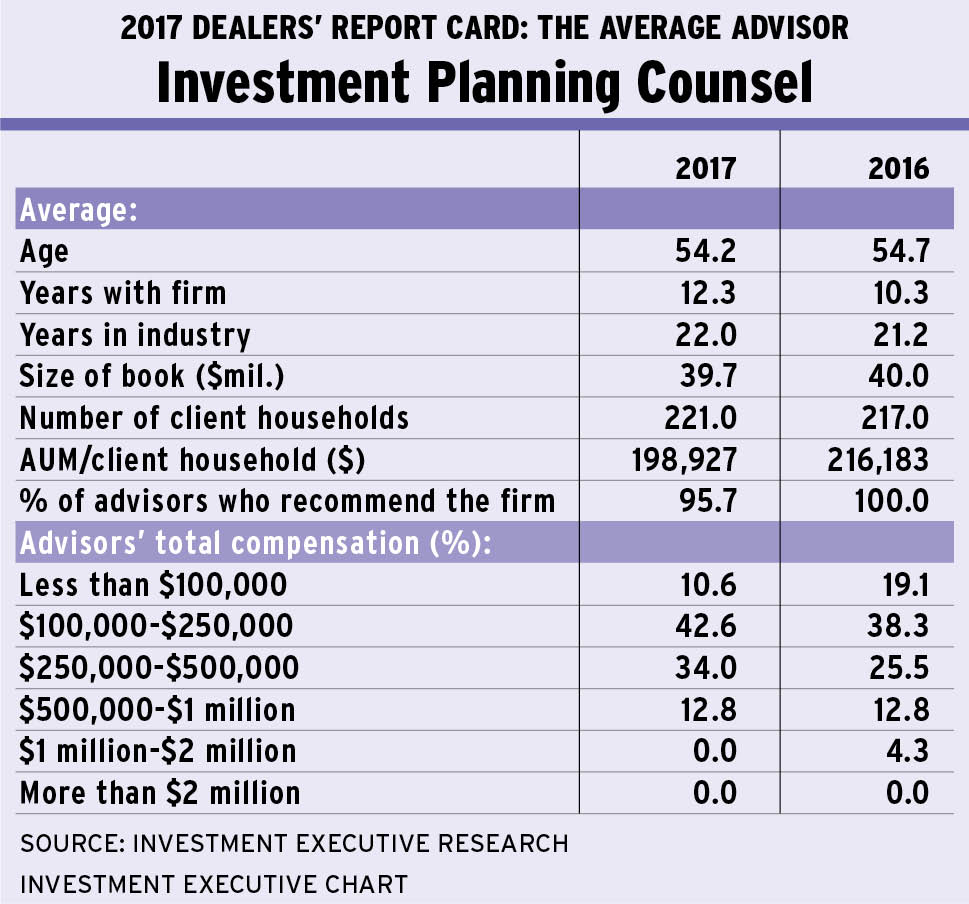

Investment Planning Counsel

Average AUM is more or less unchanged among IPC advisors while their productivity has ticked down a bit from the previous year. This apparent stagnation comes as the average age of the firm’s reps is down, indicating some turnover in the sales force. However, with compensation holding up, rep satisfaction remains relatively high as well.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

