Investment advisors surveyed for this year’s Brokerage Report Card remain dissatisfied, in general, with their compensation levels. These advisors said that their brokerage firms keep tinkering with pay structures and grids in ways that result in advisors receiving a smaller slice of the compensation pie.

“They’re always trimming margins off somewhere,” says an advisor in Ontario with Toronto-based BMO Nesbitt Burns Inc.

Adds an advisor in British Columbia with Toronto-based CIBC Wood Gundy: “Advisors are getting squeezed, and that’s just the phenomenon within the industry.”

Overall, advisors gave their firms an overall average performance rating of 8.1 in the “firm’s total compensation” category this year, down marginally from 8.2 last year. At the same time, advisors gave compensation an overall average importance rating of 9.1, equal to last year’s rating.

Thus, the “satisfaction gap,” or difference, between the two categories is a full point – the fourth-highest such gap in the Report Card this year, meaning that firms are failing to live up to advisors’ expectations.

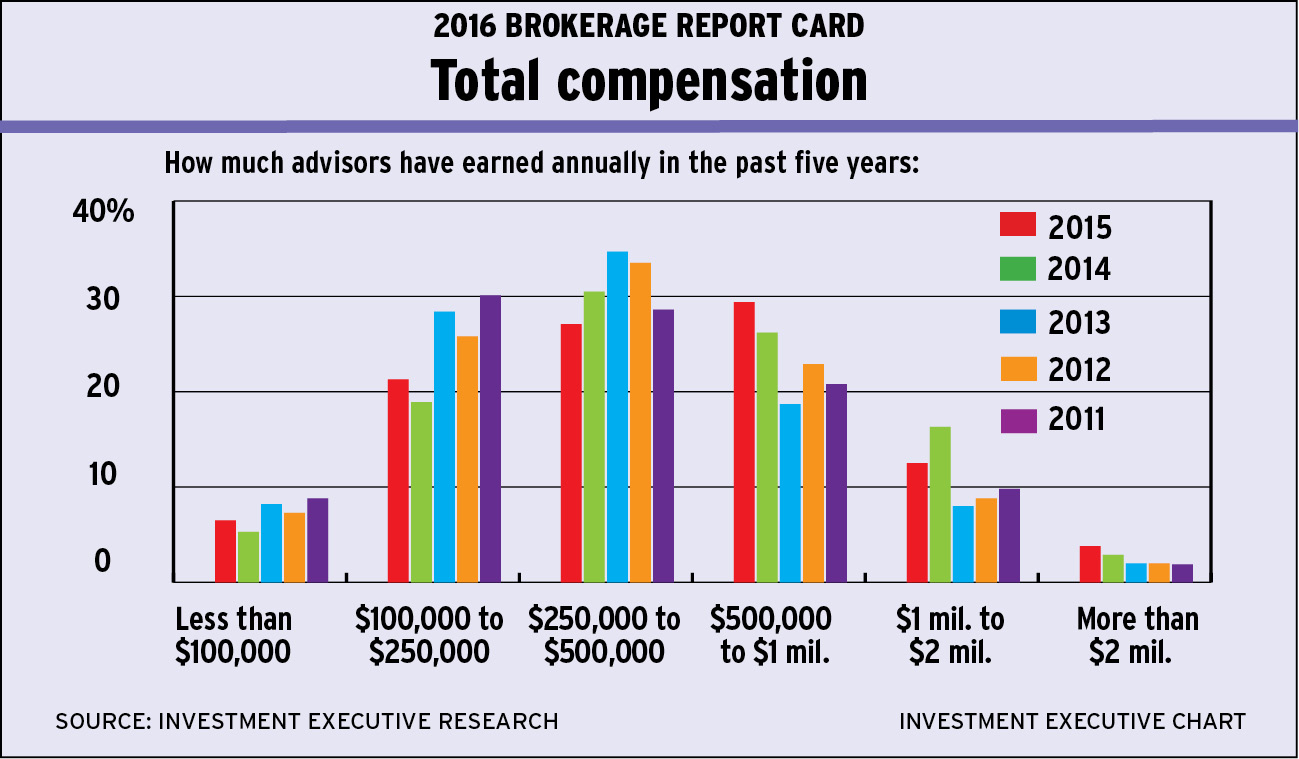

On the surface, an analysis of advisors’ compensation figures for the past year appear to bear out their dissatisfaction with their pay. For example, the percentage of advisors surveyed who reported earning $250,000 or more in total compensation this year was 72.3%, down from 75.9% the previous year. However, those numbers still are well above the 63.4% and 66.9% reported the two years prior to 2015, respectively, suggesting that advisors are earning more than they used to over the span of recent history.

Of course, the fact that there are more advisors earning $250,000 or more a year could be attributed in part to lower-producing advisors moving toward the exits as firms adjust their pay structures to reward advisors with larger or faster-growing books of business at the expense of advisors with modest-sized books.

