Financial advisors with full-service and mutual fund dealer firms appear to be overcoming the various challenges facing their industry. These advisors generated solid growth, adding both assets under management (AUM) and clients to their books of business, according to the results of this year’s Dealers’ Report Card.

At the top of list of challenges facing advisors’ practices is market weakness. Despite a recent recovery in certain market segments, stocks still are down significantly during the past year. For example, the S&P/TSX composite index was down by about 9% for the 12 months ended April 30. During that same time frame, the S&P 500 composite index was off by about 2% and global markets were hit even harder: the FTSE 100 index was down by 10%, the Nikkei 225 was down by 17% and Chinese stocks were down by about 33%.

This market turmoil is underpinned by ongoing economic uncertainty. Oil prices have remained lower for longer than expected and a convincing global recovery has yet to take hold. Geopolitical concerns, worries about the trajectory of interest rates and the prospects for emerging markets also are weighing on the outlook. In Canada, with monetary policy virtually at its limit, policy-makers are ramping up spending once again in an effort to stoke moribund economic growth. Still, forecasts remain weak, and the risks largely appear to be tilted to the downside.

Against this background of weak markets and soft economic growth, the dealer business appears to be defying the doom and gloom as gains continue to be posted. In fact, the average dealer rep surveyed for this year’s Report Card now reports having $39 million in AUM, up from $34.4 million in 2015. This robust growth puts average AUM at a new high, surpassing the previous high of $36.5 million posted in 2014.

Obviously, given the headline of weakness in financial markets, this increase in average AUM is not simply organic because there’s no proverbial rising tide to lift all boats. Rather, reps are probably adding AUM largely through their own efforts; specifically, by bulking up their client lists and by securing higher-value clients – either by targeting larger portfolios in their attempts to acquire new clients or by capturing a larger share of existing clients’ overall wealth.

Indeed, the results of this year’s survey indicate that at least some of that growth is coming through client acquisition. The size of the average client list is creeping up a bit: the average rep reports having 209.8 client households, up from 201.1 client households last year.

But the growth that reps are reporting is not solely a function of bulking up their books with new clients. In fact, as the rate of AUM growth outstrips the growth in client numbers, average productivity is on the rise as well. This year, the average rep has $226,365 in AUM/client household, up from $208,136 in 2015.

These gains for dealer reps happened even as the industry faces its share of financial sector-specific challenges, such as increasing regulation and the rise of low-cost robo-advisors. As well, the positive headline numbers also mask a stark disparity between the industry’s top- performing advisors and the rest of the business’s reps.