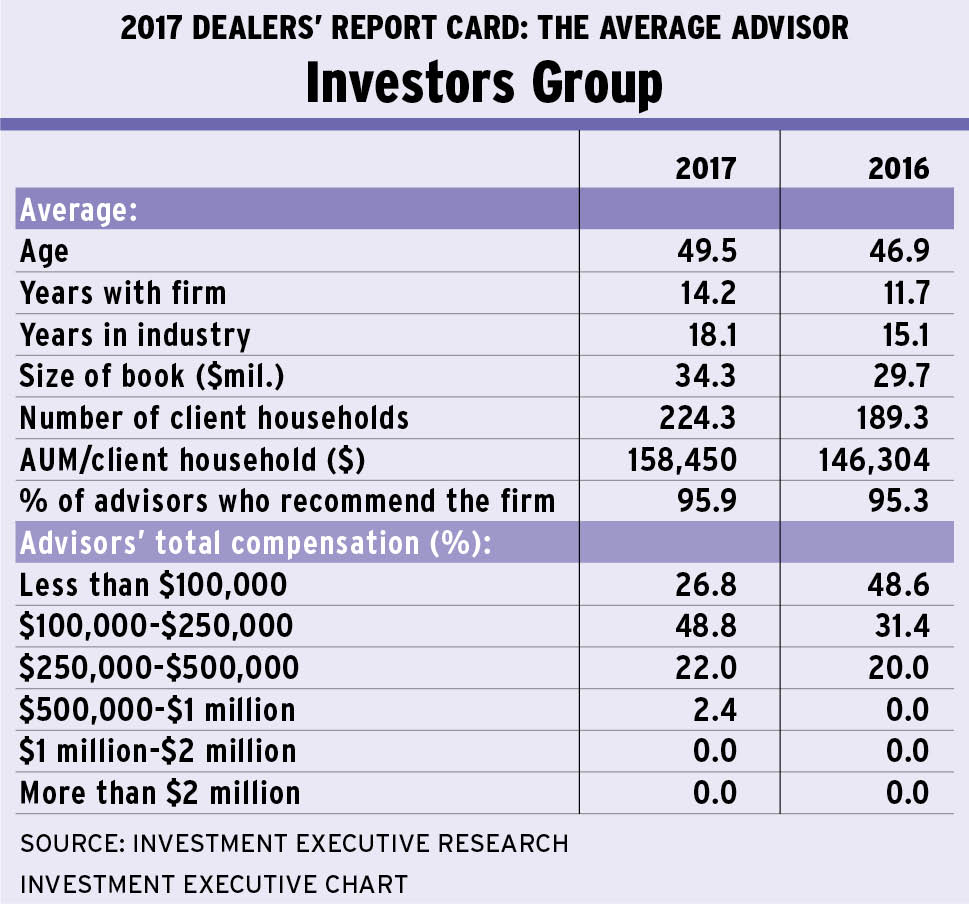

Investors Group

Investors Group boasts one of the youngest sales forces in the business, as it’s the only firm in the survey in which the average advisor is less than 50 years old. And at a time when many mutual fund dealers appear to be losing some of their more experienced reps, Investors Group is one of the few at which average age is still on the rise while industry experience is rising notably. It’s also one of the few firms at which reps have seen average AUM and productivity increase from a year ago.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

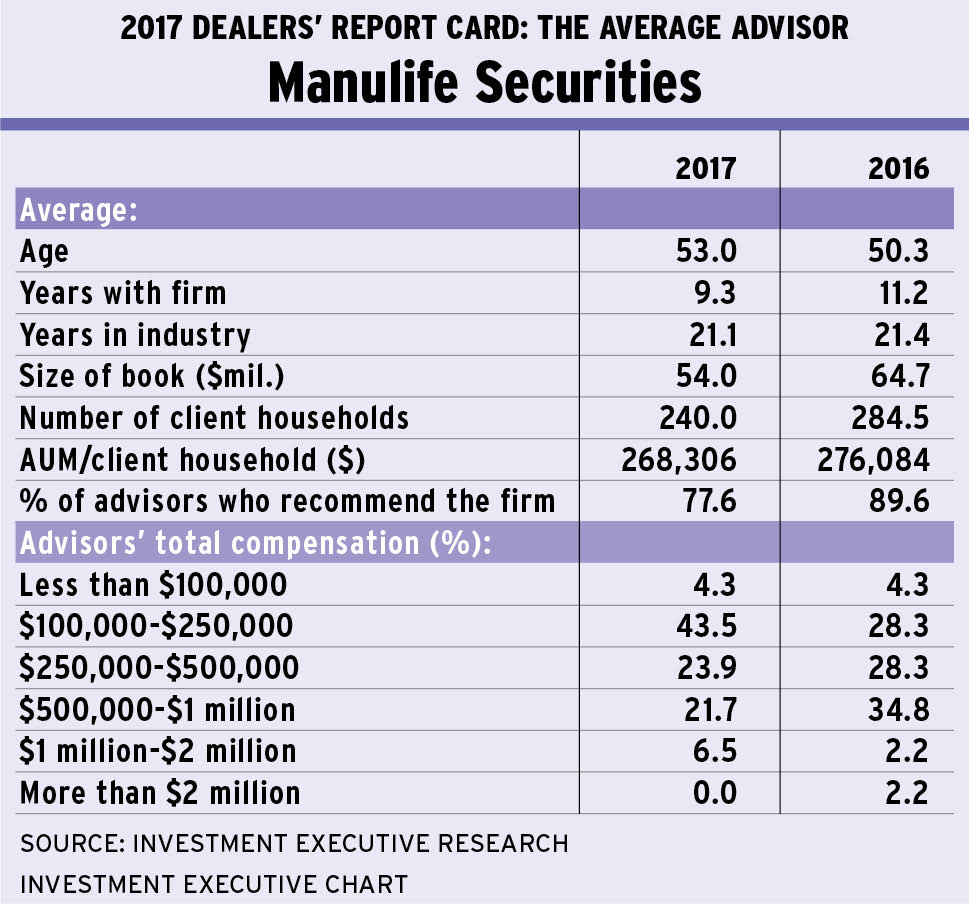

Manulife Securities

Although advisors with Manulife Securities enjoy some of the biggest books of business among the firms included in this Report Card, the trend in average AUM appears to be heading in the wrong direction. This year, Manulife Securities advisors report an average of $54 million in AUM, down significantly from $64.7 million in 2016. This, in combination with cuts to the payout grid that have resulted in the compensation distribution drifting downward, appears to be sparking some dissatisfaction as just 77.6% of reps say they would recommend the firm, down from almost 90% last year.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

