The results of this year’s Dealers’ Report Card reveal that advisors have a higher opinion of their firm when they hear from their firm on a regular basis, have frequent opportunities to provide feedback and have a clear sense of the firm’s direction.

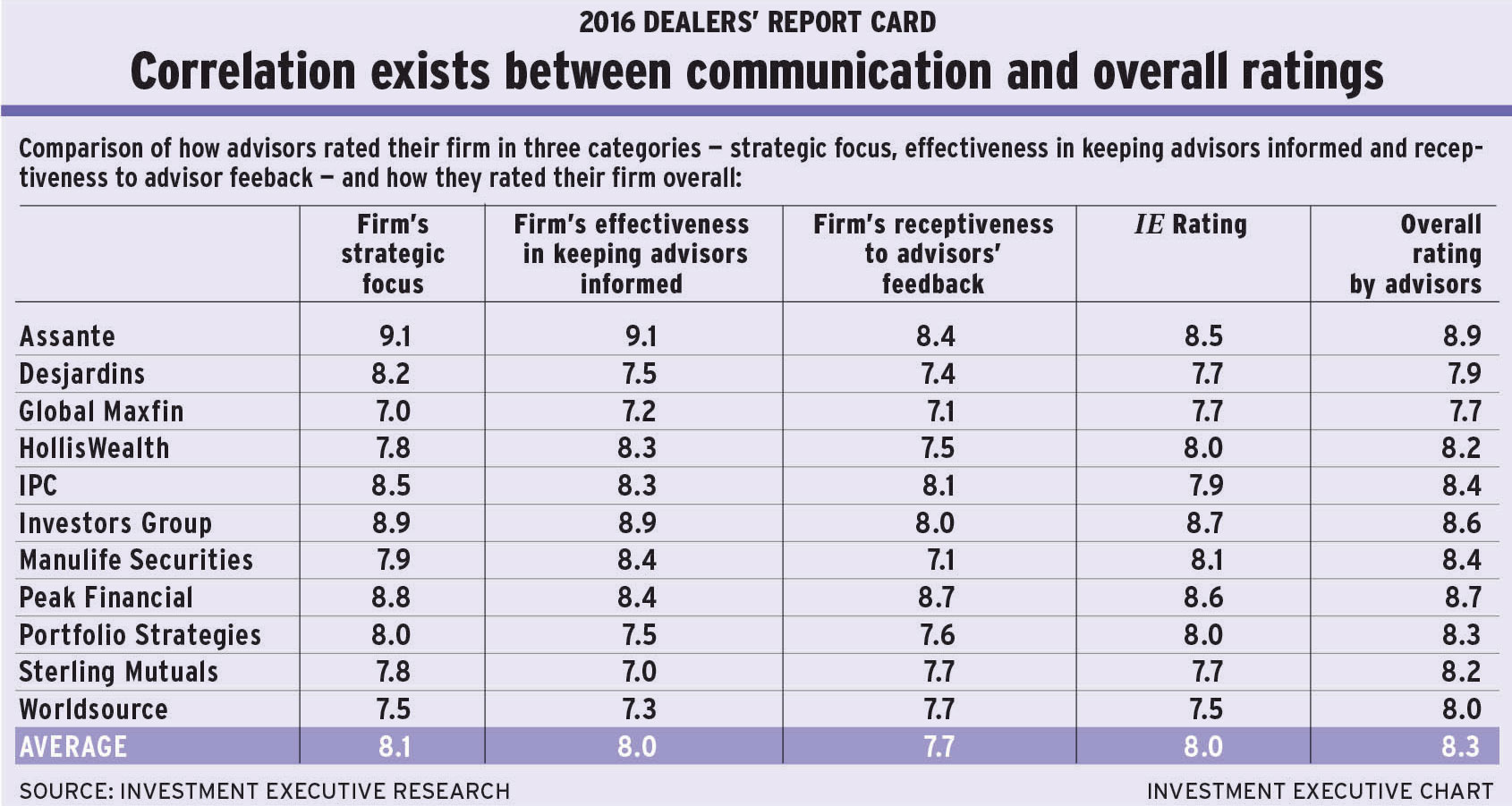

This is evident in the strong correlation among the performance ratings advisors gave their firm in three categories – “firm’s strategic focus,” “firm’s effectiveness in keeping advisors informed” and “firm’s receptiveness to advisor feedback”- and the firm’s “IE rating” and “overall rating by advisors.”

Case in point: advisors with Toronto-based Assante Wealth Management (Canada) Ltd. rated their firm highly in all these categories – as well as overall – and spoke highly of the firm’s strategic focus and how that strategy is communicated to them.