“They’re constantly raising grids in bad markets, trying to get guys to leave,” says an advisor in B.C. with Vancouver-based Canaccord Genuity Wealth Management (Canada).

Adds an advisor in Atlantic Canada with Montreal-based National Bank Financial Ltd.: “The problem with the industry is [firms] want bigger and bigger producers. I think grid [levels] are going up too high. At some point, [benchmarks] will be unrealistic.”

In fact, advisors with the three bank-owned firms that received the lowest performance ratings in the compensation category pointed out changes to their grids that affect lower-producing advisors as a major reason for their discontent.

For example, advisors with Toronto-based TD Wealth Private Investment Advice (TD Wealth PIA) gave their firm the lowest performance rating in the compensation category, at 6.5, down significantly from 7.1 last year. Many of those advisors said that a new compensation structure introduced this past November would have the effect of reducing their take-home pay, particularly for advisors with smaller books.

Shift to serving HNW

“They have really raised the grid levels,” says a TD Wealth PIA advisor in B.C.

Adds a colleague in Ontario: “Most guys in this place are taking a 4%-5% pay cut this year.”

The firm made changes to simplify its grid while “raising hurdles” at the lower end, effective this fiscal year, confirms Dave Kelly, senior vice president with TD Wealth Private Wealth Management. At the same time, the firm has boosted equity and bonus programs for advisors who bring in net new business from high net-worth (HNW) clients or had higher production levels.

The new compensation structure is part of a broader longer-term strategy of shifting the business toward serving the HNW client segment, Kelly says. Thus, higher-producing advisors, or those with faster-growing books, will prosper under the new compensation model.

“You could have a smaller practice growing very quickly and still do well in this plan,” Kelly says. “But, in general ,the demarcation point [of doing better under the new structure] is around $1 million in production.”

Nesbitt advisors rated their firm at 7.2 in compensation, down from 7.5 last year. Specifically, they said their firm’s compensation structure seems to change annually and is becoming more complex, yet offers lower payouts at the bottom level of the grid.

“You have to figure it out from year to year,” says a Nesbitt advisor in Ontario. “It can be much more confusing and there’s a lot of red tape for the same results.”

Adds a colleague on the Prairies: “We’re not compensated enough. The [grid] levels are always rising.”

Similarly, advisors with Toronto-based ScotiaMcLeod Inc. rated their firm at 7.8 for compensation, down from 8.0 last year, because they took issue with recent tweaks to the firm’s compensation regime.

“There have been changes to the grid and the bonus structure that certainly favours the top advisors,” says a ScotiaMcLeod advisor in B.C. “[The changes have] robbed from the lower[-producing] books.”

The firm introduced a new compensation regime in late 2014 that has been implemented gradually over the past year and a half and features tweaks to the grid, bonus and equity programs to reward “growing and top-performing” advisors, says Rob Djurfeldt, managing director and head of ScotiaMcLeod.

“[Advisors] who are growing their business more love our compensation,” he says. “We’ve attracted many advisors from our competitors over the past five to six years, specifically because of our focus on growth and top-performing advisors. But then – and I would only be speculating – if you’re not really growing [your book of business], you’re not going to like [the payout grid] as much.”

At the other end of the spectrum, some advisors, particularly those with the regional independent shops, gave their firms strong ratings on compensation this year for a variety of reasons.

Fairness is lauded

Advisors with Vancouver-based Odlum Brown Ltd. gave their firm a compensation performance rating of 8.9, down marginally from 9.0 last year, but tied with Calgary-based Leede Jones Gable Inc. for the highest score received by a firm in the category. Specifically, Odlum Brown advisors described their firm’s compensation as fair and transparent.

“It’s aligned with what you’re doing rather than how the firm is doing,” says an Odlum Brown advisor in B.C.

Although Leede advisors also gave their firm an 8.9 performance rating in compensation, this was down significantly from 9.6 last year. However, Leede advisors in general remain happy about the firm’s compensation model, which doesn’t feature a traditional grid.

“Compared with the [rest of] the industry, it’s straightforward and simple,” says a Leede advisor in B.C. “We have a 50% payout until you reach a certain threshold.”

Meanwhile, Canaccord advisors gave that independent firm an 8.1 rating for compensation, a notable rise from 7.5 last year.

The firm introduced a new compensation structure in late 2014 that will apply for the next three years, at least.

“[This grid is] designed to reward excellence,” says Stuart Raftus, president of Canaccord. “It would be among the highest compensation ranges in the industry.”

Although some Canaccord advisors had reservations about the firm’s new compensation model – indicating their concern that it was becoming more “bank-like” – others said they considered it very competitive.

“We probably have the best grid on the Street,” says a Canaccord advisor in Atlantic Canada.

© 2016 Investment Executive. All rights reserved.