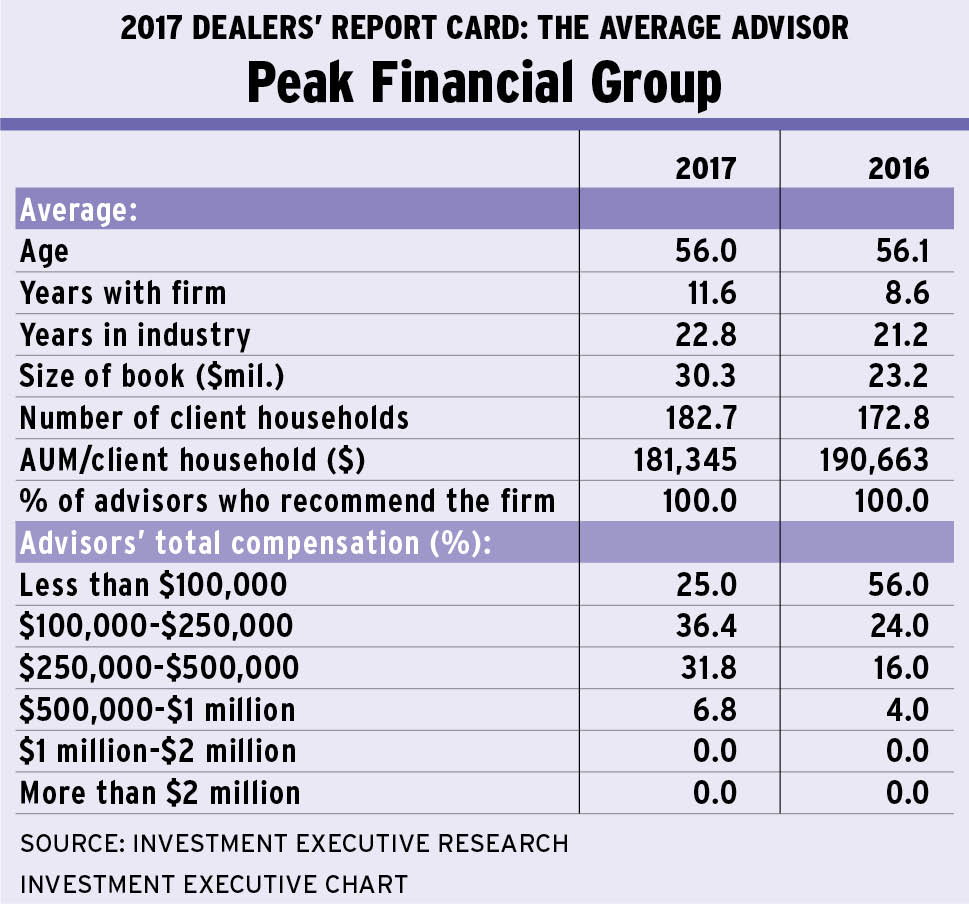

Peak Financial

Advisors with Peak Financial Group appear to be a pretty happy bunch as they were unanimous in recommending their firm. This is not surprising given that they’re also one of the few sales forces reporting strong growth in AUM, to $30.3 million this year from $23.2 million in last year’s survey. Compensation appears to be on the rise as well as just one-quarter of the firm’s reps now report earning less than $100,000 a year, which is down from 56% who said that they were in that income category in last year’s survey.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