“We are extremely strong on leadership and strategic planning,” says an Assante advisor in Alberta.

Adds a colleague in Atlantic Canada: “They’re constantly telling us their plans.”

“We’ve always had a very open-door policy,” says Bob Dorrell, Assante’s senior vice president, distribution services. “It’s just part of our culture. Advisors can contact me or Steven Donald [Assante president] at any time.

Furthermore, Assante holds quarterly “road ahead” conference calls during which advisors are informed about where the firm is heading; advisors subsequently can share their thoughts with management. This type of two-way communication, Dorrell says, ensures the firm is always on the right track.

“We want to make sure we don’t have blinders on and we are not missing anything,” he says. “A lot of our initiatives are because of [advisor] feedback.”

An Assante advisor in British Columbia speaks highly of this approach: “They have a policy that if you have something to say, email or call and you’ll get a response. They are always asking to get input and they take what they’re given seriously.”

Similarly, advisors with Montreal-based Peak Financial Group were also very pleased with their firm’s communication efforts and its ability to listen to advisor feedback.

“We are part of the discussion,” says a Peak advisor in Ontario. “There are conference calls; they explain what they’re working on and the challenges in the industry. These conversations are very helpful.”

Communication has always been a priority for Peak, says Robert Frances, Peak’s chairman and CEO. He’s not surprised that this strategy has an impact on how other advisors think of their firm overall.

“I do think high [levels of] communication [between the firm and advisors] is important to [advisors’] overall satisfaction,” he says. “We have to provide good communication to make sure we know what advisors’ needs are, what we are doing well and where we need to improve.”

To do that, Peak has put unique measures in place to ensure lines of communication between the firm and its advisors are always open, Frances says: “Some of the things we’ve set up are [related to] accessibility. Senior management is always available to advisors. We try to make sure we meet every advisor across Canada at least once a year. We communicate through newsletters, social media and all kinds of ways for our advisors to know what’s going on.

“But it also goes the other way,” he adds. “Advisors are able to communicate their thoughts, their ideas or anything they’re living through to us.”

Advisors with Winnipeg-based Investors Group Inc. also lauded their firm for focusing on communicating with them in various ways and ensuring they are up to speed with the firm’s plans.

“I’ve spoken to people at head office and they are really receptive,” says an Investors Group advisor in Ontario.

“[The firm is] always looking at what’s coming down the pipeline and making sure we are prepared and well positioned,” adds a colleague in B.C.

Investors Group makes significant effort to ensure that advisors are brought up to speed through various ways, says Todd Asman, Investors Group’s senior vice president of products and financial planning. One approach involves focusing on communicating with the regional directors that manage each of the firm’s offices.

“We’ve put a higher level of responsibility in messaging with our regional directors in a more engaging format to be able to keep them up to speed, so that they can have the one-on-one conversations on the key, important topics that we need to communicate on [with advisors],” Asman says.

In addition, Investors Group’s communication efforts are evolving, he says. The firm has used videos during the past year to inform advisors about developments.

“We’ve started to use video communication and animated videos to talk about things that are changing,” he says. “It’s a much more engaging way of getting the message across.”

Keeping advisors informed is not only important, it makes for good business, Asman says: “It’s one of the important pieces of maintaining any good relationship over time. I don’t think it’s unique to the advisor world; it applies to every business. You need to communicate regularly and often. People need to be informed.”

It’s no surprise, then, that advisors have a negative perception overall of their firm when they feel their dealer is not making an effort to communicate or share its strategic direction with advisors.

For example, advisors with Richmond Hill, Ont.-based Global Maxfin Investments Inc. believe their firm’s performance is mediocre in matters related to communication and strategic focus. As a result, the firm received one of the lowest IE ratings and overall ratings by advisors.

“[Management] doesn’t focus on informing us,” says a Global Maxfin advisor in Ontario. “It’s not something they do.”

“I don’t have a clue what they’re focusing on,” adds a Global Maxfin advisor in B.C. “That’s been poorly communicated.”

Advisors with Lévis, Que.-based Desjardins Financial Security Independent Network expressed similar concerns.

“Information is usually delayed unless it’s a regulatory issue,” says a Desjardins advisor in Ontario. “It’s not really communicated widely. It would help to be more open and know what’s going on within the corporation.”

In addition, Desjardins advisors mentioned that in the few opportunities they’ve had to give feedback, not much was done in response.

“Feedback is taken, but I don’t know if anything is done with it,” says a Desjardins advisor in Ontario.

Adds a colleague in the same province: “There is a council available for feedback, but they don’t always follow through.”

© 2016 Investment Executive. All rights reserved.