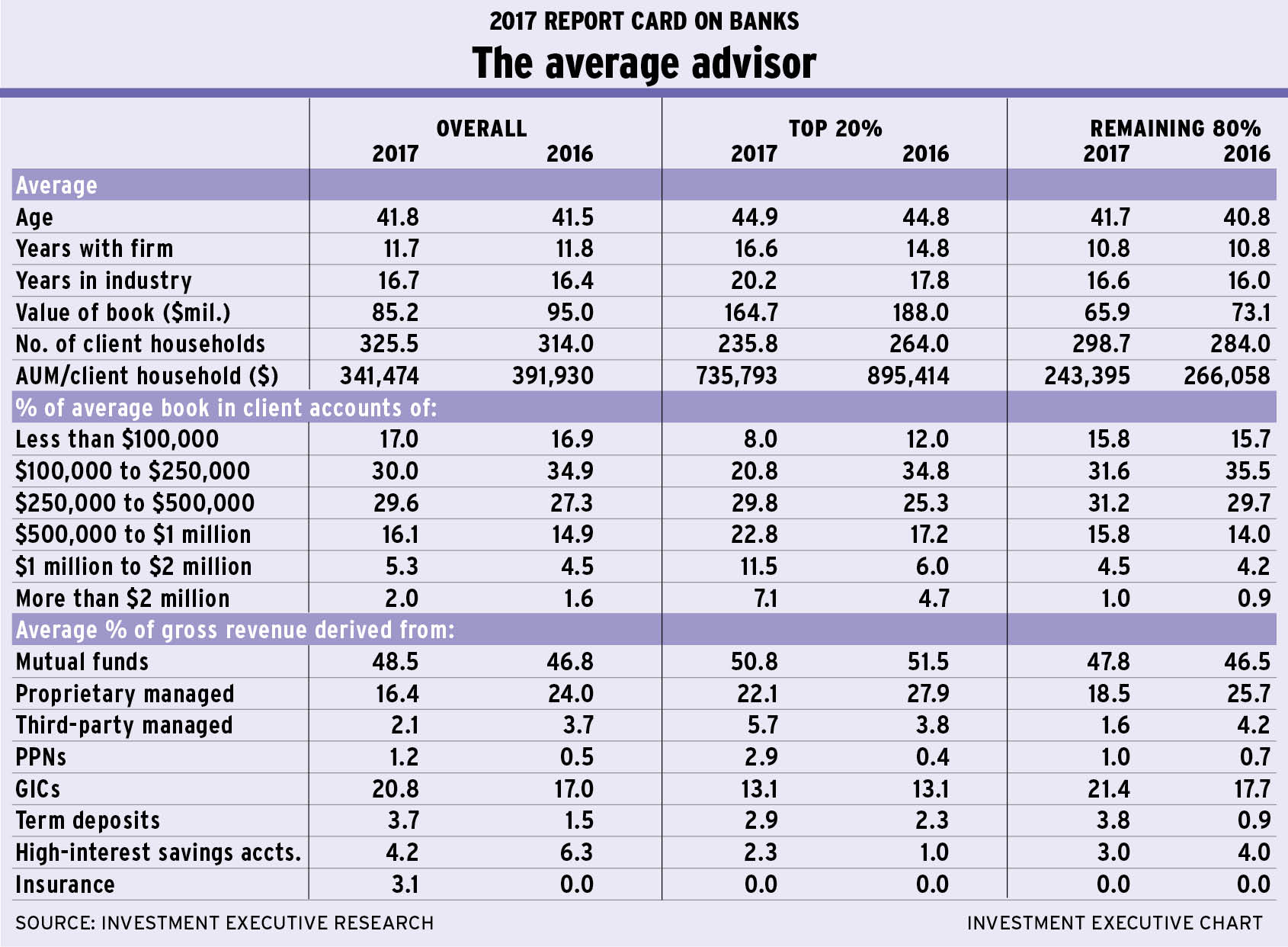

Investment Executive’s research distinguishes between the top 20% of advisors (as measured by AUM/client household) and the remaining 80% of reps. Zeroing in on those top performers, the segment of advisors who are responsible for the bulk of the productivity growth is evident. The top 20% of advisors reported their average AUM/client household is up to $617,142 from $519,012 in last year’s survey. In contrast, average productivity for the remaining 80% of advisors was essentially unchanged – these reps are stalled at a much lower average AUM/client household of $130,054 (vs $130,627 in 2015).

Although both the top performers and the remaining 80% of advisors reported growth in their average AUM, most of the growth in client rosters is coming from the remaining 80% of advisors.

Specifically, both segments of advisors reported similar growth rates in AUM. The top 20% of reps saw their average AUM rise by 12%, to $75.3 million from $67.2 million last year, while the remaining 80% of advisors saw their average AUM climb by 13.3% to $29.9 million from $26.4 million in 2015. However, the top performers barely added to their client numbers, whereas the remaining 80% reported that they’re now serving 224.2 client households, up from 214.8 client households last year.

Thus, these differing growth patterns suggest that both segments of advisors are building their books in notably different ways. For the bulk of reps, the addition of new clients is driving growth in AUM, whereas the top performers appeared to add AUM either by capturing a bigger share of existing clients’ wealth or by upgrading their client base by trading lower-value clients for wealthier ones – a strategy that kept their overall client numbers more or less unchanged, even as they made gains in AUM and productivity.

The notion that top performers are stepping up their exposure to high net-worth clients is supported by the account distribution data, which also hint at rising allocations to very high-value accounts. The top 20% of advisors reported that their allocations to the largest accounts – those worth more than $2 million – has almost doubled during the past year, to 11% from 6.2% in 2015.

Some of this increase in the proportion of top performers’ books that are allocated to the largest accounts probably represents clients migrating upward from the second-biggest account category (those worth between $1 million and $2 million), as allocations to that lower category are down a bit year-over-year. These data indicate that certain accounts may have drifted up into the $2 million or more category, either through clients’ wealth gains, reps winning greater shares of existing wealth, or some combination of the two. Still, for the top performers, their allocation to accounts worth more than $1 million (the two largest categories combined) is up to 22.8% of their overall book from 19.5% in last year’s survey.

In contrast, for the remaining 80% of advisors, their exposure to the largest accounts remains relatively tiny; and, according to the results of this year’ survey, that share declined year-over-year. In 2015, these reps reported that 4% of their accounts were worth more than $1 million. This year, that proportion is down to just 2.4%; of this, reported exposure to accounts worth $2 million or more is down to just 0.5% from 1.3% in 2015.

For the remaining 80% of advisors, the vast majority of their client accounts remain in the sub-$250,000 range: almost 70% of their accounts are in this segment, with 40.2% in the smallest category of less than $100,000.

This larger segment of the dealer rep population also drove a surprising trend in this year’s data: a shift away from fee-and asset-based sources of revenue and toward transaction-driven revenue. In 2015, the remaining 80% of advisors reported that 68.9% of their revenue came from fees and transactions accounted for 27.7% of their revenue. Those proportions shifted dramatically this year, with transactions accounting for 43.3% of revenue and fees contributing almost 53.7%.

The same trend doesn’t apply to the industry’s top performers. Their revenue mix is largely unchanged from last year, with fees continuing to account for about three-quarters of revenue and transactions making up most of the rest.

There also are some notable shifts in the asset mix in this year’s survey. Of course, mutual funds remain overwhelmingly the product of choice for all advisors, accounting for 73.1% of the average rep’s product mix, up slightly from 71.2% in 2015. However, there are some changes in the composition of products that make up the rest of the average book.

For example, both the top 20% and remaining 80% of advisors reported that direct exposure to equities and bonds rose vs 2015. For the top performers, equities almost doubled, now comprising 18% of the average book, up from 8.9% last year. Similarly, allocations to bonds more than doubled to 6.8% this year from just 2.3% in 2015.

At the same time, the top performers are making notably less use of managed products. This year, they reported that proprietary managed products represent just 2.6% of the average book, down from 8.9% last year, while their exposure to third-party managed products also declined to just 1% this year from 1.7% in 2015.

The same basic trends are evident among the remaining 80% of advisors, although the swings were less dramatic. Nevertheless, for this segments of reps, direct exposure to stocks and bonds also rose, to 4.8% combined this year from 2.8% last year. Furthermore, these reps’ use of managed products – both proprietary and third-party – also declined to just 1.3% combined this year from 4.9% in 2015.

Moreover, despite increasing interest in exchange-traded funds from both advisors and their clients, there’s no sign of increasing use of these products in this year’s survey. Allocations remain stuck at just 1.2% for advisors overall, and declined slightly among both segments of dealer reps.

© 2016 Investment Executive. All rights reserved.