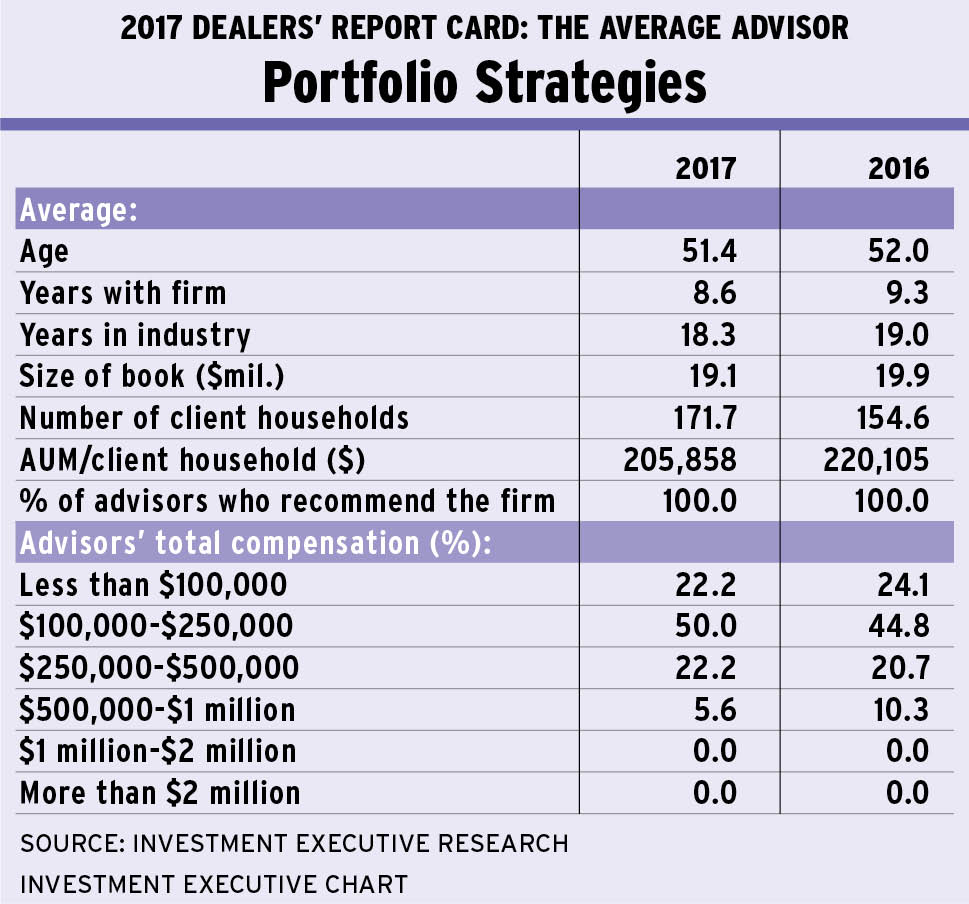

Portfolio Strategies

Portfolio Strategies advisors appear to be feeling some of the trends that are weighing on the mutual fund dealer channel, overall. Specifically, average age, industry experience and AUM among Portfolio Strategies advisors is down year-over-year. Yet, with compensation seemingly still robust, the firm’s reps report that they’re still quite happy as 100% said that they would recommend the firm.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

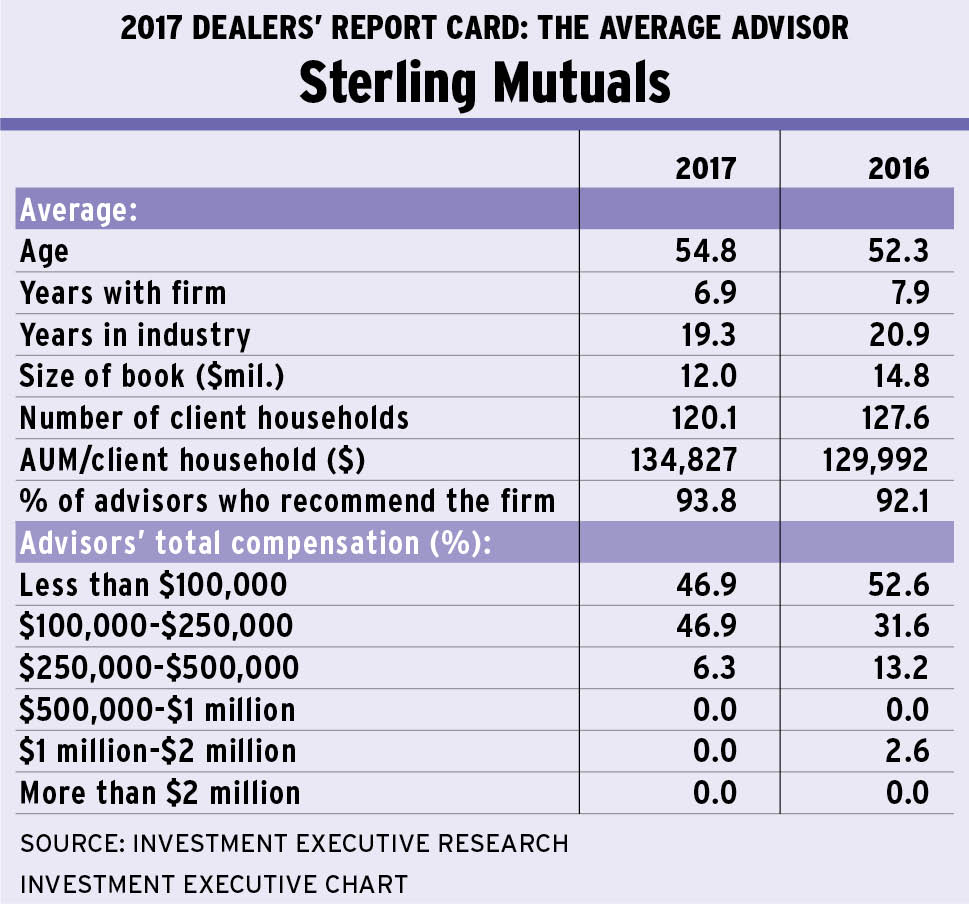

Sterling Mutuals

Advisors with Sterling Mutuals report having one of the smallest asset bases in the Report Card with average AUM of just $12 million. This is down from just $14.8 million in last year’s survey. Given these relatively small books, reps’ compensation is also heavily skewed to the lower end of the spectrum. That said, reps’ satisfaction with the firm remains high, as almost 94% would recommend the dealer.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive -

How the average advisor at each dealer is performing

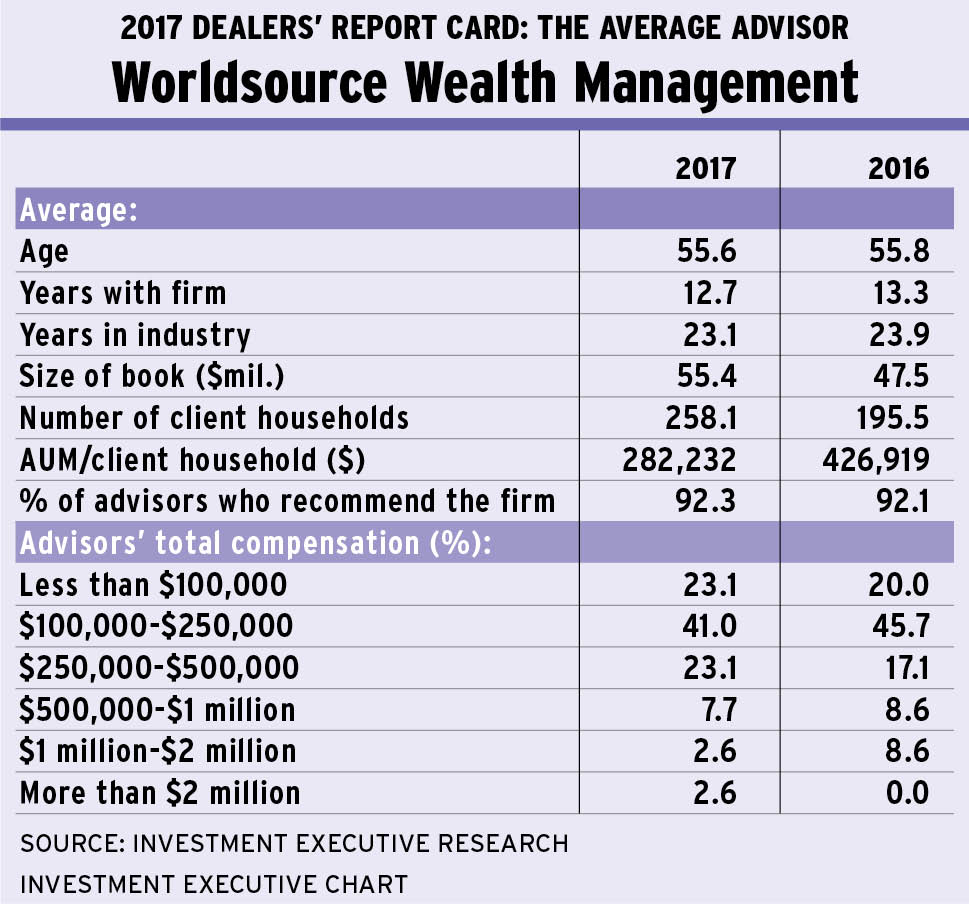

Worldsource Wealth Management

These advisors are among the most experienced in the Report Card as their average age is 55.6 years old and they have 23.1 years of experience in the business. In addition, they also boast some of the largest books of business and their AUM is growing as well, to $55.4 million from $47.5 million. The number of clients that they serve has also jumped significantly from the previous year, resulting in a decline in average productivity.Author: James Langton Source: Investment Executive Research Copyright: Investment Executive